“One Of The World’s Largest Energy Supply Shocks Ever” : Goldman Raises Oil Price Target To $135

At a time when banks are rushing to outdo each other who can come up with the highest oil price forecast for 2022 (a welcome change from January when they did the same with the number of forecasted Fed rate hikes, and November when the “winner” was who can come up with the highest S&P price target), a few hours ago Goldman’s commodities team took the lead, writing that as oil prices have surged to their highest level since 2008, “driven by the escalating military conflict in Ukraine and growing realization that imposed sanctions could meaningfully and sustainably reduce Russian exports, even with carve-outs for energy trade” the bank warns that given Russia’s key role in global energy supply, “the global economy could soon be faced with one of the largest energy supply shocks ever.” (The full must-read report is available to pro subscribers).

According to Goldman, while the West will want to avoid such an outcome, global isolation could instead drive Russia to reduce its current account surplus and energy exports. While loading data remains volatile, reports point to more than half of March

loadings remaining unsold, consistent with the exceptional discount of Russian export barrels relative to Brent. If sustained, this would represent a 3 mb/d decline in Russian crude and petroleum product seaborne exports, the fifth largest one-month disruption since WWII, after the Arab Oil Embargo (1973), the Iranian Revolution (1978), the Iran-Iraq war (1980), and the Iraq-Kuwait war (1990). Thisdisruption could further start impacting Kazakhstan piped barrels, which are typicallycommingled with Russian crude on the CPC pipeline. While the current sanctions have not been directly imposed on Russia’s oil sector, the intensification of the military conflict and the broader sanctions on Russia’s Central Bank are instead poised to significantly and sustainably reduce Russia’s own incentive to export energy.

It also means that China will hold a crucial role in shaping how the oil market will rebalance, and how much Russian oil exports end up shrinking, with logistical constraints likely to prevent a full reallocation of flows for months. While China likely has the logistical ability to take on higher Russian exports, key to the potential price upside will be its willingness to rapidly become Russia’s predominant trade partner.

Some more details:

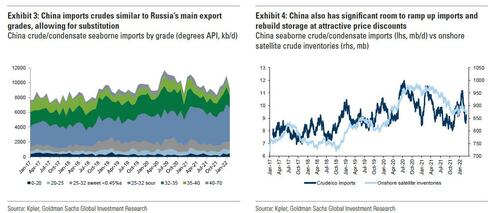

- Logistically, China imports 1.5 mb/d of Russia’s 6 mb/d seaborne exports and could feasibly take the majority of the EU-US combined 4 mb/d imports. First, from a crude import quality perspective, Russia’s crude is well suited to displace up to 3mb/d of similar quality medium sour crude imports from outside of Russia. Second,imports can increase from their recent 10 mb/d level, with a peak import capacity above 12.7 mb/d, and with the country able to replenish its depleted inventories,down at least 100 mb since their Nov-20 peak. This would admittedly not be a smooth process, as a full redirection of oil flows to the East would still tighten global markets, as it would require a 12-day increase in transit time, equivalent to the loss of 90 million barrels (nearly double Iran’s current floating storage).

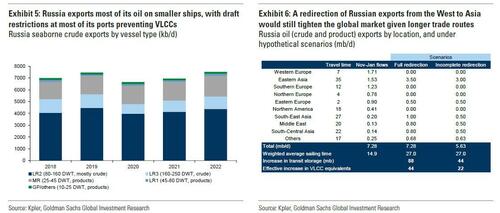

- The potential key bottleneck that could arise in such a redirection is the availability of additional ships necessary to operate on this longer route, alongside a similarly inefficient reallocation of displaced Chinese import flows. This pull on the global fleet could be exacerbated by the potential for additional sanctions on Russian-flagged vessels as well as due to draft restrictions on Russian Black Sea ports. In particular,none of Russia’s exports flow via VLCCs or ULCCs, typically using LR2s(c.500kb-1mb) for its crude, and predominantly MR vessels (c.150kb-300kb) for its products. On our calculations, however, Russia’s trade requires less than 10% of the global LR and MR fleet, with China’s LR and MR fleet alone twice the size of that needed to sustain the entirety of Russia’s oil flows. Overall, global shipping capacity should not be a limiting factor for reallocating Russian oil flows, although it may come at the expense of elevated freight rates and fast-steaming of tankers to increase effective capacity.

