Market Sentiment Has Never Been Worse And Everyone Is Hedging For A Crash

Back in 2007, Jim Cramer famously screamed at Erin Burnett that the Fed “has no idea how bad it is out there… They know Nothing!” Today’s market would agree with Cramer.

While stocks have been hammered by a relentless, furious pounding for much of 2022 which culminated today with the S&P officially entering a 10% correction from its all time highs…

… a better look at market sentiment comes from the latest AAII bull minus bear index, which shows that trader sentiment has rarely been worse.

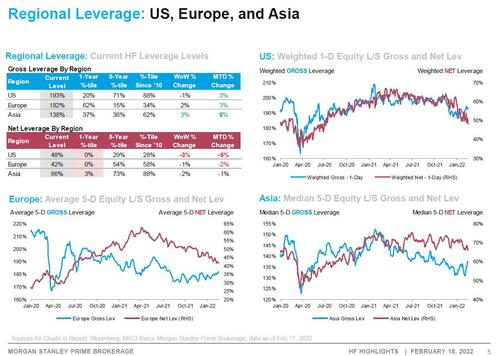

The latest Morgan Stanley Prime Brokerage report (available to professional subscribers) showed just how broken bullish sentiment has become. According to the bank’s PB group, in the last week, net leverage across long/short funds had fallen to just 48%, the lowest level seen since June 2020, as hedge funds piled into shorts.

As the bank further details, last week’s selling “was largely concentrated within N. America, though HFs did also skew towards selling EU equities as well. Most of the selling on Thursday came on the short side, with short additions in N. Am in line with some of the largest levels we have seen YTD.”

But besides just aggressive shorting of stocks – one which would need just one word of hope from the Fed to spark a massive squeeze – increasingly bearish traders have been expressing their outlook by taking out record downside hedges, which as Bloomberg notes today, “may be one reason the worst has so far been avoided.”

As we first noted several weeks ago, when we showed the record amount of puts being purchased which according to Goldman have recently averaged to roughly $1 trillion per day…

Everyone is hedged for a crash: “we have been averaging $1 Trillion worth of puts per day. Largest on record.” – GS pic.twitter.com/zRrpCgbJYZ

— zerohedge (@zerohedge) January 31, 2022

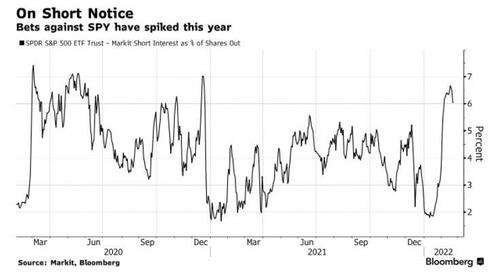

… Bloomberg today picks up on this, noting that traders have been steadily boosting bets against equities, “shaking off a reluctance to short tracing to last year’s meme stock upheaval.” As a result, not only have bearish bets on the SPY ETF surged, but put open interest on bond-focused products has also risen to historic levels. Meanwhile, professional managers have been hedging their credit exposures.

It is this unprecedented downside protection that has allowed markets to remain relatively resilient overnight, shaking off a decline in futures that at one point reached nearly 3% on the Nasdaq 100 Index.

“When markets are at record highs, there’s a lot of room for downside movement,” Randy Frederick, managing director of trading and derivatives for Charles Schwab, said by phone. “I would think that might diminish the impact of this.”

So just how pervasive is bearish sentiment? According to Bloomberg data, short interest as a percentage of SPY float has doubled since the start of the year, last week reaching the highest since December 2020, according to data from IHS Markit Ltd. More than 6% of the fund is now out on loan.

But while some are shorting the SPY, others are just buying puts, with SPY open interest last week climbed to a two-month high, and a Cboe put-to-call ratio that tracks the volume of options tied to everything from single stocks to indexes, including the S&P 500 and the VIX fear gauge, has also spiked. Among Russia-centric securities, open interest for bearish put contracts on the $1.4 billion VanEck Russia ETF (RSX) — which primarily tracks Russian energy and mining stocks — surged to the highest level since April 2018 last week.

It is this “frantic hedging” that is helping buffer any decline, said Matt Maley, chief market strategist at Miller Tabak + Co, preventing the market from flushing to the downside, a process which many way will be necessary for risk sentiment to truly bottom.

“It’s very similar to when a stock with very high short-interest gets some bad news. The decline tends to be much more orderly as those shorts starting taking profits and cover their positions,” he said.

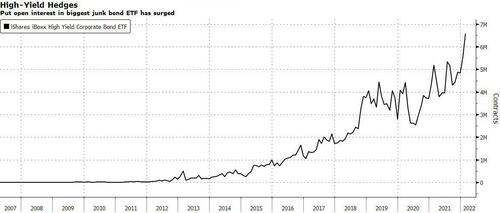

Meanwhile, as we first pointed out two weeks ago, a similar story has been playing out in the corporate-bond space as the Fed ramped up rhetoric. Put open interest for both the largest High Yield Corporate Bond ETF (HYG) and its Investment Grade peer (LQD) has surged to near records.

