Marko Kolanovic Expects A Massive Short Squeeze Into Year End

Over the past 4 years, there hasn’t been a selloff JPMorgan’s head quant (and more recently, head of market strategy) Marko Kolanovic, hasn’t loved and the current one is no exception, and remarkably while even the otherwise uber-bullish Goldman Sachs (which has a 5,100 year end 2022 price target) recently pointed to the unprecedented collapse in market breadth in the market and the divergence between generals and all other stocks…

…. as a source of major concern (see “Goldman Rings The Alarm On Collapsing Market Breadth“) because as the Vampire Squid noted…

the amount of concentration is directly proportional to the odds of a major market shock. As Goldman further explains, one measure of market breadth that has historically carried a forward-looking signal for equity market performance compares how far the S&P 500 index and its median constituent trade from their respective 52-week highs. When the index is much closer to its 52-week high than the median stock, this breadth measure plunges and signals that a small number of stocks are driving index returns. This measure of breadth registered more than one standard deviation above average as of April 2021 (highest level since 2014) before falling by 4.5% during the subsequent six months.

None of this is a concern to Marko, however, who as always sees the glass as 150% full, and instead of joining Goldman on the cautious side, admitting that “such a divergence is unknown to us”, instead flips the argument on its head, and argues that the furious selling in “non-generals” stocks is actually a reason to buy them, in other words the divergence between the handful of overvalued stocks:

Over the past 4 weeks, small caps and value stocks entered a correction (sold off more than 10%). High beta stocks have sold off ~30%, entering a bear market. In fact, there is a paradox that on average US stocks are down 28% from highs (most highs were recorded in the first half of the year) and the median stock is down ~21%, while the market is up ~22% for the year (Russell 3000). Such a divergence is unknown to us…

… so far so good, he merely echoes what we – and Goldman – said about the massive collapse in market breadth, but it is what he says next that should make one’s head spin, namely that this divergence

… indicates a historically unprecedented overshoot in selling smaller, more volatile, typically value and cyclical stocks in the last 4 weeks.

Apparently it does not indicate that the handful of stocks that have not sold off yet remains massively overbought (due to popularity, overrepresented in ETFs, etc), but that all the stocks that have sold off should be going up. And that’s why Marko is now in charge of a team meant to boost the public’s confidence in markets in general, and JPM’s commission-collecting skills in particular, because no matter how unprecedented the news, it’s always bullish!

Obviously, since his argument would be empty without at least some attempt at justification, Kolanovic does just that next, arguing that the narrative for the selloff “is related to Omicron and the Fed, while actual selling comes largely from de-risking and shorting from equity and macro hedge funds.”

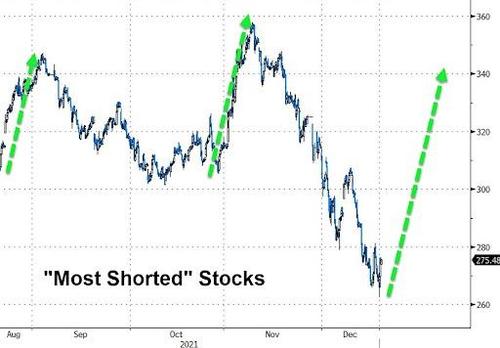

Which brings us to the crux of the thesis, and in light of recent epic short squeezes duly profiled here, Kolanovic may actually have a point. According to the Croat, “for short-selling campaigns to succeed, there have to be positioning, liquidity and often systematic amplifiers of the selloff.” But, as we have seen in recent days when sharp selloffs were followed by even bigger short squeezes…

… as we discussed most recently in “Goldman Prime: Tuesday Was The Biggest Short Squeeze In 6 Months“, these conditions are not met according to Kolanovic, who concludes that “this market episode may end up in a short squeeze and cyclical rally into year-end and January.”

