Exxon Combines Chemical And Refining Units, Moves HQ Outside Houston, As Part Of Plan To Cut Costs

The corporate changes over at Exxon are continuing with the energy giant reportedly combining two of its major units and relocating its corporate headquarters to Houston.

The company is going to be combining its chemical and refining units and is making the move as part of a plan to cut costs and find new efficiencies, according to Bloomberg on Monday.

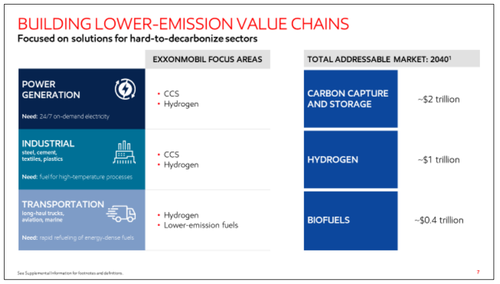

Effective April 1, the company is going to be split into three segments: ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions. They will be supported by ExxonMobil Technology and Engineering, the report says.

Exxon’s biggest U.S. office is in already Spring, just north of Houston, Bloomberg continued. The report also noted an executive shuffle taking place as a result of the corporate changes:

- Karen McKee, formerly president of ExxonMobil Chemical Company has been appointed to lead ExxonMobil Product Solutions

- Linda DuCharme, formerly president of ExxonMobil Upstream Integrated Solutions and ExxonMobil Upstream Business Development, has been appointed to lead ExxonMobil Technology and Engineering Company

- This change will also consolidate the Upstream into a single organization, ExxonMobil Upstream Company, which will be led by Liam Mallon, formerly president of ExxonMobil Upstream Oil and Gas Company

The oil supermajor has spent the better part of the last 18 months trying to appease “environmental activist investors”, and has also been making sweeping changes to its business in an attempt to put the company’s ugliest financial year, 2020, far behind in its rearview mirror.

Recall, we reported days ago that the company said it planned on reaching its target for net zero emissions by 2050. The pledge applies to Scope 1 and Scope 2 greenhouse gas emissions, we wrote. The company said it had “identified more than 150 potential steps and modifications that can be applied to assets in its upstream, downstream and chemical operations.”

We’re guessing this corporate action is part of the “master plan”. Exxon Chief Executive Officer Darren Woods said earlier this month: “We are developing comprehensive roadmaps to reduce greenhouse gas emissions from our operated assets around the world.”

Exxon says it is “working with [its] partners to achieve similar emission-reduction results”.

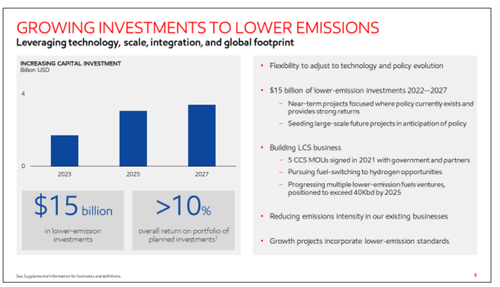

In December, we noted that Exxon was on track to meet its 2025 emissions goals 4 years in advance. In Exxon’s full plan, which can be found on its website here, the company said it “plans to increase spending to $15 billion on greenhouse gas emission-reduction projects over the next six years while maintaining disciplined capital investments.”

Bloomberg also noted that Exxon confirmed “it was on track to meet its 2025 greenhouse gas emission-reduction plans by year-end 2021, four years ahead of schedule.”

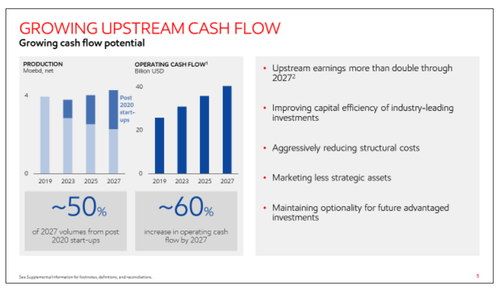

Turning to financials, the oil supermajor said it plans on maintaining capital investments between $20 to $25 billion, per year, through 2027.

The company also said it has repaid $11 billion in debt, to date, in 2021. Exxon says it’ll be “comfortably” in its range of targeted debt-to-capital ratio by year end.

These plans, of course, follow our reporting in October that the company was considering abandoning some of its oil and gas projects to appease environmental advocates.

The company’s board, we noted in October, which includes three directors nominated by activist investors, had “expressed concerns about certain projects, including a $30 billion liquefied natural gas development in Mozambique and another multibillion-dollar gas project in Vietnam.”

The change in strategic direction comes as Exxon’s board is facing growing pressure from investors to restrain its fossil fuel investments and limit its carbon footprint. The board is also considering the carbon footprint of the new projects, and how they would affect the company’s ability to meet environmental promises it has made.

Back in September we reported that as part of appeasement of the ESG lobby, the oil giant planned on implementing disclosures of shale emissions. The company announced it would start measuring its methane emissions from production of natural gas at a facility it owns in New Mexico. Exxon joins other shale gas producers, like EQT, who already provide similar data.

Bart Cahir, a senior vice president at Exxon Mobil, told Reuters: “Certifying our natural gas will help our customers achieve their goals.” The oil major has signed an agreement with “independent measuring firm MiQ to certify 200 million cubic feet of natural gas per day” at its New Mexico facilities.

Tyler Durden

Mon, 01/31/2022 – 14:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com