“HYG and LQD have been a clear focus with more consistent hedging in those products than we have ever seen,” said Chris Murphy, co-head of derivatives strategy at Susquehanna.

A similar dynamic was observed by Goldman’s Prime Broker which found that shorts on credit ETFs have increased by 29% this year, outpacing the overall short-book for U.S. exchange-traded funds, which has risen by 5% in the same stretch. Overall, hedge funds tracked by the bank had at the start of February boosted short positions in every week but one since early November.

Even before the Ukraine shock, Investors were already hedging because of the Fed’s hawkish tilt, said Schwab’s Frederick. And while the case can be made the bearish buildups are a view on the market continuing to sell off, traders buy protection not because they want to have the chance to use it but because they’re hoping not to. It also help the market sell off in a much more orderly manner.

“It’s like an insurance policy. When you buy an insurance policy on a car, it’s not because you hope you crash — it’s because you know it might happen,” he said.

Still, as Bloomberg notes, while it’s possible that all of the protective stockpiles could make downside moves less violent, “it could also be the case that the market is still misunderstanding what the macro implications of a Ukraine conflict are”, according to Peter Chatwell, head of multi-asset strategy at Mizuho International.

Sanctions on Russia could push up inflation “and therefore ratchet up the central bank hawkishness even further. As such, rates products are unlikely to perform as a safe haven,” he said. “And when the rates products fail to act as a hedge, that will in turn generate more selling of risk assets.”

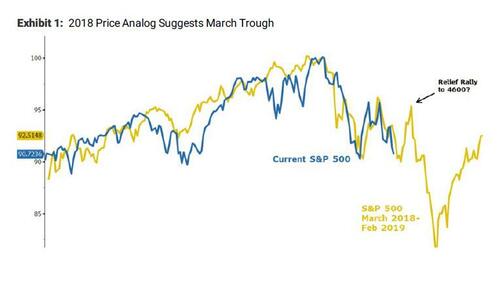

Which is true, unless of course, commodities surge so high they spark a global recession, similar to what we saw in the summer of 2008. In that case all those puts will certainly come in handy. They will also come in very handy if Morgan Stanley is right, and we are now reliving the late 2018 playbook, which will send the S&P tumbling down to 3,800 by the end of March…

… a collapse which most agree will finally trigger the Fed put because while Biden may be terrified about inflation, just wait until he finds out what a market crash will do to his approval ratings.

And as investors are ramping up their bets for a market apocalypse, the bulls are quietly going extinct. While stocks are not dropping nearly as fast as they would if downside hedges weren’t in place, they are still falling, and as noted above, the S&P 500 is now more than 10% from its record high at the start of the year, signaling a technical correction. The drop has also pushed the index below its 200-day moving average in recent days, a bearish omen suggesting it could slide toward a much lower floor.

The S&P 500 is “living on the edge of support” around the 4,300 level, according to Craig Johnson, chief market technician at Piper Sandler. A breach below that “would validate a lower low following a lower high, checking the classification box for a downtrend and forcing us to reevaluate our bull market thesis,” he wrote. Though he’s sticking with his 5,150 year-end price target for now, he says “the technical backdrop is deteriorating quickly along with our confidence in our year-end price objective.”

Among the bulls who conviction is fading by the day, and who say the price action itself convinces them the market is in trouble, is Evercore ISI technical strategist Richard Ross who said that his work continues to suggest the S&P 500 is headed toward a deep drop. He predicts a break below 4,200 could take the index to 3,600 – roughly in line with Morgan Stanley’s forecast – a decline of roughly 16% from where it closed Tuesday.

“While ephemeral relief rallies will occur as the conflict ebbs and flows, the seeds of the current decline were planted by policy and the pandemic long before troops massed on the border,” he wrote in a note. He said he urged clients to fight the temptation to buy brief rallies given “the ominous specter of the highest inflation in 40 years and more hikes than meetings to combat said inflation.”

Another among the reformer bears is Bloomberg Intelligence’s Gina Martin Adams, who noted that the S&P 500 is testing critical support levels that, if broken, suggest another 10% correction is ahead. The key level to watch is 4,280, and “even though the pattern may only emerge if the S&P 500 closes below that key support, a combination of weakening internals, rising interest rates, slowing growth and inflation pressure may result in a head-and-shoulders topping formation for the index,” she wrote in a note titled “Commodities May Be the Only Thing Keeping S&P 500 Above Water.”

Finally, chartist Katie Stockton said stock indexes saw short-term momentum turn negative last week following a brief rally off January’s lows. The S&P 500 and the Nasdaq 100 are “at a proving ground” as they approach those January lows once again.

“There are no signs of downside exhaustion yet, suggesting these levels will be tested in the days ahead,” she wrote, and she is right: as long as the market continues to drift lower and fails to flush, dragging the once invincible “market generals” along with it, stocks will not bottom, a sentiment encapsulated by the old Baron Rothschild maxim: “buy when there is blood on the streets.”

We are not there just yet, but as literal blood starts flowing in the streets, not even the record put overhang will prevent what’s coming.

Tyler Durden

Tue, 02/22/2022 – 18:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com