ARK Changes How Its Innovation Fund’s Returns Show Up On Its Website

Submitted by QTR’s Fringe Finance

Cathie Wood continues playing it fast and loose with how she presents her ETF’s projected – and now past – performance.

The most recent example of Wood pulling the ole’ switcheroo has come in the form of how Wood markets her flagship ARK Innovation ETF (ARKK) on its website.

As Twitter user @commandentesd pointed out over the weekend, Wood’s website used to track ARKK on its site using its YTD return. An archived version of ARK’s site from December 2021 shows at YTD return of -15.1%.

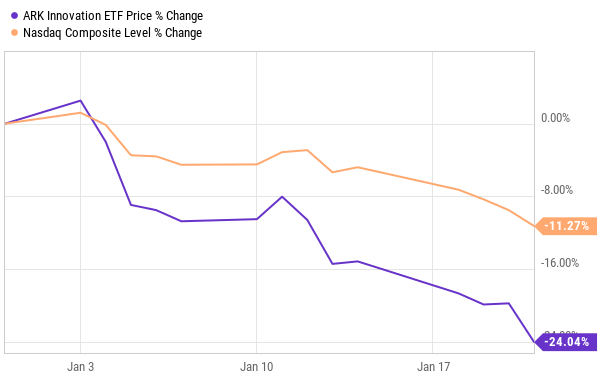

Ah, yes. The ole’ YTD metric. Let’s see how that should stand for ARKK so far in 2022.

The fund has started off the year -24%, underperforming its benchmark by -13%.

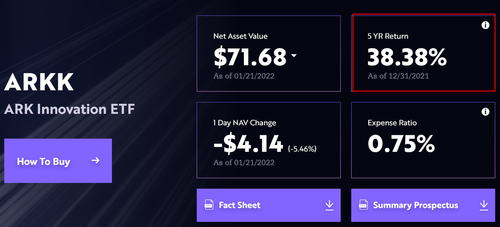

But now, all of a sudden, ARKK’s webpage shows the same other three boxes, but its “return” box has switched from a YTD return to a 5 year (annualized) return as of 12/31/2021.

The reasons for the switch could be obvious: the fund’s YTD return in 2022 has been horrific and its annualized 5 year return as of the end of 2021 is a much friendlier looking +38.38% number.

This is now the second time in as many months ARK appears to be picking and choosing numbers that are convenient for them.

My readers already know that it was only weeks ago that I wrote an article called “Cathie Wood Is Playing With Fire”, wherein I detailed how ARK’s Cathie Wood took liberties with language she used in a recent blog post about her projected future performance.

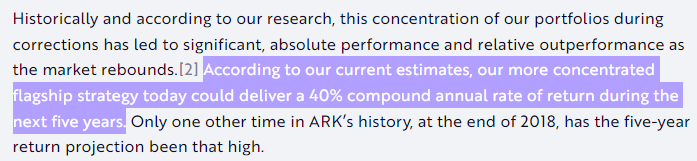

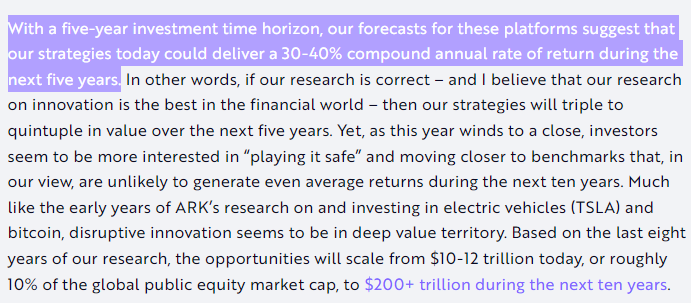

If you remember, Wood’s December 17, 2021 blog post, via Wayback Machine, projected that her “flagship strategy” – widely accepted to be her ARK Innovation Fund ETF (ARKK) – could deliver a “40% compound annual rate of return during the next five years.”

