$30 Trillion In Debt Means Ignore All The Talk: Central Bankers Are Only Pretending To Lean Against Inflation

By Eric Peters, CIO of One River Asset Management

“Average hourly earnings ran at a +9.2% annualized pace in Friday’s employment report,” said the Oracle. “On a three-month annualized pace, wages grew +7.0%,” he said, alone in the desert.

“For those hoping that the US will avoid a wage-price spiral, this report was no quaalude.” But the past was not what I’d called to explore. Of all my sources, only the Oracle foresaw 7% inflation back in early 2021. And my hope was to glimpse what the future holds.

“This year’s path is hazier with the Fed now in play. But it is difficult to see inflation below 7% for this year, and it is within the range of reasonable outcomes to see 10%.”

Overall:

“I have tried everything,” declared Senator Manchin. “It’s dead,” said the Democrat from West Virginia, lamenting the passing of Biden’s roughly $2trln Build Back Better program that would have passed but for Manchin and Sinema’s support. Fiscal conservatives cheered, pretending to appear desperate to return the good old days of pre-pandemic austerity.

You see, back in 2019, America’s economy grew 4.0%, fueled by a 4.7% federal budget deficit. But then the pandemic thrust the nation into this brave new world. The economy grew 5.7% in 2021, powered by a 12.4% federal budget deficit ($2.8trln). And that followed a monstrous deficit in 2020 to nearly offset that year’s -2.3% GDP decline.

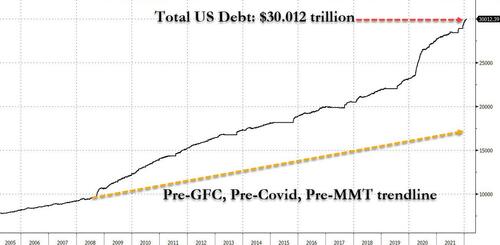

These sorts of deficits add up. And sure enough, US national debt hit $30trln this week, up nearly $7trln since late January 2020. It made for a good headline.

But of course, the Fed owns $9trln of bonds that it can hold in perpetuity, which means in practice, that federal debt is closer to $20trln.

That still sounds like a big number. But nominal GDP grew last year by 12.7% (5.7% real GDP plus 7% inflation). So $20trln isn’t what it used to be. And if nominal GDP ends up growing +10% this year (4% real GDP plus 6% inflation), then $20trln is even less.

Do that for a decade, even with a couple recessionary years of -2% real GDP and 6% inflation and we’ll have barely any debt left at all. But of course, you don’t lose passage of a $2trln Build Back Better spending program by a couple votes and end up spending nothing at all.

And if you completely slashed the deficit, we’d have a depression anyway. So massive deficit spending will continue, even as its absolute value shrinks relative to the size of the nominal economy.

That is what financial repression looks like. The whole time our central bankers will pretend to lean against the inflation. While the politicians pretend to rein in spending. And investors will writhe in pain.

But the truth is, at the end of a multi-decade debt super cycle, this is the least painful of a few awful choices.

Tyler Durden

Sun, 02/06/2022 – 14:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com