Futures Surge After 4 Day Rout On Ukraine War Optimism; Cryptos Soar

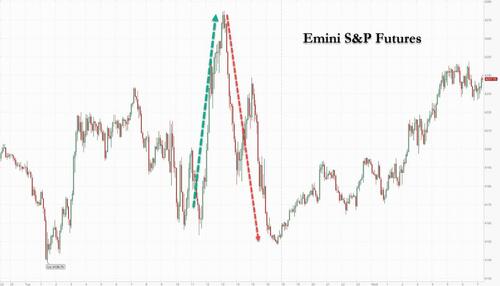

After two days of sheer market insanity, including Monday’s furious plunge and Tuesday’s rollercoaster session, U.S. equity futures jumped after 4 straight days of losses, following European equities higher, as Ukraine optimism won, at least initially, over fears about high inflation and global stagflation as a result of soaring commodity prices, sparking a furious Delta squeeze (as we will show shortly in a subsequent post).

At 730am ET, Nasdaq 100 contracts were up 2.1% while S&P 500 futures gained 1.6%. The underlying benchmark fell for a fourth straight session on Tuesday to close at its lowest since June 2021. Dow futures rose 1.5%. A bond selloff extended as investor focus turned to upcoming central-bank rate decisions, while oil prices reversed a rally driven by President Joe Biden’s ban on fossil-fuel imports from Russia. . The dollar weakened for the first time in five days, as haven demand waned. Bitcoin soared more than 10% over $42,000 spurred by optimism about an impending U.S. overhaul of crypto oversight that Treasury Secretary Janet Yellen called “historic.”

Investors are bracing for a global stagflationary shock from a commodity-price rally fueled by Russia’s isolation even as supply disruptions threaten to usher in a period of slower global growth. The next few days will give them clues on how central banks plan to address the problem: The European Central Bank will announce its rate decision on Thursday, followed by the Federal Reserve and the Bank of England next week.

“Stock markets are highly volatile as uncertainties loom,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “Rallies are mostly driven by intra-day trades, whereas longer-term investors are leaving the market.

Commodity costs underscore the inflation challenge for the Fed, which is expected to hike interest rates next week by 25bps. In Australia, central bank Governor Philip Lowe said a rate increase later this year is “plausible” as Russia’s invasion creates a new supply shock.

“The duration of this incursion is really going to weigh on the economics of both Europe and the U.S.,” Victoria Fernandez, Crossmark Global Investments chief market strategist, said on Bloomberg Television. She added the firm is cautious but has been in the market trying to be “opportunistic.”

With oil easing back slightly from 14 year highs but still above $120 a barrel, strategists warned of more volatility ahead of the Federal Reserve’s policy meeting next week, where the central bank is expected to signal a quarter-point rate hike.

“We don’t believe this to be a good time to buy more equities,” Joost van Leenders, senior investment strategist at Kempen Capital Management, wrote in a note, adding that he prefers European and so-called value stocks due to the higher risk from inflation in the U.S. “But we continue to be positive about equities for fundamental reasons. Global economic growth has the potential to pick up further and corporate results to improve slightly,” he said.

And yet someone is furiously buying today – as Nomura notes in its morning wrap, risk assets are rallying sharply overnight on more perceived optimism ov Ukraine / Russia, while critically oil (and USD for that matter) finally pulls back as the UST curve bear-flattens further, as the risk-rally then sees implied Fed hikes being added-back in STIRs. As yesterday, much of the rally was driven by an AFP news report which noted that Russia says ‘some progress’ being made in talks with Ukraine:

