US Futures Ignore China Implosion, Reverse Overnight Losses as Oil Tumbles

Welcome to another rollercoaster session where US equity futures first tumbled alongside the second consecutive day of stocks plunging in China, which also dragged Europe lower, only to hit a U-turn around 5am at which point sentiment reversed higher, ahead of tomorrow’s expected Federal Reserve rate hike and amid mounting risks from the war in Ukraine and a Chinese equity rout. Nasdaq 100 contracts trade 0.5% higher at 7:15 a.m. after earlier slumping as much as 0.8% following the first bear-market close for the first time since March 2020. S&P 500 futures also turned 0.3% green, as did Dow futures.

Much of the reversal in sentiment has been attributed to the latest drop in oil which tumbled over $8/bbl or 5.5%, sliding as low as $98 after hitting $139 one week ago. WTI crude oil also fell below $100 a barrel a barrel as traders reassessed the potential impact of disruptions in Russian oil supplies and a decline in demand from China. Iron ore futures fell for a sixth day, the longest streak since September. In other words, commodities are not sliding because of hopes for Russia peace, but because of fears about a global recession, but try explaining it all to algos. Treasuries gained, though the 10-year yield remains near the highest level since 2019. Yields across the euro region also declined. The dollar slipped, while the euro pushed higher and bitcoin dropped again.

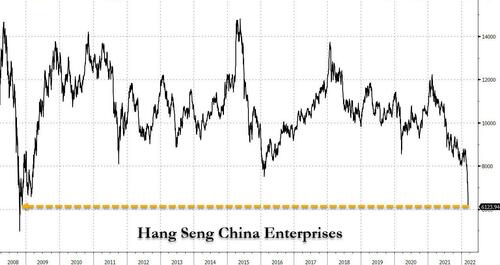

Earlier in the session, a selloff across Chinese equities deepened as concerns about ties with Russia, a growing covid crisis, and persistent regulatory pressure sent a key index to its lowest level since 2008. The Hang Seng China Enterprises Index, which tracks Chinese shares listed in Hong Kong, sank 6.6%, following a plunge in the previous session that was the biggest since the global financial crisis.

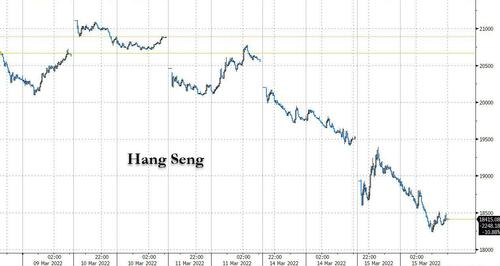

The Hang Seng index tumbled Tech giants Alibaba Group Holding Ltd. and Tencent Holdings Ltd. led the decline. Hong Kong’s benchmark Hang Seng Index slumped 5.7%, its biggest fall since July 2015.

China’s equities are looking increasingly risky on concerns that Beijing’s ties with Russia could spark new U.S. sanctions. That’s adding to worries from regulatory developments including a possible delisting from the U.S. exchanges. While upbeat economic data was a rare bright spot in the market, growing lockdowns in major Chinese cities are dimming the outlook.

“The selloff is overdone, but so is everything else,” said Andy Maynard, head of equities at China Renaissance Securities. “The market is crazy — there’s no fundamentals anymore. This might be worse than the 2008 financial crisis.”

“Risk-off sentiment stemming from both the Russia-Ukraine war and the current wave of Covid-19 in China has driven equity markets sharply weaker this morning,” Siobhan Redford, an analyst at Rand Merchant Bank in Johannesburg, said in a client note. “This has been compounded by falling commodity prices as the intersection between limited supply — given sanctions on Russia and the war in Ukraine — and a weaker demand trajectory — given further waves of the pandemic — create a perfect storm of sorts.”

With zero liquidity, and trigger happy traders looking to sell any rally, swings in S&P 500 and Nasdaq 100 futures signaled another volatile day ahead for U.S. stocks. U.S.-listed Chinese stocks sank again on Tuesday, following a brutal rout in Asia, amid concerns that China’s ties with Russia may bring sanctions to Beijing, while persistent regulatory pressures also weighed. Alibaba (BABA US) fell 6.5% in premarket trading, while rival JD.com (JD US) declined 4.5%. Apple Inc. inched lower, heading toward a bear market — defined as a 20% drop from recent highs — on worries that lockdowns in China to contain a surge in Covid-19 cases could worsen supply-chain constraints. Other notable premarket movers:

- Shares in big U.S. energy companies slide in premarket trading as crude price fall, declining after last week’s rally as worries over growing coronavirus cases in top crude importer China weigh. Exxon Mobil (XOM US) -3.1% and Chevron (CVX US) -3.7%.