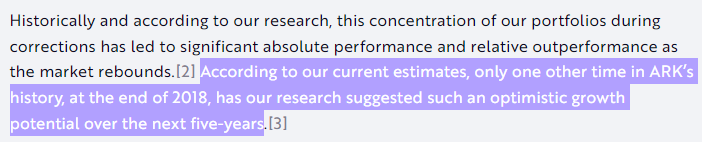

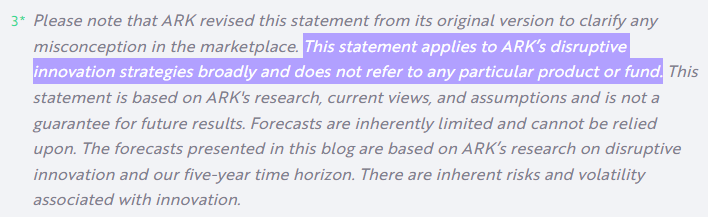

Wood then updated her December 17, 2021 blog post after her projections were mocked on social media and even questioned in the financial media. The same section of the letter now reads:

The change is explained in a footnote where Wood says it didn’t apply to “any particular product or fund”, despite the fact that she references their “flagship strategy” in the first example:

In addition, the newer version of the letter had realigned Wood’s expectations from “40%” to “30-40%” and added a lot of qualifier language, not the least of which was directing the return expectations away from ARK’s “flagship strategy” and onto – well, some vague benchmark of ARK Invest, in general.

In other words, in 48 hours, Wood went from an expectation of 40% from her “flagship” fund to a 30-40% expectation of her “strategies broadly”.

There’s only so much an asset manager can do when they’re underperforming.

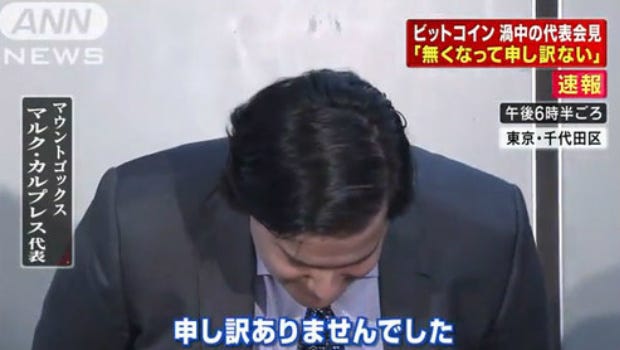

The right thing to do is level with your LPs or ETF holders and tell that your strategy simply isn’t working and that it’s potential time to reconsider the fund’s holdings and/or fall on your proverbial sword and perform the Japanese “long bow” while asking for forgiveness.

You know, like Mt. Gox CEO Mark Karpales did after $500,000,000 in bitcoin disappeared at his hands.

The wrong thing to do, in my opinion, is to tee up a rolodex of shitty excuses:

-

December 9, 2021: Cathie Wood “Soul Searching” But Staying The Course

-

December 20, 2021: Cathie Wood: My Stocks Are Now ‘Deep Value’

-

December 29, 2021: Cathie Wood says inflation will ‘unwind pretty quickly’ and that stocks will probably be fine

-

January 19, 2022: Cathie Wood: ‘In our view, the real bubble could be building in such so-called “value” stocks’

-

January 19, 2022: Cathie Wood: “The disconnect between valuations for innovative companies in the public vs. private markets is as wide as I ever have seen. The arbitrage opportunity is enormous.”

…and then start turning knobs and dials to try and window dress shitty performance to look like slightly less shitty performance.

But rather than embrace the pain and usher in a sense of calm, despite the losses, Wood is instead toying with her ARKK marketing materials – and while the changes likely don’t constitute anything illegal, they certainly seem to be heading down a path away from consistent transparency and towards a panicked fund manager worrying about optics.

If the NASDAQ continues its tumble heading into late January and early February, I’ll be interested to see what other convenient changes in ARK written materials may take place.

–

If you don’t already subscribe to Fringe Finance and would like access, I’d be happy to offer you 20% off. This coupon expires in 48 hours: Get 20% off forever

Disclaimer: I own and have owned and will continue to own ARKK, QQQ, IWM, TSLA puts at various strikes and time horizons. I currently own long dated ARKK puts. I also have nominal exposure on the long side to some ARK names in a a longer-term focused dividend portfolio. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Tue, 01/25/2022 – 09:17

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com