Another Funding Indicator Is Flashing Red

It’s not just the recent blowout in the FRA-OIS funding spread that is hinting at some major funding/liquidity dislocations beneath the market’s turbulent surface (for more details see “FRA-OIS Explodes: Here Is The Only Chart Powell Is Closely Watching, And Why It Is Soaring“).

Today another key gauge of funding stress in the credit markets started flashing red, signalling that just as Zoltan Pozsar warned last week, banks are bracing for a wave of potential funding disruptions amid the soaring geopolitical turmoil, or may already be scrambling to procure funding to meet commodity margin calls.

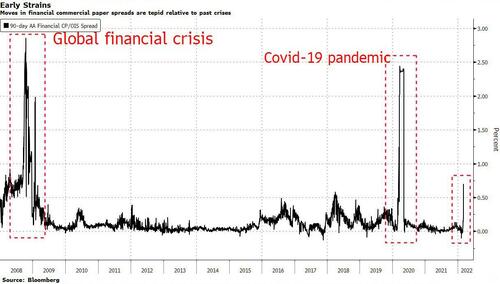

The cost of borrowing in 90 day commercial paper jumped by more than half a percentage point to reach 1.12% on March 4, Bloomberg reported noting that there were 12 issues of financial commercial paper with more than 81 days until maturity totaling $137 million.

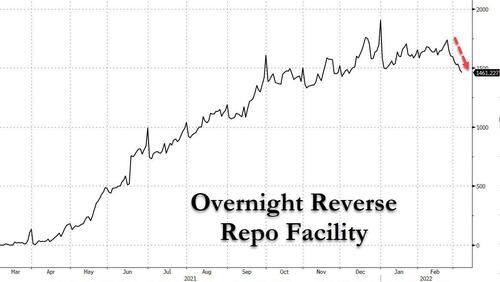

The silver lining is that while commercial-paper costs reached the highest since the onset of the pandemic relative to swap rates, they still remain low relative to past crises. Of course, a big reason for that is that the Fed’s balance sheet is now a record $9 trillion while the Fed’s reverse repo facility holds a massive $1.5 trillion, although as we noted earlier, that amount has been steadily shrinking in the past week hinting that financial institutions are already reaching into the emergency liquidity stash ahead of the start of Quantitative Tightening in the next few months.

In a comment published last week by Barclays repo strategist Joseph Abate (available to pro subs), he writes that there are two reasons for the pressure on short-term unsecured bank borrowing rates.

- First, heightened geopolitical uncertainty together with increased market volatility has encouraged banks to build up their precautionary cash holdings. Having a little extra cash on hand—just in case things should deteriorate—might make sense even if borrowing costs are somewhat higher relative to OIS than they were a couple of weeks ago, he writes. After all, it has been many years since there was a full-fledged war in Europe. And it might make sense even if there is plenty of liquidity held on deposit at the Fed. While typically banks do not have much control over their short-term funding needs, often in periods of funding market stress, they will come into the CP market to borrow funds just to demonstrate to investors that they can do so. In addition to raising some precautionary cash this borrowing is meant as a signal to money fund investors that they have no trouble accessing the funding market.

- Second, this precautionary borrowing is bumping up against a timing constraint. Money market investors are holding back in redeploying cash until the Fed raises interest rates. Not only has this created a pileup of paper that needs to be rolled after the FOMC meeting, but it also means that issuers have to pay more of a premium to sell term paper. Instead, lenders may only be willing to buy CP with maturities only as far as the next FOMC date. This effect is compounded if there is some uncertainty about the path of rate hikes. If money market investors feel that there is some, non-zero probability, of a 50bp hike at an upcoming FOMC meeting, they may be even more reluctant to lock in at current term rates.

While Abate remains complacent about the reasons behind the move, keep an eye on both CP and FRA spreads to OIS, which will be among the earliest available indicators of a major market liquidity lockdown.

Tyler Durden

Mon, 03/07/2022 – 18:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com