- *KREMLIN SAYS RUSSIA INTERESTED IN CONTINUING UKRAINE TALKS

- *RUSSIAN FOREIGN MINISTRY SAYS IT WOULD BE BETTER IF OUR GOALS IN UKRAINE ARE ACHIEVED THROUGH TALKS

- *RUSSIAN FOREIGN MINISTRY SAYS OPERATION’S AIMS DO NOT INCLUDE OVERTHROWING UKRAINE’S GOVT

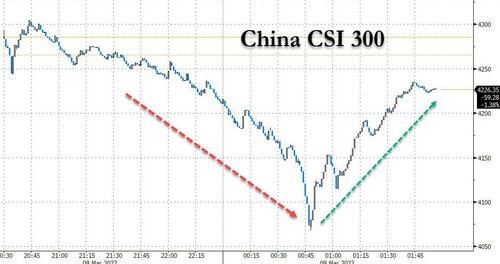

Around the globe, stocks ripped higher in beaten-down Europe (DAX +4.6%, eStoxx 50 +4.6%, lifting Spooz +1.5% & NQ +1.9%, while the Chinese “national team” intervention too lifted CSI 300 +3.9% off the lows to close down only -0.9% after being hammered earlier), while Bitcoin also saw a monster relief rally as well (+9.7% following a released statement from the US Treasury Department last night and more this morning, regarding what looks to be the “much ado about nothing” Executive Order from the White House–seemingly a non-event after much build-up).

Here are some of the other, less cheerful Russia/Ukraine headlines:

- Russian forces intensified their bombardment of Ukraine’s capital Kyiv, the U.S. said.

- The Russian stock market’s trading halt is being extended in an effort to keep prices from tumbling in the wake of vast international sanctions.

- Russian Foreign Minister Lavrov will travel to Turkey today to meet with the Ukrainian Foreign Minister, according to Ria citing the Russian Foreign Ministry.

- Russian Foreign Ministry says aims of its operation do not include the overthrowing of the Ukraine government.

- Russia says “some progress” has been made in discussions with Ukraine, according to AFP.

- Russia’s Kremlin says Russia has made no decision on nationalising foreign assets; interested in continuing talks with Ukraine. On possible compromise with Ukraine: Crimea is Russian region, must be recognised as such and Donetsk/Luhansk are sovereign republics, must be recognised as such.

- Ukraine Foreign Minister Kuleba says he has limited expectations from discussions with Russian Foreign Minister Lavrov.

- US President Biden tweeted that “This much is already clear: Ukraine will never be a victory for Putin. Putin may be able to take a city — but he will never be able to hold the country”.

- UK Transport Secretary Shapps tweeted they have made it a ‘criminal offence’ for any Russian aircraft to enter UK airspace.

As Nomura’s Charlie McElligott notes, “why such a violent Eq squeeze on such “meh” Ukraine / Russia headlines? ” The reason is that stocks are so deeply-immersed in Negative Gamma and critically, extreme “Short Delta” location for Options Dealers from all that downside hedging (after yday’s session, $Delta for SPX / SPY 0.2%ile, 0.0%ile for QQQ, 0.4%ile for HYG, 4.1%ile for IWM that this would mean violent rallies which have to be “bot into” as Dealers cover shorts in futures, and that’s precisely what we are seeing.

Going back to US stocks, tech heavyweights Apple, Meta, Microsoft and Tesla were among notable gainers in premarket trading, while cryptocurrency-exposed stocks tracked a rally in bitcoin alongside global risk assets as investors go bargain hunting. Marathon Digital (MARA US) +9.4%, Microstrategy (MSTR US) +8.4%. Bumble jumped 22% after the dating app owner gave a better-than-expected forecast. The dating app maker posted 4Q revenue in-line with expectations, while the FY22 top-line guidance was above Street expectations, analysts said. Here are some of the other notable premarket movers today:

- Stitch Fix (SFIX US) shares declined 19% in extended trading on Tuesday, after the personal-styling company reported its second-quarter results and gave a third-quarter forecast that was weaker than the consensus view.

- Oscar Health shares fell 6% in postmarket trading after disclosing that Chief Operating Officer Meghan Joyce is leaving the company effective April 10.

- Yext Inc. (YEXT US) tumbled 21% in postmarket trading after its revenue forecast for the first quarter fell short of analyst expectations. It also announced a leadership transition wherein Michael Walrath will become CEO and chairman.

