Oil Prices And Sanctions Strategy: The Apparent Contradiction

By John Kemp, senior market analyst at Reuters

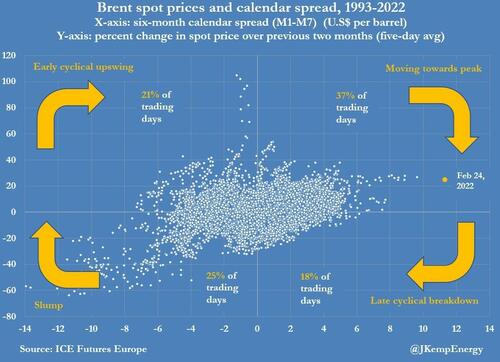

Apparent contradictions are the most fascinating phenomena in commodity and other financial markets, pointing to an unresolved tension for policymakers and potential mispricing. Even before the Ukraine crisis intensified this week, oil price indicators pointed to a market that was exceptionally tight, with production persistently falling short of consumption, inventories low and expected to fall further.

Russia’s invasion and the imposition of sanctions by the United States and the European Union in response have caused traders to anticipate the market will become even tighter as production and exports are disrupted.

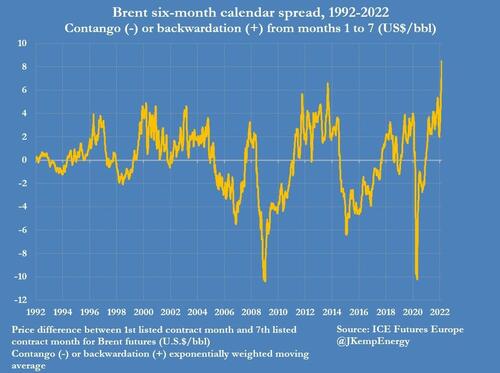

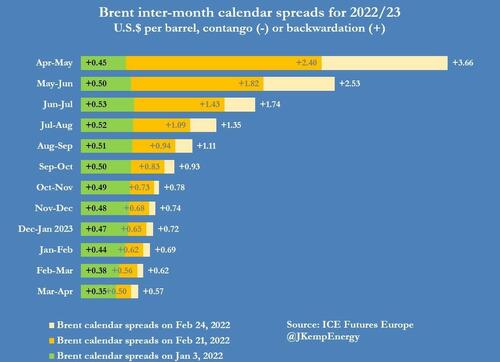

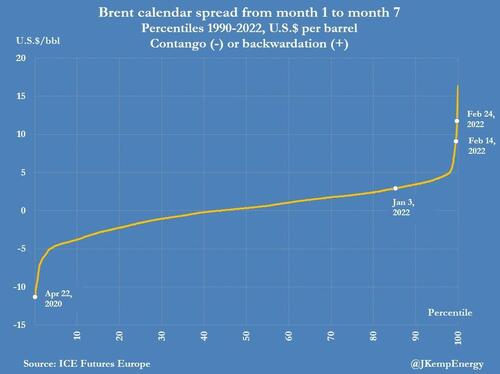

Brent’s six-month backwardation has climbed to more than $11 per barrel, the highest since September–October 1990 following Iraq’s invasion of Kuwait, up from $6 at the start of this month and $3 at the beginning of January.

The combination of rapidly escalating spot prices and a steep backwardation is consistent with a market expected to be severely under-supplied with a further depletion of inventories.

But senior U.S. policymakers have gone out of their way to emphasize their response will not increase oil and gas prices, which would add to inflation and the squeeze on household incomes.

The White House has briefed journalists that sanctions “will not target oil and gas flows.” The U.S. Treasury Department has specifically exempted financial transactions “related to energy” from sanctions.

So either the market is over-estimating the fallout from the crisis on the actual availability of oil and gas; the U.S. government is under-estimating the impact sanctions will have on oil and gas supplies; or a bit of both.

If the U.S. government’s view is correct, spot prices and the backwardation should both fall as oil and gas continues to flow, easing some of the fear about a recessionary spike in prices.

If traders are correct, the disruption of oil and gas supplies (actual or threatened), possibly as a result of a miscalculation about the escalation ladder, will worsen inflation and increase the risk of a recession.

But given the contradiction between where prices are trading and the U.S. government’s strategy, someone must be wrong.

Tyler Durden

Fri, 02/25/2022 – 21:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com