Fed Scrambles To Push Back Against Damage Caused By Bullard’s “Immature, Unprofessional” Comments

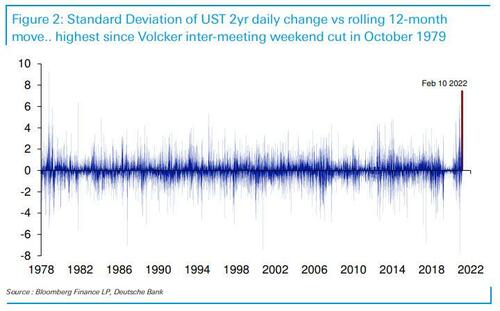

After yesterday’s shockingly hawkish post-CPI outburst by Bullard, which sparked the biggest US rate shock since Volcker’s October 1979 massacre…

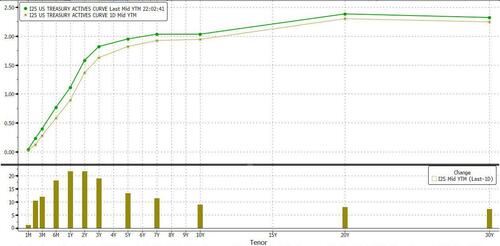

… and whose comments RJ O’Brien slammed as “immature and unprofessional” adding that “as a 2022 voter, the St Louis President — who has a history of verbal gaffes and inaccurate monetary proclamations — may have gone too far in his comments on immediate policy”, the bond market has gone on tilt with yields blowing up especially on the front-end in one of the most memorable one-day curve flattenings in history…

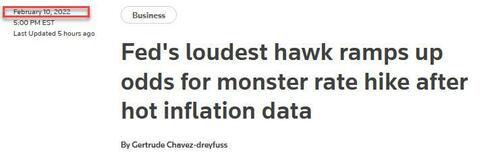

… while the Fed Funds futures market was at one point predicting not just a 100% certainty of a 50bps rate hike in March, and more than 7 rate hikes for all of 2022, but also 30% odds for an intermeeting rate hike (i.e., as soon as today or tomorrow).

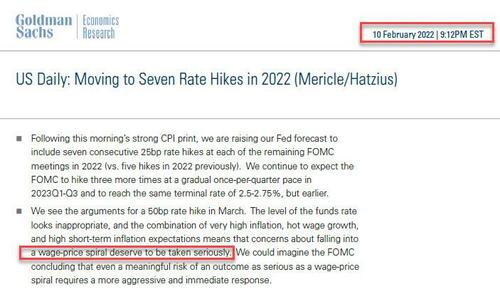

The rate hike frenzy got so bad that late on Thursday Goldman joined Bank of America in changing its rate hike forecast for the second time in two weeks, writing that “following this morning’s strong CPI print, we are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously). We continue to expect the FOMC to hike three more times at a gradual once-per-quarter pace in 2023Q1-Q3 and to reach the same terminal rate of 2.5-2.75%, but earlier.”

The reason for Goldman’s reversal? The bank now says that “concerns about falling into a wage-price spiral deserve to be taken seriously”..

… which is hilarious because exactly one month ago, the same Goldman told us that…

Goldman’s pathetic flip-flopping aside, which is only comparable to the Biden admin’s flip-flopping on covid mask use, the bank also said that it sees “the arguments for a 50bp rate hike in March” noting “the level of the funds rate looks inappropriate, and the combination of very high inflation, hot wage growth, and high short-term inflation expectations” but then countering that “so far, though, most Fed officials who have commented have opposed a 50bp hike in March.” Goldman therefore thinks “that the more likely path is a longer series of 25bp hikes instead.”

Goldman concludes that Bullard became the first FOMC participant to call for a 50bp hike earlier today, “and we would consider changing our forecast if other participants join him, especially if the market continues to price high odds of a 50bp move in March.”

We doubt that will happen, especially since Bullard who indeed was the first FOMC participant to call for a 50bps hike yesterday…

… said just 10 days ago that he a 50bps rate hike will not “really help”…

… confirming that neither Goldman nor the Fed has any idea what is going on.

In any case, to avoid further contagion, and to minimize the risk of an even greater reout, overnight we had first Bloomberg then CNBC write articles scrambling to undo the damage done by Beartard Bullard.

Starting with Bloomberg, its Fed watcher Craig Torres couldn’t be more clear and in an article titled “Fed Doesn’t Yet Favor a Half-Point Hike or an Emergency Move” he writes that “Federal Reserve officials are in no rush to raise interest rates prior to their scheduled policy meeting next month, nor is a half percentage-point move in March yet likely, despite a bigger-than-expected jump in consumer prices that stoked speculation about such options.”

And while Bloomberg did not quote sources pushing back on Bullard, CNBC’s Steve Liesman did, and in an article published this morning he writes that “several Federal Reserve officials, both privately and publicly, are pushing back against calls by St. Louis Fed President Jim Bullard Thursday for super-sized rate hikes, and instead suggesting the central bank is likely to embark initially on a more measured path.”

As Liesman writes, the comments of these officials suggest markets may have wrongly interpreted Bullard’s remarks as being more widely held than it is by Fed officials and leadership.

CNBC reporting found that several Fed officials were already looking for a bad inflation number and the January report was not substantially worse than expected. Improvement is not expected until mid-year and only then, if it remains high and rising and does not respond to rate hikes and plans for balance sheet reduction, would these officials want to accelerate the pace of tightening.

There are still five weeks before the meeting, including another inflation report, and the situation could change. But key officials, even after the inflation report, continue to hold to an outlook for measured tightening.

So did Bullard, cluelessly flipflopping from one extreme to the other as he has always doen, spark a near market crash with his opinions which have had zero input from the only opinion that matters, that of Jerome Powell? Judging by the sharp recovery in futures and the slide in rate hike odds this morning, the answer is a resounding yes.

Tyler Durden

Fri, 02/11/2022 – 09:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com