Bullard Bombshell & Soaring CPI Spark VaR Shock-nado, Rate-Hike Odds Explode

A 40-year-high print for US CPI stole the jam out of most investors donuts today as the hawkish implications of the far hotter than expected inflation print sparked a total VaR Shock across every asset class

Notably, The White House commented that it would be appropriate for The Fed to recalibrate support for the economy (after blaming the soaring inflation on the pandemic). This sounds a lot like “meddling” with the independence of The Fed (cough Trump cough) but seems like a clear message to Powell that it’s ok to crash the economy (to slow inflation)… perhaps in the mistaken belief that it will somehow help his approval ratings?

Since even Goldman admitted that the Fed has never successfully hiked its way into a soft landing, Biden is basically telling Powell to start a recession to undo the consequences of his idiotic fiscal policies that have sparked the biggest inflationary conflagration since Volcker… and having no job and soaring inflation would make matters worse for Biden’s approval rating.

pop quiz: what happens at the end of every Fed tightening cycle pic.twitter.com/wummqlAoKe

— zerohedge (@zerohedge) February 10, 2022

As David Rosenberg (@EconguyRosie) notes, the best way to cure inflation? Recession. Yield curve getting close to inverting and making the call – 2s/10s less than 50 basis points away and 5s/10s within 10 basis points. Never mind bonds – things are getting very interesting for the stock market. Will the bulls fight the Fed?

St.Louis Fed’s Bullard piled on, urging a 50bps hike asap… and suggesting an inter-meeting hike (and a Q2 start to QT).

What the hell happened in the last 9 days to get to that from this…

The Fed has not started a rate-hike cycle with a 50bps increase since at least 1990.

Rate-hike odds exploded higher with a 50bps hike by March now fully priced in…

Source: Bloomberg

And even February now pricing in some rate-hike premium…

Source: Bloomberg

Getting so hawkish out there. @TimDuy says Fed is deeply behind curve on inflation, adds “I would not be surprised by an intermeeting move either tomorrow Friday or by Monday. I know, this is crazy aggressive.”

— Michael S. Derby (@michaelsderby) February 10, 2022

And finally, the market is pricing in a 40% chance of 7 rate-hikes this year…

Source: Bloomberg

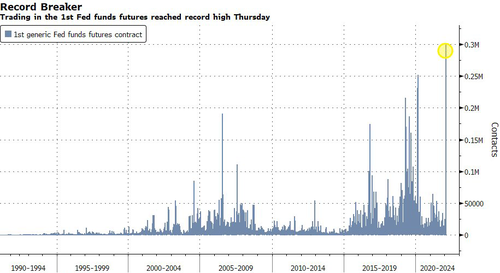

Today saw the greatest front-month Fed Funds Futures volume day ever… The volumes were at 300,000 in late Thursday trading, that’s about eight times more than usual levels.

Source: Bloomberg

Yields exploded higher across the curve with the short-end massively underperforming (2Y +25bps, 30Y +8bps)…

Source: Bloomberg

…pushing 10Y yields above 2.00% and 2Y above 1.60%…

Source: Bloomberg

And as the market anticipates a sooner and faster rate-hike trajectory, the yield collapses as it prices in an imminent policy error.

The 5s30s curve crashed to just 35bps above inversion today…

Source: Bloomberg

In the last 30 years, there have been just two times where the curve inverted and in both cases it was brief. Both times a recession followed but also the curve widened as short- term rates fell more aggressively than the longer end of the curve.

The last time we saw rates this jumpy was 2008/9…

Source: Bloomberg

And the forward market shows 2s30s has actually inverted one-year out (recessionary indicator)…

Source: Bloomberg

Equity markets were an utter shitshow also today, flying around all day until Europe closed and then it was “sell Mortimer, sell!” with all the majors closing at the lows of the day. Nasdaq was the worst performer on the day but Small Caps had the wildest swings…

Today’s drop sent The Dow, S&P, and Nasdaq back underwater on the week.

The S&P fell back below its 100DMA, as did The Dow…

All the sectors ended red on the day, with financials and energy the least bad horse in the glue factory…

Source: Bloomberg

Notably financials are still relatively outperforming the market (as rates rise), but have dramatically decoupled from the yield curve…

Source: Bloomberg

And Nasdaq has a long way to fall relative to Small Caps if Real Yields are to be believed…

Source: Bloomberg

Credit markets cracked wider again today and VIX started to play catch up…

Source: Bloomberg

Credit anticipates, equity confirms…

Source: Bloomberg

The Dollar was utter chaos: soaring on the hawkish CPI print, then collapsing to 4-week lows before rebounding on Bullard’s hawkish comments…

Source: Bloomberg

And the dollar closed unchanged on the year…

Source: Bloomberg

Bitcoin was just as chaotic, dumping below $43.5k, ripping to almost $46k, and then back to $44.5k…

Source: Bloomberg

Gold ended the day marginally lower but also had quite a volatile day..

WTI ripped back above $91.50 after tumbling on CPI, then fell back below $90 at the settle…

And finally, the forward OIS market is signaling rate-cuts are coming between 2023 and 2024… The last time the market was here, The Fed folded on its monetary tightening…

Source: Bloomberg

In fact OIS expect rates to top in Dec 2022 before The Fed is forced to react…

Source: Bloomberg

So there’s your recession countdown indicator!! 1 year and counting.

last time inflation was this high, this was the music everyone was listening to pic.twitter.com/5XOVpFWstN

— StockCats (@StockCats) February 10, 2022

Tyler Durden

Thu, 02/10/2022 – 16:01

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com