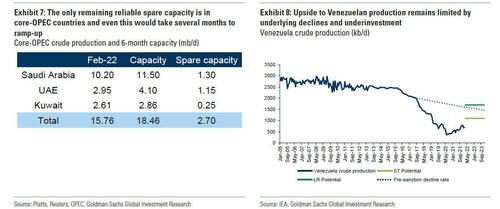

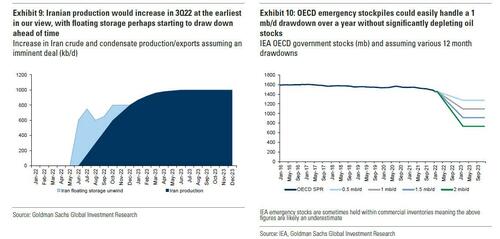

Goldman also expects supply to eventually respond, but this will be a politically driven process, between SPR releases, a core-OPEC surge and potential lift of sanctions on oil imports from Iran and Venezuela.

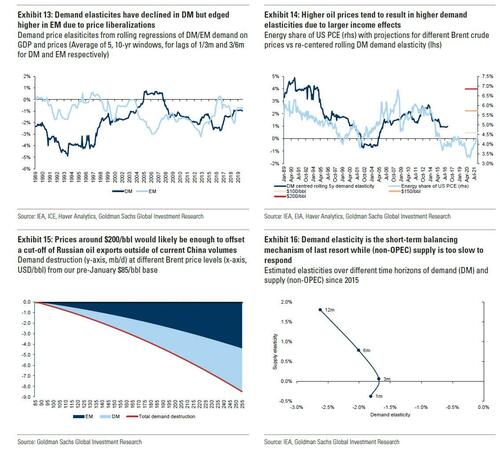

Here Goldman cautions that the price induced shale supply response would not be a suitable rebalancing mechanism for a large and immediate supply shock, given the lag in capex raises and the several months needed to drill and bring new wells online. The largest constraint to a fast ramp-up in shale production is likely to come from an already tight oil service sector.

While all of these measures could help offset a sizable decline in Russian seaborne exports, they would leave the global oil market with no buffer, still requiring demand destruction through higher prices (which will eventually lead to recession). The shale supply response would further remain modest initially, due to drilling times, still cautious producers and a tight service sector.

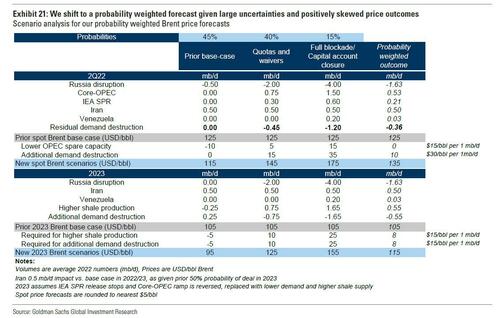

Looking ahead, Goldman writes that “the uncertainty on how this conflict and oil shortages will be resolved is unprecedented.” To attempt to provide an estimate of where oil prices are heading, Goldman has built three scenarios, ranging from a resumption in exports in the coming months to a sustained two-thirds reduction of Russian seaborne exports. Even assuming SPR and OPEC supply relief, these point to oil prices ranging from $115/bbl to $175/bbl in 2022.

Given a still intensifying military conflict, escalating Western sanctions and growing isolation of Russia, the bank says that its subjective probability weighting of these potential outcomes currently leaves it with a base-case of a 1.6 mb/d disruption. As a result, Goldman is raising its 2022 Brent spot price forecast to $135/bbl, with a 2023 forecast at $115/bbl, up from $98 and$105/bbl respectively.

To be sure, the range of possible outcomes remains extreme given the threat that a spike in oil prices represents to the global economy; yet even so, Goldman reiterates its view that long-dated oil prices remain significantly under-priced, still below pre-Ukraine escalation forecast; as a result, Goldman continues to recommend long positions in Dec-23 Brent, both as a hedge for oil consumers and macro investors.

The full must-read report is available to pro subs in the usual place.

Tyler Durden

Tue, 03/08/2022 – 09:28

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com