- Coupa Software (COUP US) slides 30% in postmarket trading after the company’s revenue forecast for the first quarter misses the average analyst estimate.

- Gitlab (GTLB US) shares rose 12% in extended trading on Monday, after the software company reported fourth-quarter revenue that beat expectations and gave a full-year forecast that is stronger than the analyst consensus.

U.S. technology stocks have been particularly hard hit in the past week with the Federal Reserve expected to begin a rate-hike cycle on Wednesday, another negative for growth stocks valued on future profits. Investors are also looking for cues from the central bank about how aggressively it plans to continue tightening monetary policy as Russia’s invasion of Ukraine sent commodity prices soaring when inflation was already running high. A reading on the producer price index is due on Tuesday.

“If we are entering a world of above-target inflation for several years to come, investors should ditch the easy answers,” said Sahil Mahtani, strategist at Ninety One. “Conventional 60-40 type portfolios are likely to struggle. Investors should reflect about what specifically is driving the inflationary process and invest in equities that have pricing power but are not at frothy valuations.”

The Stoxx Europe 600 index fell more than 1.5%, with basic resources, consumer and technology stocks leading a broad-based decline. All sectors are in the red. Euro Stoxx 50 slumps 2.4%. IBEX outperforms peers but still trades off ~1.5%. Here are some of the biggest European movers today:

- Ahold Delhaize shares gain as much as 3.2%, the best performer in the Stoxx 600’s personal care, drug and grocery stores subgroup, after being upgraded to buy from neutral at UBS, which says the stock is at an “attractive entry point.”

- S&T rallied in Frankfurt, climbing as much as 18%, after the Austrian company said a forensic audit by Deloitte found allegations by short seller Viceroy Research were almost completely inaccurate.

- Sensirion shares spike as much as 13%, the most since June 2020, after the Swiss sensor manufacturer reported full- year sales and gave a revenue forecast that blew past analysts’ estimates. Stifel says the company’s growth is driven by all end markets and the performance of new environmental sensors looks “impressive.”

- Wacker Chemie shares gain as much as 6.9%, as Baader sees dividend proposal 56% above and midpoint ‘22 Ebitda guidance 3% ahead of consensus.

- Tecan falls as much as 16% after reporting sales for the full year that missed the average analyst estimate, and as the outlook disappointed.

- Dr. Martens shares tumble as much as 11% to the lowest since listing in January 2021 after RBC cut its price target to a Street-low, citing the bootmaker’s growth outlook.

- Swedish Match drops as much as 8.4%, the most intraday since February 2021, after the company suspended the spinoff of its U.S. cigar business. The move highlights regulatory risk, according to JPMorgan.

Meanwhile, Russia has started the payment process of two bond coupons due this week. Investors are waiting to see if the nation defaults after the U.S. and its allies froze Russia’s foreign-currency reserves. The ruble gained in Moscow trading.

Asian stocks plunged, on track for a third-straight daily loss, as the selloff in Chinese technology stocks continued after Monday’s plunge, while traders tried to gauge the impact of an imminent interest-rate hike by the Federal Reserve. The MSCI Asia Pacific Index fell as much as 1.9%, heading for its lowest close since August 2020. Tencent and Alibaba Group were among the biggest drags on the regional index, along with TSMC. The sustained selling pressure came as investors mulled the potential consequences of China’s assistance for Russia’s war in Ukraine and delisting risk for Chinese stocks traded in the U.S. Hong Kong’s benchmark Hang Seng Index tumbled 5.7%, its biggest fall since July 2015, while the Hang Seng Tech Index lost 8.1% following a wild intraday swing. Read: Relentless Selling in China Stocks Evokes Memories of 2008 Crash China’s CSI 300 Index slumped 4.6% as the nation’s strong set of economic data failed to lift sentiment amid market jitters on the rising case numbers of Covid-19. Japanese stocks rose for a second day as a weaker yen boosted the outlook for the nation’s exporters. “There are plenty of storms blowing through China right now,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific. “Fears continue to dog stock markets, that lockdowns could spread, which would severely impact China’s growth.” The risk of tighter monetary policies globally remained on investors’ minds as the Fed this week is expected to announce its first interest rate hike in three years in a bid to curb rising inflation amid surging commodity prices. Markets are now pricing in as many as seven quarter-point hikes for the full year.