- XPO Logistics (XPO US) shares jumped 10% in postmarket trading after the company said it intended to separate its tech-enabled brokered transportation services from its less-than-truckload business in North America; also plans to divest the European business and North American intermodal operations.

- MongoDB (MDB US) shares gained 10% in extended trading on Tuesday, after the database software company reported fourth-quarter results that beat expectations and gave a first-quarter revenue forecast that is above the analyst consensus view.

In Europe, the Stoxx 600 rebounded 3% with automakers and travel and leisure stocks outperforming. “From worst to first” is the nature of EU’s bottom-feeding today: Autos, Travel and absolutely throttled EU Banks (SX7E +7.1%) are leading the charge on the dead-cat bounce, while those banks most negatively impacted by proximity to Russia sanctions are seeing double-digit rallies today (Raffeisen, Erste, SG, BNP and Unicredit all +9 to +20%). Here are some of the biggest European movers today:

- European bank stocks are among the biggest gainers on the Stoxx 600 amid a broad market rebound and as BNP Paribas joins peers in detailing its exposure to Russia and Ukraine. BNP rises as much as 9.6%, Raiffeisen climbs as much as 22%.

- Automotive stocks gain too, as companies in several sectors with exposure to Russia outpace the wider market: Nokian Renkaat gains as much as 13% and Renault as much as 12%

- Polymetal and Evraz surge after the London-listed Russian miners posted reassuring updates on their businesses against a backdrop of a rebounding market. Polymetal rises as much as 58%, Evraz as much as 28%.

- Adidas gains as much as 11% after the German sports-apparel maker gave guidance that reassured investors despite a 4Q earnings miss.

- Accor climbs as much as 11% after Berenberg upgrades the French hotelier to buy, citing limited exposure to Russia or Ukraine in terms of rooms or guests, and efficiency savings.

- Stagecoach surges as much as 38% after its board backed a cash bid from a fund managed by DWS Infrastructure that topped an agreed deal with rival transport firm National Express.

- Ericsson rises as much as 5.5% after UBS upgraded the stock to neutral, saying the market has already priced in about $10 billion of negative impact from the U.S. DOJ’s Iraq investigation.

- Deutsche Post climbs as much as 9.3% after results, with Citi highlighting the logistics firm’s cash return and strong free cash flow generation.

- D’Ieteren falls as much as 16% in Brussels as profit margins at its vehicle-glass business Belron declined sequentially and implied margin guidance fell short of analyst projections.

- Commodity-linked stocks underperform the Stoxx Europe 600 after rallying over the past few days as energy and resources prices stabilize: Vestas falls as much as 7.2%,

Earlier in the session, Asian stocks swung in and out of losses as traders assessed the impact of a ban on Russian oil by the U.S. and the U.K., which could further stoke already-high inflation and hurt corporate earnings. The MSCI Asia Pacific Index fluctuated between a loss of 0.6% and gain of as much as 0.9% following a three-day slide of more than 6%. The index was weighed down by both China and Hong Kong, where a move by the world’s largest sovereign wealth fund to snub an apparel firm stirred investor angst. Healthcare and utility sectors were the worst performers on the gauge, while energy and communication services firms advanced. The regional benchmark plunged into a technical bear market earlier this week, falling more than 20% from its February 2021 peak amid a surge in crude prices and concerns over the impact of sanctions on Russia. The 14-day relative strength index is below the key 30 level, which some traders interpret as a sign that the market is due for a rebound. “Overall sentiments remain fragile, as the U.S. announced a ban on Russian fossil fuels imports, including oil, which marks another clear step towards the ‘isolation’ of Russia’s economy,” said Jun Rong Yeap, market strategist at IG Asia Pte. This could prompt “Russia to cut off commodities exports to the West as retaliation,” increasing inflationary pressure and risks for firms’ margins and consumer spending, he said. Benchmarks in China and Hong Kong were the worst performers on Wednesday, as traders cited selling by a Norway fund to higher-than-expected producer prices as reasons for their pessimism. The CSI 300 and the Hang Seng Index both tumbled by more than 3% before paring losses sharply as the National Team stepped in.

