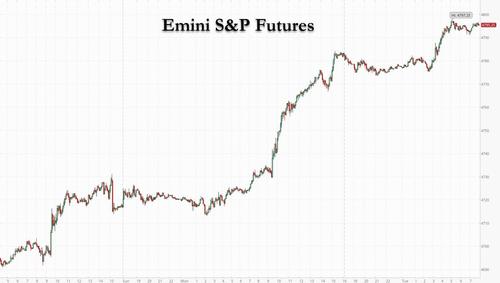

Futures Hit New All Time High As Santa Rally Drags Everything Higher

The Santa rally, which made an expected appearance during yesterday thinly-traded session now that most desks have closed their books for the year pushing stocks to their 69th all-time high for 2021, is back (as discussed in “Goldman: There Has Been No FOMO In Late 2021, This Changes In 5 Trading Sessions“) amid a combination of low volume, delta-chasing, dealer gamma and a plain old short squeeze (as predicted correctly by Marko Kolanovic), and has pushed e-minis just shy of 4,800 this morning, and a little over 200 points away from the 2022 year-end targets by both JPM and Goldman. Stocks in Europe advanced along with US equity futures as traders evaluated the resilience of the global recovery to a record spike in coronavirus cases. 10-year Treasury yields and the dollar were little changed. Oil surged to a five-week peak, while iron ore futures extended a decline after data showed softening Chinese steel output. Bitcoin tumbled following fresh selling out of Asia, where the PBOC seems to have a death wish against the cryptocurrency.

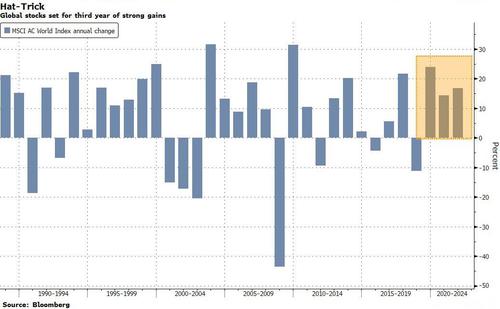

As Bloomberg notes, global stocks are on course for a third year of double-digit returns, powered by trillions in liquidity from the Fed and other central banks. The climb has overcome coronavirus waves and a late-year shift by some key central banks toward tighter monetary policy to fight high inflation (it also explains why most of the gains were achieved early in the year). Concerns remain that those variables could spur heightened volatility.

“The remedies that we put in place to counter the Covid recessions, they were so substantial, we had massive stimulus,” Sandip Bhagat, chief investment officer of Whittier Trust, said on Bloomberg Television. “We’ll be left with a legacy of those policy responses well into the future” and stocks can continue advancing, he said.

Here are some of the biggest U.S. movers today:

- Apple (AAPL US) shares are up 0.3%, with the stock now just about 1% shy of hitting a historic $3 trillion market valuation for the iPhone maker. The shares are on track for a fifth straight gain.

- ADDvantage Technologies Group (AEY) shares jump 9% after the communications infrastructure company reported a 61% increase in revenue during the fourth quarter.

- Arrival SA (ARVL) gains 2.4% after the electric-vehicle company announced that it has started trials of the Arrival Bus at a testing facility in the U.K.

- Bit Digital (BTBT) falls 3%, down with other crypto stocks as Bitcoin tumbles back below the $50,000 level.

- Clear Secure (YOU) rises 3% after Grasso Global CEO Steve Grasso said last night on CNBC’s “Fast Money” that shares “should be up another 30% from current levels.”

- Flotek Industries (FTK) rallies 46% after the company said it received an unsolicited indication of interest for all or part of the environmental solutions company.

- JinkoSolar Holding Co. (JKS), controlling shareholder of Jinko Solar, shares are up 3% after the China Securities Regulatory Commission allows Jinko Solar to list on the Star board in Shanghai.

- Kiniksa Pharmaceuticals (KNSA) shares plunge 16% after the company said its phase 3 trial of mavrilimumab in COVID-19-related acute respiratory syndrome did not meet the primary efficacy endpoint.

- LiveOne (LVO) shares rises 21% after the company entered into a binding letter of intent for an exclusive option to purchase Trader2b’s business or its assets and operations.

- Tesla (TSLA) shares rise 1.6% as Wedbush says the company is in a strong position heading into 2022. China demand is key for bull thesis on Tesla, analyst Daniel Ives writes.

Elsewhere, cryptocurrency-linked stocks fell in premarket trading as Bitcoin tumbled back below the $50,000 level as the now traditional selling pressure out of Asia emerged right on schedule (see “The Crypto Trading Cycle: Asian Weak Hands Selling To US Whales“). Bitcoin fell as much as 4.5% and trades at $49,167 as of 6:35 a.m. in New York. o Other digital currencies are also lower this morning, with Ether falling 3.5%, while Litecoin slips 4% and Monero drops 3.8%.

Overnight, a flood of omicron infections took global Covid-19 cases to a daily all-time high on Monday. The surge has disrupted global reopening and could squeeze hospitals. At the same time, investors are taking comfort that while highly contagious, Omicron is a far less severe illness. Meanwhile, France announced it would force its citizens to work from home for most of next month to contain the spread of the highly transmissible omicron variant. Meanwhile, an outbreak in the western Chinese city of Xi’an continued to fester, with new cases hitting a record high days after its 13 million residents were locked down. The U.K. government won’t introduce stricter restrictions in England before the end of the year, despite the rapid spread of the omicron variant.

