JPMorgan Publishes Terrifying Take On What Ukraine Crisis Will Do To Commodity Prices

So far western media has been relatively silent on what the escalating Ukraine crisis means for western consumers when it comes to prices for everyday commodities such as oil, gas, wheat, corn (and gold, for the goldbugs), and with good reason: as the Russian ambassador warned, “ordinary Americans” are about to feel the pain. As such it is understandable that the pro-Biden media is hoping to avoid discussing the consequences to America’s checkbook from the escalation in Ukraine: after all, the last thing hundreds of millions of Americans want to hear is that already sky high prices are about to get even higher.

JPMorgan’s commodity desk, however, has no such political considerations and in a must-read note published earlier today by the bank’s commodity strategist team led by Natasha Kaneva (available to pro subs in the usual place), the bank writes that “geopolitical escalation over the last few days has materially increased the risk of further aggravating commodity market imbalances. At this stage of the conflict, it is hard to see a path towards an easy de-escalation.” Consequently, JPM now expects “a steady rise of tensions in Ukraine and a corresponding intensification of sanctions from the West.” In that case, the bank warns that “the world could see an extended period of elevated geopolitical tensions and high risk premium in all commodities given Russia’s far reaching impact on global commodities markets.“

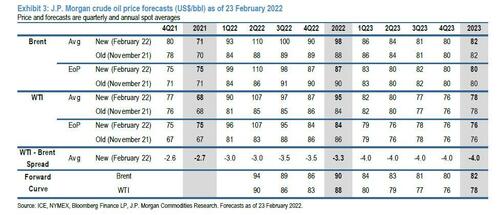

First, JPMorgan looks at what the impact on oil could be and it’s not pretty.

Confirming what we wrote just two days ago in “Oil Prices Will Be Above $100 For A “Prolonged Period“, Kaneva notes that Russia has always been a reliable supplier of oil, even at the height of the Cold War, she warns that if the market begins to price a probability that things have changed and Russia may take retaliatory measures by reducing its energy exports, a four-month disruption of 2.9 mbd of Russian export volumes to Europe and the US, will likely see the Brent oil price averaging $115/bbl in 2Q22, $105/bbl in 3Q22 and $95/bbl by 4Q22.

While that is certainly a downside case (if not nearly as bad as a full-blown war, which JPM recently predicted could lead to $150 oil and a global recession driven by soaring inflation ) JPM notes that even as bilateral relations have soured, Russian diplomats have continued working with European and US counterparts to revive the Iran nuclear agreement, signaling a deal may soon be reached. As such, a return of Iranian volumes could bring about 180 mn bbls of oil to the market, offsetting some of the estimated Russian supply shock. Assuming Russian escalation is coupled with an Iranian deal, JPM sees the Brent oil price averaging $110/bbl in 2Q22, $100/bbl in 3Q22 and $90/bbl in 4Q22, which is also the bank’s new base case view (for comparison, an Iranian deal with fading geopolitical risks would likely produce an average Brent oil price of $90/bbl in 1H22, with prices declining to $88/bbl in 3Q22 and $86 by 4Q22).

Things get scarier when looking at European gas prices, where JPM now revises its summer 2022 TTF price forecast to 77.50 EUR/MWh “to reflect the evolving geopolitical risks of the Russia/Ukraine conflict.” While current fundamentals suggest softness for TTF price in the offing (as per JPM’s previously published price forecast), the bank notes that it can “no longer avoid the risk premium of a supply disruption that could manifest with this geopolitical crisis.”

And with both Germany and now Joe Biden removing the prospect of Nord Stream 2 commencing in 2022, an in-service date for the pipeline in 2023 could create a reprieve for TTF price; however, based on statements made by the European Union and the US, the probability that Nord Stream 2 does NOT commence in 2023 is increasing, and as JPM calculates, “if Nord Stream 2 does NOT commence in 2023, we would expect the European natural gas market to find itself in a perpetual competition for LNG, ultimately manifesting in higher prices for longer.”