Singapore and Taiwan outperformed. South Korean markets were closed for a presidential election. “If there is even a little sign of a ceasefire in Ukraine, the market situation will change,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management in Tokyo. “But we’ll have to wait for that to happen.”

Japan’s Topix index and the Nikkei 225 Stock Average reversed earlier gains to finish the day lower, with power utility and marine transportation sectors leading declines. The Topix fell 0.1% to close at 1,758.89, while the Nikkei 225 declined 0.3% to 24,717.53. Earlier in the day, both gauges were up more than 1%. Recruit Holdings Co. contributed the most to the Topix’s decline, decreasing 4.5%. Out of 2,176 shares in the index, 884 rose and 1,209 fell, while 83 were unchanged. “Ukraine and Russia are dominating investors’ minds at the moment,” says Serdar Armutcu, head of electronic trading at Mita Securities in Tokyo. “It’s a risk-off environment right now.”

Indian stocks outperformed their Asian peers for a second day as investors bought beaten-down sectors, with markets adjusting to worries over the geopolitical situation in Ukraine. The S&P BSE Sensex rose 2.3% to 54,647.33 in Mumbai on Wednesday, clocking its biggest two-day advance in almost a year. The NSE Nifty 50 Index advanced 2.1% to trim its losses so far this year to 5.8%. All but three of the 19 sector sub-indexes compiled by BSE Ltd. gained, led by a gauge of energy companies. Reliance Industries provided the biggest thrust to the equity gauges, rising 5.3% — its biggest single-day rally since Nov. 25. The company, which operates the world’s biggest refinery complex, is said to be stepping up crude processing to take advantage of surging demand for diesel. Despite sharp selling of Indian stocks by foreign investors, inflows from local funds have remained resilient, mainly helped by monthly flows from retail investors through the mutual funds route. In February, equity mutual funds’ inflows grew 32% over the preceding month to 197.1 billion rupees ($2.5 billion), data from industry body AMFI showed on Wednesday. Investors will also be watching the results of elections in five Indian states, vote counting for which is scheduled to commence Thursday morning.

In FX, the Bloomberg dollar spot index falls 0.5% as the greenback traded weaker against all of its Group-of-10 peers apart from the yen, which fell to an almost one-month low. JPY and CHF are the weakest performers in G-10 FX, SEK and AUD outperform. Implied volatility in the Group-of-10 space is in retreat mode following the sharpest repricing since the pandemic rattled markets in March 2020. Still, it remains elevated versus recent averages as tail risks haven’t vanished altogether. Sweden’s krona led a G-10 advance as it recovered a second day after dropping to its lowest level since April 2020 on Monday. The Australian dollar also rose and the nation’s bonds fell, tracking Treasury losses on concern over rising inflation. RBA Governor Philip Lowe said an interest-rate increase in Australia is “plausible” this year. The euro advanced a second day to near $1.10 and the pound strengthened for the first time in five days as traders are back to pricing in at least one unconventional 50 basis- point hike from the Bank of England by June on speculation that the central bank will stick to its plan to tighten policy. Russia’s ruble slid as much as 8.2% versus the dollar as local traders got their first chance this week to react to a raft of negative developments for the country including curbs on oil exports, the nation’s key earner.

In rates, Treasuries extended this week’s major losing streak led by the belly of the curve as S&P 500 futures rally, following steep rebound in European stocks. US yields are cheaper by more than 7bp in belly of the curve, flattening 5s30s spread by more than 4bp on the day; 10-year yields around 1.90% with bunds trading ~1bp cheaper and gilts slightly outperforming. A drop in Treasuries was led by the front-end as traders solidified monetary tightening bets before a report due Thursday which may show U.S. inflation accelerated to a fresh four-decade high in February. Focal points for U.S. session include 10-year Treasury auction, which follows a weak reception for Tuesday’s 3-year, which tailed by more than 1bp. The $34BN 10-year reopening at 1pm ET trades at a WI yield of about ~1.905%, slightly above February’s, which stop through by 2.2bp; cycle concludes with $20b 30-year reopening Thursday. Also, jumbo corporate bond offering by Magallanes is expected sometime this week. Three-month dollar Libor +4.20bp at 0.74500%.