In Europe, the Stoxx Europe 600 index nudged closer to last month’s record high, with utilities leading the advance as all industry sectors gained while French travel and catering stocks dropped on the country’s new work-from-home order. Pierre & Vacances, an operator of holiday villages and residences, drops 1.8% in Paris trading, while tour operator Voyageurs du Monde falls 1% after the French government announced new measures amid efforts to contain the spread of the omicron variant.

Earlier in the session, Asian stocks climbed, following a rise in U.S. peers to fresh record highs, as investors’ risk appetite improved. The MSCI Asia Pacific Index rose as much as 0.8%, driven by an advance in hardware technology firms. Japan led gains around the region, while Hong Kong underperformed. Australia and New Zealand remained shut for holidays. The key Asian stock gauge is on course for a monthly advance of about 1.9%, which would be its best since August. Positive economic data and easing worries over the omicron coronavirus variant have helped of late, although the measure is still down 3.3% on the year amid the selloff in Chinese tech giants. “U.S. equities are so strong that investors here can’t help but pick up stocks and chase the rally amid fear of being left behind,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank in Tokyo. “But it’s not as if there are loads of new reasons to buy stocks now, so some caution is needed.” The S&P 500 Index posted its 69th record close for 2021 on optimism stocks can withstand risks from the coronavirus and tighter policy. TSMC and Tokyo Electron were among the top contributors to the Asian benchmark’s rise Tuesday after the Philadelphia Semiconductor Index rallied 2.7% to an all-time high. “U.S. yields are strangely stable,” Sera added. “It may be that some are looking way ahead and thinking that not too many hikes will be required down the road” thanks to the swift rate increases expected from the New Year, she said.

The latest escalation in Beijing’s wider regulatory clampdown on private industry casts more doubt over the prospects for overseas initial public offerings, which had proceeded virtually unchecked for two decades.

Meanwhile, the People’s Bank of China — which on the weekend vowed more economic support — boosted a short-term liquidity injection.

India’s benchmark stock gauge advanced for a second day, tracking regional peers after the S&P 500 climbed to a record high. The S&P BSE Sensex rose 0.8% to 57,897.48 in Mumbai, while the NSE Nifty 50 Index increased 0.9%. All 19 sectoral sub-gauges compiled by BSE Ltd. gained, led by a measure of capital goods companies. Asian Paints Ltd. contributed the most to the Sensex’s gain, increasing as much as 2.9%. Out of 30 shares in the Sensex index, 28 rose and two fell. Most regional markets advanced as investors’ risk appetite improved. India’s economy expanded at a steady pace in November, a month that also saw the omicron virus variant raising fresh concerns about risks to the recovery, according to data tracked by Bloomberg News.

In FX, the yen steadied close to the 115 level against the dollar while Japanese stocks climbed. Turkey’s lira declined after the central bank introduced new measures to discourage lenders from holding foreign-exchange savings accounts, while two former governors of the monetary authority were subjected to criminal complaints over comments.

Bitcoin slid below $50,000, a level some analysts view as a key pivot for assessing the largest cryptocurrency’s outlook heading into 2022

In rates, bonds were little changed after low liquidity resulted in no trading of the benchmark 10-year issue yesterday. Treasury yields were slightly higher on the day amid gains for European stocks and U.S. futures, and $57BN 5-year note auction ahead at 1pm ET. Yields are higher by as much as 1bp across the curve after declining slightly during Asia session; U.K. bond market is closed. Monday’s 2-year sale tailed slightly, and last month’s 5-year drew weak demand following a spate of extreme volatility in the sector that continued through mid-December as Fed policy evolved.

The yield on China’s 10-year sovereign bonds declined to the lowest level since June 2020, as interbank borrowing costs fell after the central bank boosted short-term liquidity. China is seen adding stimulus to stabilize growth next year, with various ministries vowing more proactive measures to reverse the slowdown caused by a worsening property slump, weak consumption and the coronavirus.

On today’s calendar, expected data includes October FHFA house price index and S&P CoreLogic CS home prices at 9am, and December Richmond Fed manufacturing index at 10am; no Fed speakers slated this week. Poultry producer Cal-Maine Foods is scheduled to report earnings.

Market Snapshot

- S&P 500 futures up 0.3% to 4,796.75

- STOXX Europe 600 up 0.5%

- MXAP up 0.8% to 193.35

- MXAPJ up 0.5% to 627.48

- Nikkei up 1.4% to 29,069.16

- Topix up 1.4% to 2,005.02

- Hang Seng Index up 0.2% to 23,280.56

- Shanghai Composite up 0.4% to 3,630.11

- Sensex up 0.8% to 57,904.60

- Australia S&P/ASX 200 up 0.4% to 7,420.30

- Kospi up 0.7% to 3,020.24

- Brent futures up 0.8% to $79.19/bbl

- Gold spot up 0.1% to $1,814.36

- U.S. Dollar Index little changed at 96.05

- German 10Y yield up 1bp to -0.23%

- Euro little changed at $1.133

Top Overnight News from Bloomberg

- Global Covid-19 cases hit a daily record on Monday, disrupting the holiday season a year after vaccines first started rolling out and two years after the emergence of the virus

- Russia will start talks first with the U.S. on its demands for guarantees of an end to NATO’s eastward expansion before a proposed Jan. 12 meeting between the military alliance and Moscow, Foreign Minister Sergei Lavrov said

- The vast majority of Libor benchmarks are about to be consigned to the history books, with final settings taking place at the end of this week

US Event Calendar

- 9am: Oct. FHFA House Price Index MoM, est. 0.9%, prior 0.9%

- 10am: Dec. Richmond Fed Index, est. 11, prior 11

Tyler Durden

Tue, 12/28/2021 – 08:12

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com