Lockdowns in major Chinese cities are dimming the outlook for economic growth and posing risks for energy and raw-materials demand, just as concerns about the country’s relationship with Russia stoke a relentless stock selloff. The virus is also making a comeback in Europe: Germany on Tuesday set a fresh record for infection rates for the four straight day. Austria has also reached new highs, while cases in the Netherlands have doubled since lifting curbs on Feb. 25.

Japanese equities rose, extending their rebound to a second day, supported by gains in exporters on a weaker yen. Auto and chemical makers were the biggest boosts to the Topix, which climbed 0.8%. KDDI and Recruit were the biggest contributors to a 0.2% rise in the Nikkei 225, while Fast Retailing fell. The Japanese currency extended its loss against the dollar to a seventh-straight session, weakening more than 3% in that span. Despite its “haven” status,” the yen has dropped as Russia’s war in Ukraine has driven up prices of oil and other raw materials which Japan imports. “The market has already factored in a lot of bad news” regarding Russia and Ukraine, said Hajime Sakai, chief fund manager at Mito Securities. “The weakening of the yen is positive for exporting, but looking further on we need to think of the negative effect from import costs.”

In rates, Treasuries unwound a portion of Monday’s sharp selloff with yields richer by up to 4.5bp across front-end of the curve into early U.S. session. U.S. 10-year yield near 2.12% is down ~2bp vs Monday’s close, outperforming bunds and gilts in the sector by ~1bp; 2-year yield drop back to ~1.83% after topping near 1.89% during Asia session. Gilts and bund curves bull-flatten while Treasuries bull-steepen; short-dated USTs outperform bunds and gilts by roughly 2bps.

In FX, the Bloomberg Dollar Spot Index fell 0.1% after rising to its highest level since July 2020 in early Asian trade. Treasury yields fell by up to 4bps led by the front-end after rising in early Asian session, when the 10-year yield climbed to 2.17%, the highest since June 2019. Antipodean currencies as well as the Canadian dollar and Norwegian krone were steady to lower as commodities extended losses. The euro extended an Asia session gain, to touch $1.1020 before paring. European benchmark bond yields also fell, yet underperforming Treasuries. Sweden’s krona advanced after inflation expectations rose considerably for the coming two years. Australia’s dollar pares reased an intraday loss, in part on short covering seen after Chinese economic data beat estimates. Reserve Bank said Russia’s invasion of Ukraine has the potential to prolong a period of elevated consumer-price growth and is clouding the economic outlook, minutes of its March 1 policy meeting showed. The yen whipsawed in the spot market as stocks and oil turned south, but options wagers suggest fresh lows versus the dollar may be in store. Whether the greenback can extend its recent rally and maintain its bullish momentum for long depends on options pricing changing course.

In commodities, crude futures decline. WTI drifts 5.3% lower to trade around $97.50. Brent falls 5.3% but holds above $101. Most base metals trade in the red; LME aluminum falls 2.3%, underperforming peers. LME tin outperforms, adding 0.4%. Spot gold falls roughly $17 to trade near $1,934/oz. Elsewhere, nickel trading will resume on the London Metal Exchange on Wednesday, over a week after being suspended amid a historic short squeeze.

Looking to the day ahead now, markets have PPI for February in the US. In Europe, Germany’s ZEW survey expectations, UK jobless claims change, ILO unemployment rate 3 months, Eurozone ZEW survey expectations and industrial production are all due. Elsewhere, housing starts and manufacturing sales in Canada will be released. Earnings include Volkswagen, RWE and Generali.