In credit, the IG dollar issuance slate is empty so far; three names priced $1.9BN Tuesday as 5-6 issuers decided against announcing transactions; AT&T mandated banks for a bond sale by spin-off entity Magallanes that could come Wednesday or Thursday and raise in the neighborhood of $30BN.

In commodities, crude futures decline as oil is yet-again looking like “the straw that stirs the drink,” clearly acting as the chief “War inflation overshoot” proxy which triggers “stagflation”- and thus, “hawkish policy error”- fears in traders according to Nomura (hence, the very short-term (3d) yet “extreme” -89% correlation btwn ES1 and CL1). WTI finds support near $120, rebounding to trade back above $122. Most base metals trade in the red. Bitcoin rallies over 9%, back above $42k. Spot gold falls roughly $35 to trade near $2,015/oz. Anecdotally, Nomura’s Charlie McElligott writes that he kept repeating to clients that “imminently, we’re going to walk-in to see Crude limit-down (say on a profit-taking avalanche), at which point, we could expect to see Spooz +3.5% or more in sympathy; well, we are nowhere close to that large of a drawdown in Crude, but the Equities response has us “halfway there” already.”

Bitcoin jumped above $42,000 amid a sharp rally in digital tokens, spurred by optimism about a sweeping U.S. overhaul of crypto oversight that Treasury Secretary Janet Yellen called “historic.” A Biden administration cryptocurrency executive order strikes the right balance between encouraging responsible innovation and addressing potential risks to consumers and the broader financial system, Yellen said in a statement posted to The Treasury Department’s website Tuesday night.

Looking at the day ahead now, and data releases include the US JOLTS job openings for January, as well as Italy’s industrial production for January. Earnings releases include Deutsche Post, Prudential and Adidas.

Market Snapshot

- S&P 500 futures up 1.6% to 4,233.50

- STOXX Europe 600 up 3.3% to 428.55

- MXAP up 0.3% to 170.69

- MXAPJ up 0.6% to 560.69

- Nikkei down 0.3% to 24,717.53

- Topix little changed at 1,758.89

- Hang Seng Index down 0.7% to 20,627.71

- Shanghai Composite down 1.1% to 3,256.39

- Sensex up 2.2% to 54,625.66

- Australia S&P/ASX 200 up 1.0% to 7,053.03

- Kospi down 1.1% to 2,622.40

- Brent Futures down 0.3% to $127.62/bbl

- Gold spot down 1.2% to $2,026.57

- U.S. Dollar Index down 0.46% to 98.60

- German 10Y yield little changed at 0.16%

- Euro up 0.7% to $1.0972

Top Overnight News from Bloomberg

- Bitcoin jumped above $42,000 amid a sharp rally in digital tokens, spurred by optimism about a sweeping U.S. overhaul of crypto oversight that Treasury Secretary Janet Yellen called “historic.” A Biden administration cryptocurrency executive order strikes the right balance between encouraging responsible innovation and addressing potential risks to consumers and the broader financial system, Yellen said in a statement posted to The Treasury Department’s website Tuesday night

- Russia was downgraded to the second lowest level by Fitch Ratings, which said a bond default is “imminent” as a result of measures ushered in since the war in Ukraine

- Russia agreed to open humanitarian corridors in parts of Ukraine for 12 hours to allow civilians to escape from several cities, Ukrainian Deputy Prime Minister Iryna Vereshchuk said, even as the U.S. warned that Russian forces were intensifying their bombardment of Kyiv

- The U.K. ratcheted up its sanctions against Vladimir Putin’s administration by banning all Russian aircraft from landing and overflying Britain, and prohibiting aviation and space-related exports

- Surging oil prices have battered market sentiment toward major energy importer India, pushing the rupee down to a record low and dragging stocks and bonds. With few signs the commodity boom will end soon, investors are bracing for more possible losses