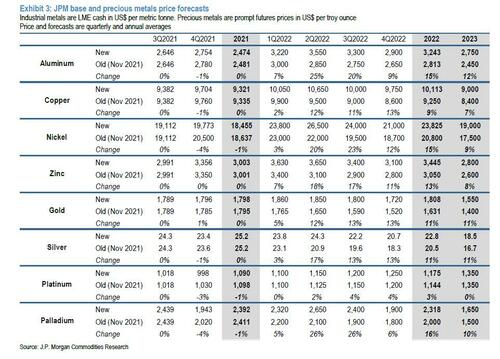

Stepping away from oil and gas, JPM next looks at base metals where inventories are already running extremely low, and as Marko Kolanovic warned yesterday, “there is very little additional cushion for further supply disruptions—either from Russia directly or via higher-for-longer gas and power prices. With Chinese demand already looking set for a strong post-CNY rebound, boosted Russian risk premium adds further bullish fuel to industrial metals complex in the coming quarters.” As such, JPMorgan boosts its 2Q22 forecasts to $3,550/t for aluminum, $26,500/t for nickel, $10,650/t for copper and $3,650/t for zinc.

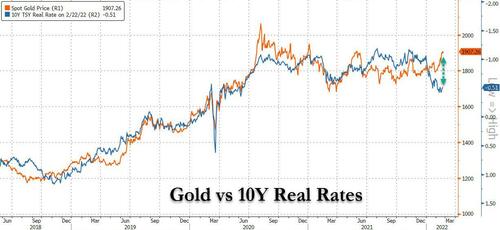

Gold is also not immune to the upcoming commodity shortage, and safe-haven buying on the back of the escalating Russia-Ukraine conflict has further driven gold’s ytd decoupling with real-yields with gold now trading around $250/oz rich vs the current level of US 10yr real yields

According to JPM, the elevated Russian risk premium in the coming quarters likely means this premium will be sustained much longer than the bank previously envisioned, blunting golds fall amidst higher rates, and as such JPM now boosts uts full year 2022 gold price average by 11% to $1,808/oz.

An even bigger price shock hides in palladium, where according to JPM, the risk to a disruption in Russian PGM supply is immense, with the country accounting for ~12% of global platinum mine supply and ~40% of global palladium supply. As such, JPM now sees palladium continuing to gain sharply over the coming months and averaging around $2,650/oz in 2Q22 while platinum gains to average $1,150/oz next quarter

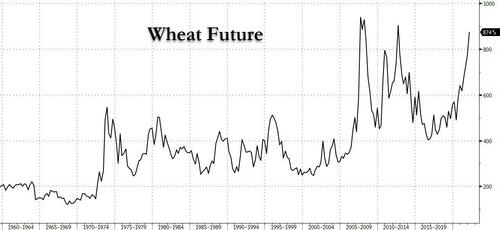

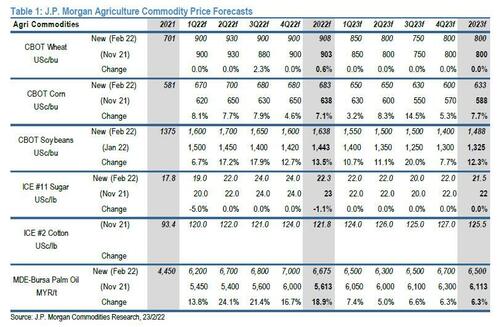

But wait, there’s more, with JPM next warning that the unfolding conflict between Russia and Ukraine remains the primary driver and upside risk factor for agri markets. The outlook for increased Brent crude oil prices over the quarters ahead is a materially supportive factor for the sector, raising the opportunity costs for biofuels and increasing production costs further, at a time of critical inventory tightness. Our agri price forecasts have been revised higher across much of the agri complex. Translation: your food is about to get much more expensive.

Of course, the timing of any potential disruption in grain exports from Russia or Ukraine will dictate the extent of risk premium across exposed agricultural markets, especially CBOT Wheat and CBOT Corn. In the event of export disruptions to Russian wheat-outside of the existing old crop quota, JPM sees CBOT Wheat tracking to the bank’s high case price scenario of 950 – 1,100 USc/bu. Not surprisingly, wheat today is soaring and has just hit the highest level since 2012. Expect it to reach fresh all time highs in the days ahead.

Finally, while disruptions to Ukrainian corn exports is a perceived lower risk, critical tightness in exportable supplies drive asymmetric risk to the upside and we see CBOT Corn trading in a 700 -900 USc/bu range under this scenario.

There is much more in the full report available to professional subscribers.

Tyler Durden

Wed, 02/23/2022 – 15:04

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com