Tesla Shares Surge After Record Quarter: Here’s What Analysts Are Saying

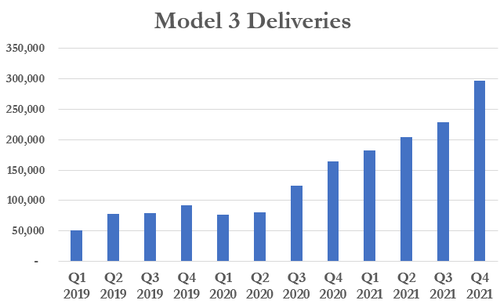

Shares of Tesla are surging more than 7% in pre-market trading on Monday after the automaker announced it had delivered a record of over 308,000 vehicles in Q4.

We highlighted yesterday’s delivery numbers from Tesla here. For the year, the automaker delivered “over 936,000” vehicles, per a company press release. Those numbers are up about 87% from the year prior, according to Bloomberg. The report also reminded that Tesla has said “repeatedly it expects 50% annual increases in deliveries over a multi-year period”.

On that front, it’s so far, so good, heading into 2022.

It looks as though the phasing out of the Model S and the Model X is heading toward completion. Of the deliveries in the fourth quarter, 296,850 of them were Model 3 or Model Y vehicles, while just 11,750 were Model S or Model X vehicles.

Estimates had called for 12,719 Model S and X deliveries and 263,422 Model 3 and Y deliveries.

Recall, we highlighted Gordon Johnson’s analysis in late November where he claimed Tesla would beat its delivery expectations for Q4. Here’s what analysts are saying about the record quarter to start the new week, according to Bloomberg Monday morning:

Wedbush (outperform, PT $1,400)

- Deliveries underpin electric- vehicle demand which looks “robust” for Tesla going into 2022, analyst Daniel Ives writes in a note

- Says China demand is notable this quarter and “will be a focus for the bulls digesting these results”

- Figures will improve sentiment for the EV industry as a whole, Ives writes

Jefferies (buy, PT $1,400)

- Jefferies analysts including Philippe Houchois say “Tesla ended 2021 on a high”

- Model S and Model X deliveries were “light due to capacity constraints” but Models 3 and Y over-compensated

- Notes that deliveries exceeded production for the second quarter in a row

Cowen (market perform, PT $625)

- “Tesla continues to shrug off the chip supply crunch and clearly has ramped Shanghai at breakneck speed”

- However, Tesla will also need to successfully ramp up its new plants in Austin, Texas and Berlin, as well as maintain growth in China, for the stock to “continue to work” in 2022

- Believes 2022 will be a more challenging year than 2021 due to increasing competition as Tesla’s existing vehicles get “long in the tooth”

Piper Sandler (overweight, PT $1,300)

- Tesla’s 4Q run-rate suggests 2022 consensus is too low

- Believes the company’s margins may also have ramped up substantially in the quarter

- “Our estimates are biased higher”

Standing at odds with most analysts was GLJ Research’s Gordon Johnson, who put out a note on Monday morning asking whether or not Tesla’s numbers could be overstated. Johnson wrote:

Well, according to official Chinese Communist Paty (“CCP”) mouthpiece Yicai Global, in an article published today, we learned, and we quote: “According to industry insiders, Tesla’s sales in China in December 2021 may exceed 60,000. However, due to soaring orders and insufficient supply of chips and other components, it is estimated that only orders for October 2021 will be delivered at most”. We take this to mean that the numbers reported by the China Association of Automobile Manufacturers (“CPCA”) next week may fall materially below TSLA’s implied Dec. 2021 sales of 80.041K cars.

“…there could be quite a bit of explaining to do (by both the company and the media/sell-side-analyst-community, who are seemingly ignoring what Yicai Global reported this morning regarding TSLA’s China sales),” Johnson concluded.

Tyler Durden

Mon, 01/03/2022 – 10:04

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com