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly mixed with the region finding some respite from recent selling despite the weak lead from the US, where the major indices were choppy after the US and UK moved to ban imports of Russian oil. ASX 200 gained with the gains across sectors led by tech, consumer discretionary and financials. Nikkei 225 briefly reclaimed 25k, but with initial upside reversed after downward revisions to the final Q4 GDP data. Hang Seng and Shanghai Comp. bucked the trend with Chinese sports brands underperforming in Hong Kong as Norway’s sovereign wealth fund is to offload its stake in Li Ning over suspicions of forced labour, while Goldman Sachs sees China on course to miss its growth target this year by 1ppt due to the oil shock and COVID

Top Asian News

- Wild Ride in China Stocks Triggers Memories of 2018 Meltdown

- Hong Kong Indefinitely Postpones Mass Testing Plan: Virus Update

- Shimao Faces $2.5 Billion in Bond Obligations: Evergrande Update

- Singapore Minister Says Omicron Wave Looks to Have Peaked:

European bourses are firmer across the board as risk-sentiment recovers, Euro Stoxx 50 +5.0%; albeit, Energy /Basic Resources names are lagging amid an unwinding in geopolitical-premia. US futures are firmer across the board, though the magnitude of action is less pronounced when compared to European peers, ES +1.7%.

Top European News

- Russia’s Ruble Drops as Onshore Trading Resumes in Moscow

- Russia- Exposed European Stocks Lead Rebound in Shadow of War

- Traders Price in BOE Bumper Hike by June as Inflation Fears Rise

- Hungarian Inflation Surges Before Currency, Oil Shock

In fixed income, bonds continue their losing streak as yields reach or approach psychological levels amidst a marked improvement in risk sentiment. US Treasuries also face 10 year issuance, but the deeper concession may help after a weak 3-year note sale. BTPs hold up better than Eurozone peers on the eve of the ECB, perhaps hoping for some support.

In FX, safe havens shunned as sentiment flips firmly to risk back on mode. Dollar, Yen and Gold out of favour with the DXY hovering around 98.5000, USD/JPY eyeing 116 and spot bullion hovering just above Usd 2k/oz. Aussie outperforms after RBA Governor Lowe says tightening in 2022 might be plausible; AUD/USD regains 0.7300+ status and AUD/NZD probes 1.0700 even though the Kiwi is bouncing vs its US rival to test 0.6850. Euro claws back more of its hefty declines, but Rouble remains pressured ahead of talks between Russian and Ukrainian Foreign Ministers in Turkey tomorrow EUR/USD fades just shy of 1.1100 vs recent low close to 1.0800, USD/RUB still near record highs in contrast.

In commodities, WTI and Brent continue to pullback as geopolitical-premia lessens as updates are, seemingly, more constructive; currently, WTI Apr and Brent Mar are around USD 121.50/bbl and USD 125.50/bbl respectively vs highs of USD 126.84 and USD 131.64 respectively. US Private Energy Inventory Data (bbls): Crude +2.8mln (exp. -0.7mln), Cushing -0.4mln, Gasoline -2.0mln (exp. -2.1mln), Distillate -5.5mln (exp. -1.9mln) US Crude Output to gain 850k BPD to 12.03mln BPD in 2022 (prev. saw a rise of 770k BPD M/M) and is to rise 960k BPD to 12.99mln BPD in 2023 (prev. saw a 630k BPD rise M/M), according to EIA. OPEC Secretary-General Barkindo said there is no physical shortage of oil. Barkindo also said they are in unchartered territory and that uncertainties keep mounting, according to Energy Intel. Nigerian Minister of State for Petroleum and Resources expects the country to raise output to meet OPEC quota by year-end. Libya’s NOC Chairman Sanalla said state production is currently 1.3mln bpd which will reach 1.5mln bpd by year-end and 2.1mln bpd in 2-3 years. Beijing tells China state refiners to pause diesel and gasoline exports in April, according to Reuters sources. Venezuela released two American prisoners following discussions with the US and the US is said to pin any easing of Venezuela oil sanctions on direct oil supply to the US, according to Reuters sources. Greek PM Mitsotakis is calling for “targeted and temporary market intervention” within the electricity and gas markets, such intervention is justified by the high level of price volatility; calling for a price and profit cap, alongside an emergency price setting. (Politico) Measures are to be discussed by EU leaders on Thursday Shanghai Futures Exchange suspends some nickel futures contract trading for one day. Spot Gold/Silver are pressured, moving in-line with action in safe havens; a move that has seen spot gold, for instance, approach a re-test of the USD 2000/oz mark to the downside.

