Goldman’s Startling Admission: “The Economy May Be Slowing More Than Expected”

On Monday, Morgan Stanley’s chief equity strategist and the man we call “Wall Street’s biggest bear” once again stunned his colleagues when he penned an article writing that between the big hit to the US consumer – now that stimmies are no longer funding the relentless spending spree – and the potential for sharp escalation in the Ukraine conflict, “materially increases the odds of a polar vortex for the economy and earnings.” Of course, with Wall Street – even Morgan Stanley – calling for an ungodly number of rate hikes, with JPMorgan now joining BofA in calling for 7 rate hikes in 2022, signaling continued solid growth few other have been worried that the economy could slow down dramatically, let alone be in danger of recession, despite our frequent warnings that the core pillar of the US economy, the consumer, is in far worse shape than economic data would suggest.

However, that may be changing, because as even Goldman Sachs, traditionally one of the biggest sellside cheerleaders cautions in its Midday Market Intelligence note, one of the reasons for the sharp drop in risk assets today is not just the resurgence in geopolitical concerns but also “the potential the economy may be slowing more than expected.”

We except from the full note below:

A renewal of old concerns — geopolitical issues, economic growth — is driving the market to assume a risk-off stance of Thursday. In addition to the political situation in the Ukraine, the Philly Fed — an important real-time gauge of the economy — retreated in February. While the +16 reading remains in ‘expansionary’ territory (anything above ‘0’), the slowdown comes on the heels of a very strong January reading (+23) and against FactSet consensus expectations for a +22 reading.

The combination of increasing geopolitical concerns and the potential the economy may be slowing more than expected sent the VIX back up to 24, and drove a decline in equities as investors turned to bonds and gold — both traditional investor perceived ‘safe havens’. Yields on 10-year US Treasuries lower to 1.98%. Turning to today’s equity markets, investors are leaning into Consumer Staples, and dividend-yielding sectors like Energy, Utilities, and Real Estate. Unsurprisingly given renewed concerns about growth, Tech is the worst performing sector in the S&P 500 today.

Interestingly, the move lower comes after an end-of-day ‘relief rally’ yesterday as markets responded positively to the release of the February FOMC Meeting Minutes which yielded some additional clarity on the Fed’s potential hiking plan. The minutes indicated that participants judged that it would “soon be appropriate” to raise the federal funds rate, but “some” participants noted that “financial conditions might tighten unduly” in response to rapid monetary policy tightening, suggesting a 50bp hike in March is less likely. Our economists continue to expect liftoff at the Fed’s March meeting, with seven hikes in 2022 and three more times at a gradual once-per-quarter pace in 2023Q1-Q3.

The take home here is that between MS and now Goldman, the reality of a much faster economic slowdown than virtually anyone had penciled is starting to emerge, and with it the cognitive dissonance that will now sweep across both Wall Street and the Fed, which will now have to scramble to reassess the central bank’s tightening intentions, especially if the US may be facing a recession (as soon as the second half of 2022 according to BofA’s Michael Hartnett) when the Fed is still at zero and still buying bonds!

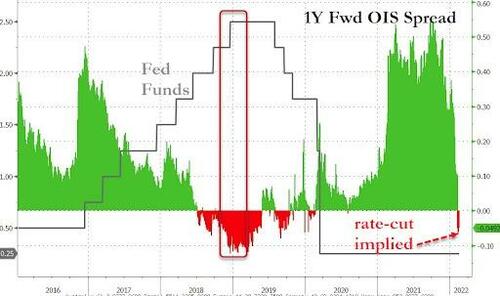

Practically, this means we are due for some substantial market turbulence as the market reappraises the latest data – which will only get worse as we get deeper into 2022 – which will translate into not only fewer rate hikes before the Fed is forced to relent, as it did in late 2018, but proceed with easing and rate cuts, something the market is already pricing in for 2024.

Which then leads to the $64 trillion question: will the Fed continue its aggressive hiking plans, and if so will it dare to hike into a recession, or – as Zoltan Pozsar suggested earlier – is the Fed just trying to spike volatility, i.e., crash markets, in hopes of hammering inflation which as Joe Biden reminds Powell at every opportunity, is the only mandate the Fed has at this moment.

Tyler Durden

Thu, 02/17/2022 – 14:43

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com