Market Snapshot

- S&P 500 futures down 0.4% to 4,154.75

- STOXX Europe 600 down 1.7% to 429.03

- MXAP down 1.7% to 165.53

- MXAPJ down 2.9% to 531.41

- Nikkei up 0.2% to 25,346.48

- Topix up 0.8% to 1,826.63

- Hang Seng Index down 5.7% to 18,415.08

- Shanghai Composite down 5.0% to 3,063.97

- Sensex down 1.4% to 55,702.16

- Australia S&P/ASX 200 down 0.7% to 7,097.45

- Kospi down 0.9% to 2,621.53

- Brent Futures down 5.7% to $100.79/bbl

- Gold spot down 0.9% to $1,934.19

- U.S. Dollar Index down 0.21% to 98.79

- German 10Y yield little changed at 0.33%

- Euro up 0.5% to $1.0995

Top Overnight News from Bloomberg

- Germany is preparing to boost the supply of a scarce bond entangled in Russian sanctions, a move that will likely ease pockets of tension in European repo markets. The nation is looking to sell on Tuesday an additional 5.5 billion euros ($6.1 billion) of the notes maturing 2024, which the German government believed became difficult to source after sanctions were imposed against some bondholders

- Chinese stocks suffered another deep selloff on Tuesday as concerns about the country’s ties with Russia and persistent regulatory pressure sent shares on a downward spiral. The Hang Seng China Enterprises Index, which tracks Chinese shares listed in Hong Kong, sank 6.6%, following a plunge in the previous session that was the biggest since the global financial crisis

- Fund managers are leery of buying Chinese stocks as the country’s close ties to Russia, extreme Covid-19 curbs and lack of clarity on the end of regulatory crackdowns overwhelm the dip buying opportunity presented by the 75% plunge from their peak

- China wants to avoid being impacted by U.S. sanctions over Russia’s war, Foreign Minister Wang Yi said, in one of Beijing’s most explicit statements yet on American penalties that are contributing to a historic market selloff

- The global economy is bracing for greater disruption as China scrambles to contain its worst outbreak of Covid-19 since the pandemic began

- Russia’s economy is fraying, its currency has collapsed, and its debt is junk. Next up is a potential default that could cost investors billions and shut the country out of most funding markets

- The dollar has powered ahead of every major currency over the past nine months due to the prospect of Federal Reserve interest-rate hikes but the end of its rally may be in sight, if history is any guide. The U.S. currency has weakened by an average of 4.1% during the Federal Open Market Committee’s four previous tightening cycles

- Traders are ramping up their bets on the amount of Federal Reserve rate hikes in 2022 but are still toying with the possibility of a rate cut as soon as next year

- U.K. unemployment dropped below its pre- pandemic level for the first time as companies generated more jobs and granted higher wages than expected. The jobless rate fell to 3.9% in the three months through January, the lowest since the start of 2020

US Event Calendar

- 8:30am: Feb. PPI Final Demand YoY, est. 10.0%, prior 9.7%; MoM, est. 0.9%, prior 1.0%

- 8:30am: Feb. PPI Ex Food and Energy YoY, est. 8.7%, prior 8.3%; MoM, est. 0.6%, prior 0.8%

- 8:30am: March Empire Manufacturing, est. 6.1, prior 3.1

- 4pm: Jan. Total Net TIC Flows, prior -$52.4b

DB’s Jim Reid concludes the overnight wrap

Some hints of positive diplomatic developments in the Ukraine crisis that materialised on Sunday night helped contribute to another major sell-off in bonds and a mild risk on move in European equities yesterday. While in the States, the reality of the impending Fed tightening cycle pushed yields higher and drove equities lower.

Bonds are in a strange situation at the moment as we seem to have reached a point where higher energy prices are deemed to be signalling recessionary risks and encourage flight to quality flows that push nominal yields lower, outweighing the potentially savage inflationary impact. Conversely, the collapse in the likes of oil and gas since early last week has led to a huge rise in yields as it appears policy tightening is back on the central bank menu. Brent is around -25% from its intra-day highs last Tuesday and 10yr bunds are +46.6bps higher since hitting -0.10% last Monday morning. Meanwhile, 1-month futures on Dutch Gas have fallen from a high of 335 last Monday morning to 110.50 at the close last night. Remarkable moves.

On the conflict, Russia and Ukraine finished a fourth day of negotiations yesterday and decided to take a pause to assess outcomes. Still, it seems that negotiations are making some progress. Meanwhile, President Zelensky is set to address the US Congress tomorrow, while there were reports that President Biden was considering a trip to Europe to express the US’s steadfast support for NATO allies.