In crypto, US Treasury will create a report on the future of money and payments and evaluate crypto security risks. Subsequently, US President Biden is to sign an executive order on assessing pros and cons of digital assets; core policy objective remains to maintain centrality of USD in global markets.

US Event Calendar

- 7am: March MBA Mortgage Applications, prior -0.7%

- 10am: Jan. JOLTs Job Openings, est. 11m, prior 10.9m

DB’s Jim Reid concludes the overnight wrap

In keeping with the trends of recent days, the most important market developments have been further gains in oil and gas prices over the last 24 hours after the US moved to ban the import of Russian oil and gas. To some extent these moves had already been priced in given building pressure from Congress, but energy prices have taken another leg higher, with Brent Crude closing up +3.87% at $127.98/bbl even if that was well off the session highs of $133.15/bbl. This morning it’s then followed that up with a further +1.91% gain to $130.42/bbl. That would be its highest closing level since 2008, and leaves prices up by over +67% on a YTD basis, and a world away from its levels beneath $20/bbl less than two years ago after the pandemic initially hit.

The growing prospect of stagflation has seen the major equity markets trading in negative territory this morning in Asia, mirroring the overnight losses on Wall Street earlier. The Hang Seng (-2.39%) is leading the regional declines, whilst the Shanghai Composite (-1.07%) and CSI (-1.27%) are also lagging. That comes as China’s own inflation data remained strong in February, with PPI falling but by less than expected to +8.8% year-on-year, whilst CPI remained at a much weaker +0.9%. Markets in South Korea are closed today due to the country’s presidential election, but the Nikkei (+0.45%) has been an outperformer, pointing higher alongside US and European equity futures, with those on the S&P 500 up +0.51%.

This move by the US on Russian energy imports reflected the growing pressure on Western governments to sanction energy, which up to now has been relatively unscathed by the assortment of measures. Indeed, the UK also followed yesterday by announcing that the country would phase out Russian oil imports by the end of the year. This didn’t cover natural gas, but Business Secretary Kwarteng said that he was “exploring options to end this altogether” as well. We’re yet to see other European nations follow for the time being, but given how quickly the US and the UK have moved on sanctioning energy relative to where they were immediately after the invasion, it begs the question of whether the EU might soon follow. Leaders will be meeting tomorrow at Versailles for a summit, so it’ll be interesting to see if they announce any further measures on that front.

The fascinating running theme is how quickly the world is moving towards alienating Russia. 10 days ago when the west imposed the huge sanctions, it felt like they’d moved towards the maximum end of what people expected. However now it feels like European public opinion is building towards completely cutting off the Russian energy supply. There are still big differences of opinion here amongst countries so this won’t be easy but pressure is building. Don’t be surprised if Russia moves first though if the direction of travel looks inevitable. More broadly, we’re also seeing corporates move independently of governments, and over the last 24 hours McDonald’s announced it would temporarily be closing its restaurants in Russia, whilst Coca-Cola and Starbucks said they would also be suspending their business in Russia. In addition, there was a further downgrade of Russia’s debt by Fitch overnight, who cut them to C, and said a sovereign default was “imminent”.

