How Dealer Gamma Made The Market Into A Vomit-Inducing Rollercoaster

Back in the summer of 2020, long before most traders had heard of “gamma squeezes”, or dealer delta, or option expiration triggers, we wrote an article titled All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows in which we said that “gamma has the potential to be one of the most important non-fundamental flows in equity markets (particularly when “short gamma” causes volatility to accelerate).”

As we further noted late last month, while dealer gamma in particular and derivative technicals, flows and positioning in general, are both ever-present pillars of daily market moves, rarely do they matter more than when market liquidity is dismal, as it has been in the past months with Emini book of depth near all time lows, and comparable to the liquidity wasteland that was the March 2020 market bottom when emini bid/ask spreads hit 50 ticks at one point.

This matters because anyone trying to explain the market’s odd behavior over the past few weeks without touching on arguably the most important concept – dealer gamma – can just pack it early as few things matter to today’s price discovery than the “Greeks”.

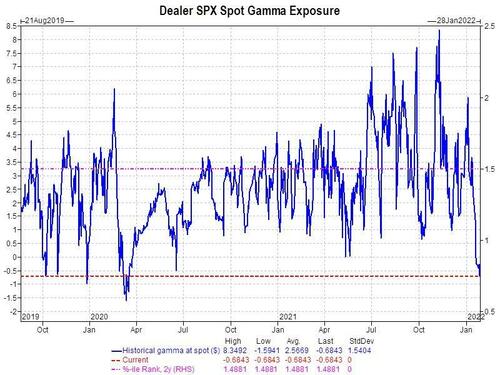

It’s why when we discussed the market’s tactical positioning over the weekend, we underscored why a near record negative dealer gamma could only go up as risk bounces and shorts are squeezed, helped explain why stock managed to stage a remarkable rebound last week, and were poised for continued stabilization in the coming days.

We also noted that with the current dealer gamma position ranking in the 8th percentile on a 3-year rank meant that the long dealer gamma position, which stocks had enjoyed as a market buffer for so long, was no longer present at least until stocks rise another 150 or so points. Furthermore, we observed that “hedging activity has been exacerbated by those dealers hedging customer delta with demand for puts” and noted that the “market could move freely both to the upside and downside, but this has mattered given the low liquidity provided by futures hedging (mostly end of day).”

Picking up on this, in his latest note published overnight, Nomura’s in house x-asset tactician Charlie McElligott notes that major US Equities index options “have continued to remain stuck under the boot of this seemingly never-ending Dealer short Gamma vs spot location, where largely since mid-December (with a few brief periods of exception), we have remained in this whip-saw fueling “mechanical” dynamic” due to the following previously discussed factors:

- persistent demand for Puts (keeping Dealers “short” downside optionality)

- substantial notional deleveraging flows from investors (as well as outright “shorting” from CTA Trend and dynamic hedgers)

- the Fed’s regime change signaled by their inflation / financial conditions “hawkish pivot” around that same time

- as the fixed-income selloff has then only further exacerbated the thrashing of legacy Secular Growth “Longs” (expensive / unprofitable / crowded) and their significant Equities index weight, which then into Jan / Feb came under further pressure from…

- a number of high profile earnings / outlook “misses,” jarring sentiment, and

- the Corporate buyback “blackout”—meaning the market is missing much of its decade-long, price-insensitive primary “bid”

Here McElligott – who primarily deals in flows, technicals and gamma, and will therefore explain everything through the prism of flows, technicals and gamma – writes that “a core “truth” to modern market-structure is that “Dealer Gamma” is the primary input which matters as it pertains to the ongoing cries from market participants about the current “horrible liquidity” environment with no “depth-of-book” – because a “Long / Positive Gamma” position means that prolific options hedging flows where Dealers can function as “liquidity providers”-“countercyclical buffers” which tend to sell into strength (“offer” futures / stock when there is high demand), or buy into weakness (provide the “bid” for markets to hit into selloffs).”

But, as Charlie adds, where “Long Gamma” regimes often see extended periods of “low volatility” moments of eventual “market truth” occur (e.g. Fed pivot, COVID growth shock, Trump Tariff tweets)—and spikes in implied Volatility then follow, as the prior “stability” sows the seeds of “instability” via leverage and lazy-narrative “crowding,” which tends to then see “asymmetric” positioning tip-over thereafter.

