We’re Due For A Limit Down Day

Submitted by QTR’s Fringe Finance

I’ve got a feeling that a limit down capitulation style morning is still on its way, as I first asserted about a week ago – here’s why.

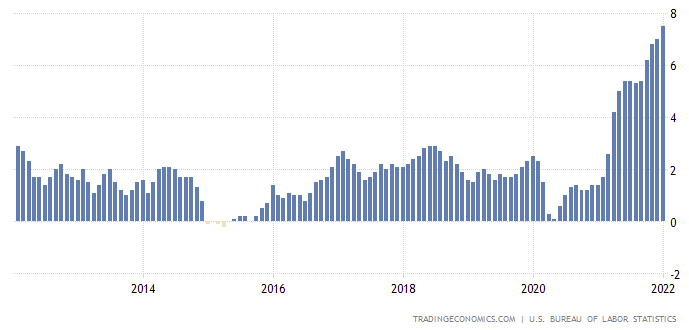

Last week’s CPI number coming in at 7.5% ratchets up the temperature not only for the Fed to not change course, but also to act sooner and more decisively.

As I have written about, inflation is the kryptonite that won’t let the Fed off the hook easy anymore. There can’t be anymore Powell pivot, because the inflation numbers absolutely have to be addressed.

Make no mistake about it, the Fed has stuck their foot into the shit. The days of inflation being a “mystery” that somehow magically fixes itself are over.

We are in a situation unlike any situation we have been in over the last 25 years.

Now, there are whispers of an emergency rate hike, which in my opinion is desperately needed.

The fact that stocks rose over the last couple of weeks heading into Thursday’s CPI print tells you how disjointed and askew the investing mindset has been made, thanks to decades of arrogant Fed policy.

Either investors over the last two weeks assumed the Fed would let off the gas if a 6.X% print happened (still a pornographic amount of inflation, so it would be totally ridiculous to do) or they are just conditioned to think the Fed is always going to have an “easy” solution the way they have over the last 20 years.

Either way, they – and a lot of other people – are going to be in for a wakeup when they run face first into the realization that the only solution here is something the Fed has desperately tried to avoid for the last 30 years: discomfort.

And the thing about discomfort is, the longer you put it off, the worse its going to feel. Now we have to give back the gains of the last few weeks and then resume plunging. This caught the market by surprise, even though it shouldn’t have.

The Russian/Ukraine headlines on Friday helped accelerate this move, but I still think there’s further to go.

I won’t be stunned to wake up one morning and see capitulation now that the only solution becomes even more visible to market participants. Will you?

I wrote at the beginning of February that if there’s one thing that you can say about this “bear market” that we’ve been in over the last couple months, it’s that at no point during the selloff has there appeared to be panic. For the most part, stocks are getting brutalized this year, but there haven’t been too many “oh shit” style, “Markets In Turmoil” moments.

The last couple of trading days have offered up a respite from one of the ugliest Januarys on record as the market has popped slightly on what are, to me, clearly bear market rallies.

But the old expression is that bear markets slide down a “slope of hope”, and that’s what it has felt like so far.

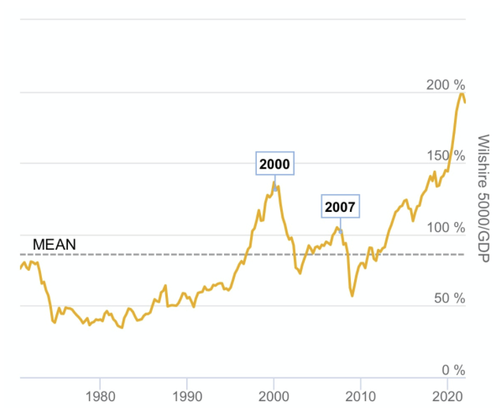

Despite this, every serious indicator in the book that we can look at – from the Schiller PE (currently still at 37x) to market cap/GDP – suggests that if the Fed is going to continue course without interruption, stocks likely need to fall well further to even consider a notion of reverting to historical means.

I believe stocks will have to fall about 40% from their all time highs, at a minimum, despite the fact that that would still leave many companies with perversely optimistic valuations.

Massive technology staples like Facebook beefing earnings, as they last week, will only serve to help create the climate for panic to bubble up. One terrible earnings report at a time, investor sentiment will start to worsen, then worry.

If the Fed doesn’t change course, there simply doesn’t seem to be a way out for people who are buying stocks at this level – at least in the short to mid-term. I’ve written before in my article “Sometimes Bad News Is Just Bad News” that rate hikes will be outright destructive to the market if they are followed through with — there’s no silver lining.

While the market has caught onto some of the fact that the Fed appears to be serious, the last couple days have shown us that shorts are covering some and longs are likely unable to forget the “buy the dip” conditioning they’ve been part of over the last decade. But the gravy train has left the station and, again, as long as the Fed doesn’t pivot, BTFD is going to be DOA for the foreseeable future.

The only thing that’s been missing so far has been a collective realization by a significant amount of market participants that it’s really no longer worth trying to climb and cling to this slope of hope — when that reality check hits home, and it may not be far off, we may witness the capitulation and real fear that this bear market has been missing thus far.

Now read:

-

Selling In A Few Mega Caps Can Quickly “Turn Into A Waterfall”: Former CBOE Floor Trader

-

Has The Red Carpet Been Rolled Out For A Mainstream Pivot On Ivermectin?

-

Cancel Culture Is Now Officially A Snake Eating Its Own Tail

-

Shipping Expert Talks His Favorite Stocks For the Supply Chain Crisis

Disclaimer: This is not a recommendation to buy or sell any stocks or securities. I own QQQ AMC and ARKK puts, among other puts that would benefit if the market crashes. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Mon, 02/14/2022 – 06:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com