Markets Are Now More Vulnerable To Systemic Stress On A Scale Not Seen Since The Global Financial Crisis

By Ven Ram, Bloomberg Markets Live commentator and analyst

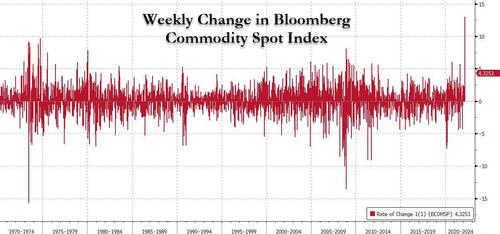

What’s common to the euro swooning more than 3% in a week, countries in Europe issuing bills and re-opening bonds every other day as repos go special, while nickel prices double in short order to touch $100,000 a ton?

All measures of extraordinary distress in the markets, that’s what. JPMorgan Chase’s head of trading, Troy Rohrbaugh, captures it succinctly when he says that the markets are “extremely treacherous at the moment.”

Yet, given the widespread sanctions on Russia, major credit cards suspending transactions as well as businesses pulling out of the country right, left and center, the story of acute market stress may be just starting to unfold.

Somewhere in all this stage of unadulterated melee, inflation balloons are soaring. So high that DoubleLine Capital’s Jeffrey Gundlach fears the headline number in the U.S. could reach 10% this year. Yet in a quiet corner of that stage, the Fed is trying to figure out the mood music, but is still convinced that baby steps of 25 basis points, taken one step at a time, will be enough to bring down price pressures while also ensuring a soft landing for the economy.

The combination of runaway inflation, pockets of distress and a short squeeze causing a surge in commodity prices all mean that the markets are now more vulnerable to the prospect of systemic stress on a scale not seen since the global financial crisis.

Given this backdrop, the risk of counterparty default in many tail-risk options that are now probably deep in the money isn’t negligible — though we won’t hear about it immediately. As I have observed before, the first shoe to drop during the financial crisis was in early 2007, but it wasn’t until late 2008 that some of the events that are most recalled about the episode took place.

That means that daily moves of 10 basis points in key developed-market bond yields and swings of 1% in G-10 currencies aren’t going to go away anytime soon. Not to mention U.S. stocks, which until recently behaved like they were immune to all laws of financial gravity and had a special license to thrill.

Truly, what goes around, comes around.

Tyler Durden

Wed, 03/09/2022 – 18:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com