Hedge Funds Take Oil Profits As Inflation Fears Intensify

By John Kemp, Senior Market Analyst at Reuters

A bout of profit-taking ensued last week as seven-year highs in crude oil and middle distillates prices intensified concerns about inflation and the possibility of countermeasures from central banks.

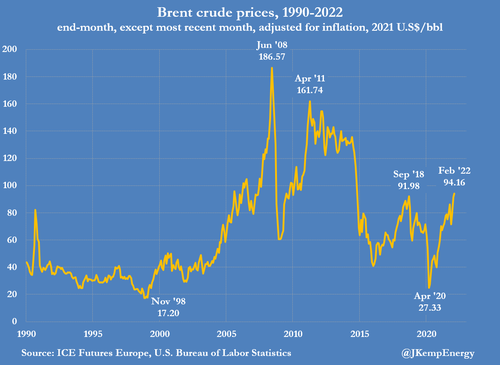

Rapidly escalating prices for oil and other commodities have become a central problem for macroeconomic policymakers in advanced economies. Unless inflation in oil and other commodities starts to decelerate on its own, the U.S. Federal Reserve and other central banks will be forced to raise interest rates to slow growth and bring prices back under control.

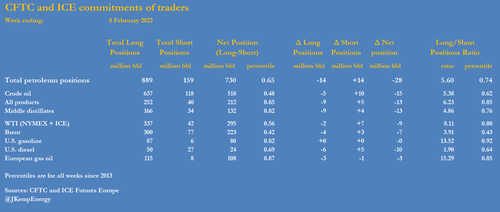

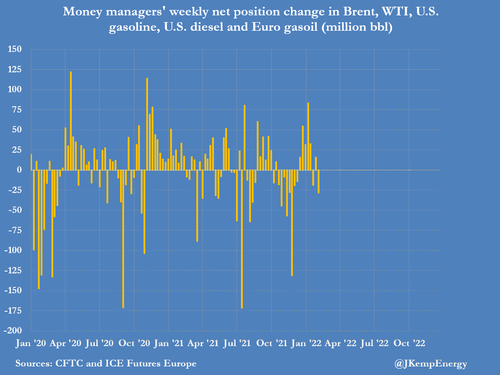

Against that backdrop, hedge funds and other money managers sold the equivalent of 28 million barrels in the six most important petroleum-related futures and options contracts in the week to Feb. 8. It was the second time in three weeks that portfolio managers sold petroleum, and the sales were the largest since the end of last November. In the most recent week, there were net sales of NYMEX and ICE WTI (-9 million barrels), Brent (-7 million), U.S. diesel (-10 million) and European gas oil (-3 million), with only U.S. gasoline unchanged.

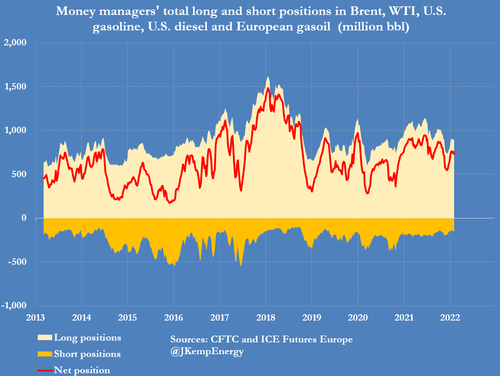

The combined position is essentially unchanged from mid-January after previously rising by 150 million barrels since the end of November.

Portfolio managers are still bullish on the outlook for prices, with the combined position of 730 million barrels in the 65th percentile for all weeks since 2013.

Bullish long positions outnumber bearish short ones across the six contracts by a ratio of 5.6:1, which is in the 74th percentile.

But prices have already risen by more than 30% in less than three months and there are growing concerns about rising inflation and interest rates, prompting fund managers to realize some profits.

Funds reduced bullish positions by 14 million barrels last week, while adding 14 million barrels of new bearish ones, confirming a much more cautious outlook on further price gains.

Tyler Durden

Mon, 02/14/2022 – 11:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com