These “Vol spikes” then coincide with the dealer Gamma position vs spot markets moving abruptly lower – or the most extreme scenario, outright negative in this most recent period – as generically Dealers being “short Puts” into said Vol spikes sees market Liquidity then removed (iVol up, Gamma down, Delta down)— as all Dealers turned the same-way, i.e., “liquidity TAKERS” as client flows in “negative / low / short Gamma” position, either acting as another seller on the way down (with few MM bids to hit), or buyers on the way up (when there are few offers around), thus McElligott’s usage of the term “accelerant flows” – or as we call it “momentum ignition” (which also activates the HFT frontrunning crew) from Dealers as it pertains to a “short Gamma” regime, instead of the “countercyclical liquidity provider” role they play in a “long Gamma” environment.

In short, while dealers stabilize markets during “long gamma” periods, they not only act as agents of instability but also drain liquidity when volatility spikes, when market liquidity is zero and when dealer gamma is negative as it is now.

With all that said, the good news according to McElligott who in turn echoes what we said last Sunday, is that we continue to whittle-through the worst of Options Dealer positioning and metrics, such as Vol and Vol of Vol, both of which continue to bleed under smaller “close-to-close” moves, with iVol vs rVol currently way too low, while Term Structure is flat and Skew / Put Skew are “off the boil.”

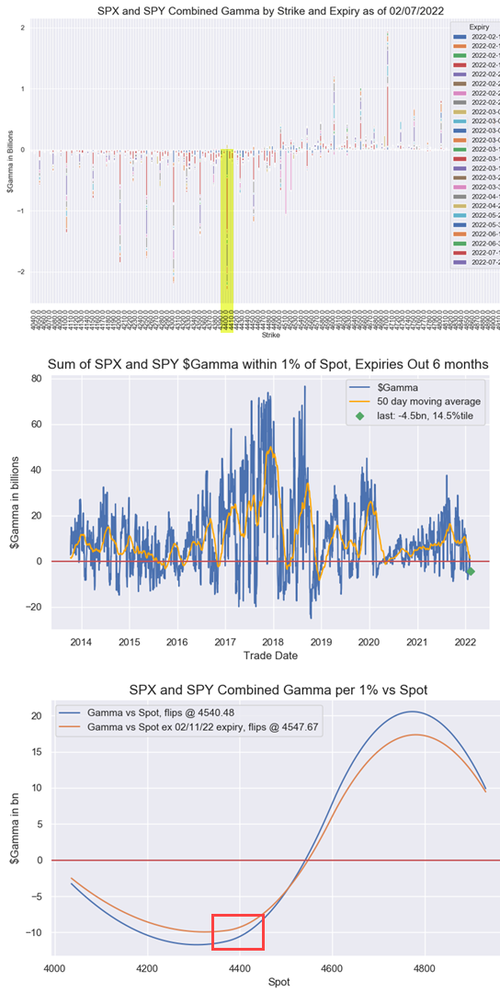

Nonetheless, until markets recover near 4,600 – which probably won’t happen unless Thursday’s CPI is a big miss, short gamma and extreme negative Delta means aforementioned hedging flows which press market moves continue to act as an “accelerant” and creating overshoots in both directions, but as McElligott also notes, the “Extreme Short Delta” can act as vicious “short covering” fuel on market moves higher:

And yet, to this observation of “Extreme Short Delta” acting as fuel for covering squeezes, the Nomura quant adds that “it should be concerning for bulls that we continue struggling to rally despite this 1) “short hedge” covering fuel from Dealer shorts in futures (unable to sustain squeezes), and 2) despite implied Vol continuing to soften—yet still, the “supportive” Vanna flows continue to struggle supporting Spot Equities as well”:

- SPX / SPY -$4.5B $Gamma (14.5%ile), still short “Gamma vs Spot” with the neutral line up at 4540, currently ~-$7B Gamma per 1% move; $Delta -$258.6B (5.9%ile), still extreme short “Delta vs Spot” with the neutral line at 4572

- QQQ -$337mm $Gamma (7.2%ile), still short “Gamma vs Spot” with the neutral line up at $365.45, currently ~-$375mm Gamma per 1% move; $Delta -$30.9B (0.6%ile), still extreme short “Delta vs Spot” with the neutral line at $372.42

- IWM -$168mm $Gamma (23.3%ile), still short “Gamma vs Spot” with the neutral line up at $205.71, currently ~-$125mm Gamma per 1% move; $Delta -$14.1B (1.8%ile), still extreme short “Delta vs Spot” with the neutral line at $211.55

Ominously, McElligott concludes by laying out his view that the next “move of magnitude” for stocks will likely have to experience an impulse lower first (4250 / 4300) before any real attempt to test prior highs (4800 / 4850), particularly because “resumption of rally” to that extent will actually further ease financial conditions, which then will pressure the Fed and market forces to increase their hawkish rhetoric/pricing.

Welcome to the joy of reflexive markets.

Tyler Durden

Tue, 02/08/2022 – 14:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com