Alongside those developments, markets were also reacting to news on the EU fiscal side after Bloomberg reported that the EU is considering joint bond issuance for energy and defence spending. There is no doubt that the pandemic and the Russian crisis has sharpened the focus of the EU and has potentially made it a more cohesive force. Whilst such news doesn’t much help with the short-term problems Europe is facing, we shouldn’t underestimate the greater significance. Europe spent the 2010 decade doing everything it could to limit fiscal spending and relied on monetary policy. In a post financial crisis deleveraging world this was a recipe for stagnation and disinflation. However yesterday’s news continues to suggest that the policy mix this decade will be different. With more fiscal, monetary policy can normalise to some degree assuming the ECB ensure that fragmentation risk is managed by more targeted bond buying if needed. So some big structural forces operating in the background.

Relative to a very weak Asian session, this Bloomberg story led to a big risk-on move that sent the Italian-German 10yr spread down by –12.5bps on the day, although there was a small reversal after Commission Vice President Frans Timmermans was asked about the report and said that there were no plans in the Commission, although he didn’t know if there were some in the member states. Bloomberg’s report said that the proposal may be presented after the Versailles summit tomorrow. So another event on a day that includes the ECB meeting and the latest US CPI. Overall on the day, 10yr bund yields rose +12.8bps, putting them back in positive territory at 0.11%.

As well as the gains for energy, yesterday was another firm day for commodities more broadly even though the index closed off the highs. Bloomberg’s Commodity Spot Index (+1.27%) advanced for the 11th time in the last 12 sessions, and gold (+2.63%) was a particular beneficiary given the flight to haven assets, surpassing $2,000/oz for the first time since August 2020 before closing at $2,050/oz, which is just shy of its all-time closing high at $2,064 in nominal terms back in June 2020. Elsewhere natural gas in Europe fell back slightly, shedding -5.57% to hit €215/MWh even though it opened much higher again. Industrial metals also soared to new heights, with nickel trading being suspended on the London Metal Exchange early on Tuesday after surpassing $100,000/ton at one point meaning a 250% increase in two days. See the chart of the day here for how extraordinary Monday’s move was, let alone yesterday’s abbreviated trading session.

Unsurprisingly, the latest round of commodity price gains led to further rises in inflation expectations, with the US 10yr breakeven up another +7.9bps to 2.9255%, their highest level in data going all the way back to 1998. Nominal 10yr yields were up +7.2bps but off the highs of the session. German 10yr breakevens also hit a record in data back to 2009, rising +5.9bps to 2.63%, and their Italian counterparts hit 2.46%, the highest since 2008.

Bond moves were pretty uncorrelated with equities and a risk-off tone continued yesterday in the latter as worries about stagflation gathered pace, and global equities hit fresh recent lows as a result. The S&P 500 fell -0.72% (after being up over +1.75% at one point) to reach levels not seen since last June, whilst the STOXX 600 (-0.51%) hit a fresh one-year low. Volatility remained elevated with the VIX staying around 35pts, whilst Bloomberg’s index of US financial conditions fell to its least accommodative level since June 2020.

We’re now just a week away from the Federal Reserve’s decision next week, but an interesting theme over recent days is that investors have become increasingly confident that the conflict won’t derail a potential tightening cycle this year. Indeed, for the first time in over a week, Fed funds futures yesterday were pricing in more than 150bps worth of hikes by the December meeting, including over 100bps worth by the July meeting, implying at least back-to-back hikes of 25bps until then. Overnight index swaps are also implying a further 6 hikes this year from the BoE (on top off the one they did in February), and are even pricing in 27bps from the ECB, which is up from a low of just 6bps of hikes for the year at the start of the month just over a week ago. Separately, we also heard overnight from RBA Governor Lowe, who said in a speech that an increase in the cash rate in late 2022 was “plausible”.

Finally, there wasn’t much on the data front yesterday as investors look forward to tomorrow’s CPI release in the US. However, we did get German industrial production for January, which grew by a stronger-than-expected +2.7% (vs. +0.5% expected).

To the day ahead now, and data releases include the US JOLTS job openings for January, as well as Italy’s industrial production for January. Earnings releases include Deutsche Post, Prudential and Adidas.

Tyler Durden

Wed, 03/09/2022 – 08:08

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com