Which, incidentally, is a carbon copy of what Goldman’s flow trader Scott Rubner said one week ago when he went all in predicting that A Face-Ripping Santa Rally is on deck. It is therefore not surprising that Kolanovic lists some of the exact same technical and structural, i.e., positioning and flows, drivers behind his cheerful forecast. These are as follows:

Positioning of systematic and discretionary investors has already declined significantly to the bottom third of the historical distribution (~30-35th percentile). CTAs are fully short small cap and many international indices, while S&P 500 positions are not under pressure given the ~25% one-year appreciation of the cap-weighted benchmark. Volatility targeting and risk parity funds started adding exposure, given muted realized volatility and correlations. This is a result of strong value-growth rotations reducing correlation and internally offsetting large stock moves.

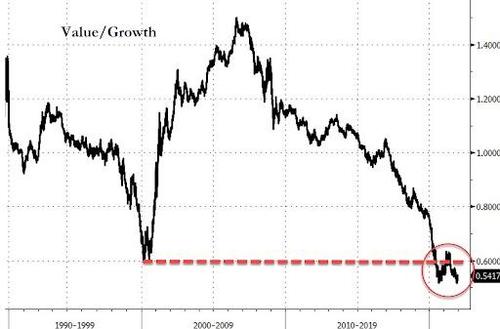

While he may have a point here, it’s worth also noting that for the past year, Kolanovic has been pounding the table on value outperforming value when in reality value has gotten absolutely crushed by growth and tech. So maybe if he had foreseen some of the blow ups experienced by his clients heading into the past week, his forecast would carry some more weight…

It’s not just positioning but also seasonals, and the JPM quant predicts that there will “also be buying of equities into month- and quarter end – particularly for international, SMid, and cyclical benchmarks that are impacted the most.”

In short, Kolanovic argues, “this is not a setup similar to 4Q2018 from a fundamental or technical angle”, which – as we reminded readers earlier – is when stocks tumbled 20% to force the Fed to halt its tightening plans, and which Morgan Stanley believes will happen again in the next “3-4 months”, as such we now have a bearish Morgan Stanley calling for market fire and brimstone in the next 3-4 months in one corner, and JPMorgan (and Goldman Sachs) forecasting a face-ripping short squeeze into year end.

And speaking of the aggressive shorting, Kolanovic says that it is “likely in a hope of declines in retail equity position and cryptocurrency holdings – while in fact both of these markets and retail investors have shown resilience in the past weeks.”

His last point on positioning is that “large short positions likely need to be closed before (the seasonally strong) January, which is likely to see a small-cap, value and cyclical rally. And given that market liquidity is dwindling, the impact of closing shorts may be bigger than the impact of opening them, when liquidity conditions were better.”

Technicals aside, Kolanovic is also bullish for several fundamental reasons, chief of which is his increasingly optimistic view on Omicron in particular and covid in general (which last week he said will soon be over as the “extremely mild” omicron soon becomes the dominant variant). Indeed, in his latest note he writes that “we retain our positive outlook for COVID. Despite the recent panic about the Omicron variant, global COVID deaths are at the lowest point of the year, and cases actually flat for the past 2 weeks. This is despite the addition of a large number of less severe Omicron cases. In particular, cases in the EU are declining, starting from the east (Russia, Ukraine, Bulgaria, Romania, Austria, Germany, etc.). Even in the UK – where some of the most sensational headlines come from – fatalities declined ~30% over the past month, and are down over 90% from the highs earlier this year.”

Finally, Kolanovic points to South Africa, where the new strain was first detected, and where deaths are also declining the last few weeks, and down 95% from January highs.

And, as shown in the chart above, correlating and lagging COVID cases and deaths in South Africa indicates Omicron’s mortality rate is very low (e.g., an appropriately lagged deaths to cases ratio is ~25 times lower than in the previous peak), which to is consistent with the JPM quant’s claim from two weeks ago that “Omicron is a bullish rather than bearish market development.“

Tyler Durden

Fri, 12/17/2021 – 13:49

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com