Citi Stopped Out Of Oil Short At Double Digit Loss As TD Sees Oil Spiking To $145

While Wall Street was getting increasingly bulled up on oil prices, one bank was turning ever more bearish, and exactly one month ago when Brent traded at $82, Citigroup’s commodity head told Bloomberg he was advising clients to go short December Brent futures, predicting U.S. production would be “on the low side” at the end of the year while saying he doesn’t expect an LNG crunch in Europe if Russia invades Ukraine.

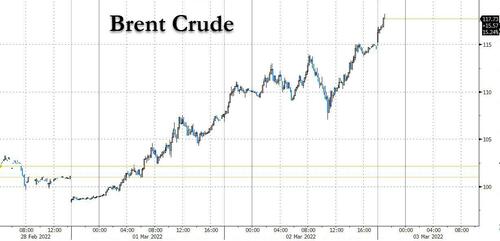

Boy was he wrong… but at least the pain didn’t last long and earlier today Citi announced that it was closing its oil short at a substantial, 11.5% loss:

We hit the $92/bbl stop loss on our short December 2022 (COZ2) ICE Brent futures trade established on Feb 3 for a loss of 11.5%. While our market outlook remains out-of-consensus and we continue to project significant downside for crude oil prices in a 6-9m context, the timing of this was negatively impacted from the escalating Russia/Ukraine conflict, widening supply risk premiums, and upward price momentum for the crude oil futures strip. With the potential for spot oil prices to clear $125/bbl in the short-term, we step aside. Over the next month, there will probably be a better opportunity to either tactically or thematically short the energy market again.

Meanwhile, in a far more realistic assessment, today TD Securities head of commodity strategy Bart Malek writes that any additional sanctions or unanticipated supply interruption – which are certainly coming now that buyers have balked at buying more oil from Russia – could “easily see prices surge still higher in the near-term, as this would augment the already significant concern of a large deficit, and there are few alternatives.” Under these conditions, TD writes that it would not be surprising to see key benchmark crudes jump to around $145/b, which was last seen back in the summer of 2008.

While sanctions thus far are meant to leave energy trade largely untouched, the cutting off of some Russian banks from the SWIFT payment system has disrupted commodity trading activity. These shortfalls would be extremely hard to offset with product sourced elsewhere. For that reason, another $25/b move higher could easily happen if either sanctions or some sort of Russia-Ukraine war related event reduces shipments.

Perhaps having heard what’s coming, Brent spiked as high as $118 on Wednesday evening, up $10 since the start of Biden’s SOTU address just 24 hours ago.

The good news is that if oil indeed explodes to around $150 – a level last reached just days before Lehman filed for bankruptcy – it won’t stay there too long for the same reason it didn’t stay there long in the summer of 2008, a dynamic we described back in January in “Shades Of 2008 As Oil Decouples From Everything.” Here is Malek again:

Longer-term however, price at the current $110/b or higher may not be sustainable as there are some avenues that could reduce the risk of shortages, and reduce the impact of the sanctions, moderating scarcity…. At the same time, there will no doubt be demand destruction due to the sky-high prices too.

Translation: the lack of enough oil to keep the market imbalance will lead to demand destruction, lead the forced shuttering of economic output which eventually translates into a recession. And just to make sure of that, the Fed – which has zero control over the supply of global oil – is hiking to make sure that demand – along with the rest of the economy – is truly destroyed. Which brings us to another note from TD, the bank’s Global Markets recap published earlier today, in which it writes that “Perhaps the only certainty at the moment is that everyone’s forecasts are wrong. It is reasonable to ask whether the ECB and/or the Fed will be easing again this year, even if their next steps are toward tightening.“

Yes it is: the Fed will be easing as soon as this fall when the stagflationary recession arrives, something BofA’s Michael Hartnett has spent the past few months correctly predicting.

Tyler Durden

Wed, 03/02/2022 – 21:26

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com