Overnight in Asia, most equity markets are down with Hong Kong and Chinese stocks leading regional losses. The Hang Seng (-3.56%) opened sharply lower, slipping more than 4% before recovering slightly as a resurgence of Covid-19 in Hong Kong and China and potential delisting of Chinese stocks from US exchanges weighed on sentiment. The Shanghai Composite (-2.18%) and CSI (-1.75%) are also down even if losses were pared following the release of stronger-than-anticipated economic data. A fresh lockdown in China’s Jilin province of 24 million people is offsetting this. Elsewhere, the Nikkei (+0.33%) is advancing while the Kospi (-0.56%) is lagging. Moving forward, equity futures on the S&P 500 (+0.17%) and Nasdaq (+0.47%) are higher while DAX contracts (-0.45%) are weak.

On that China data, industrial output rose a more-than-expected +7.5% y/y in January and February, (vs market estimates of +4.0%) and against a +9.6% gain in December while retail sales grew +6.7% y/y in the same period compared with analyst estimates of a +3.0% increase amid rising demand during the Lunar New Year holidays and the Winter Olympic Games. Meanwhile, fixed asset investment also beat, up by +12.2% y/y YTD in February and well above the forecast for a +5.0% increase. Separately, the People’s Bank of China (PBOC) unexpectedly kept the one-year medium-term lending facility rate (MLF) at 2.85%, resulting in a net injection of 100 billion yuan in fresh funds. The central banks’ action dashed hopes of a rate cut as the policymakers may want to avoid widening policy divergence with the US ahead of their expected hike tomorrow.

Oil prices have extended their recent declines this morning with Brent futures sliding -4.0% to trade at $102.64/bbl and with WTI futures -4.2%, breaking below $100/bbl. It saw a similar fall yesterday after opening the week above $109/bbl. Elsewhere, the yield on the 10-year US Treasury note is roughly flat at 2.138%.

As discussed at the top, the calm in yields overnight followed a rout yesterday. 10yr bunds eventually rose +11.9bps yesterday as risk premium eased, and to the highest level since November 2018. With a modest +2.2bps uptick in breakevens, most of the move was in real yields. Note that page 24 of the “Dislocations” chart book shows that 10yr real bund yields last week hit all-time low levels. Since those lows last week we’ve backed up +48.8bps. The move in other European sovereign yields was remarkably similar to bunds yesterday with BTPs (+11.3bps), Spanish (+11.0bps) and even Greek (+11.8bps) bonds seeing hardly any change in spreads.

US Treasury yields sold even more (10yr +14.1bps) and unlike in Europe, higher yields were met with falling breakevens (-2.3bps) with real yields +16.4bps putting in their biggest daily move since February 2021. No small feat given the considerable sell-off in real rates that marked the beginning of this year. The 2s10s (+2.8bps) curve steepened a little which might be welcomed by the Fed. Yields across the US curve notched fresh cycle highs, with those on 2y (+11.3bps) and 10y reaching the highest levels since summer 2019.

Notably, US futures moved to fully price in 7 Fed hikes in 2022 for the first time this cycle, in line with our US econ team’s view. While there were reports of incoming corporate issuance and hedging flows driving the Treasury rate sell-off, it appears markets are waking up to the magnitude of tightening the Fed is about to embark on, starting this week. If the war wasn’t enough to get the ECB to strike a dovish tone, the Fed will be all the more emboldened given fewer direct linkages to growth shocks from the conflict and the higher starting point for inflation. Indeed, in a new periodical we launched yesterday, Questions for the Chair, link here, DB Research personnel offer the questions they would ask Chair Powell at his FOMC press conference. A common question was wouldn’t policy rates need to be higher than current forecasts given the inflationary outlook. It seems markets are coming around to that view.

That line of thinking passed through to US equities, where the S&P 500 slid -0.74%. The tech-heavy NASDAQ, which is more exposed to rising rates, underperformed, falling -2.04%. Sector-wise, amid plummeting oil prices energy stocks (-2.93%) performed the worst after a sustained run of outperformance, while financials (+1.23%) were the top performers in the S&P 500 amid a steeper yield curve.

European stocks outperformed their American counterparts, with the positive geopolitical noise outweighing a tighter monetary policy path to push major indices into positive territory. The STOXX 600 rallied +1.20%, but gains in country-level benchmarks like the German DAX (+2.21%) and the French CAC 40 (+1.75%) were even more startling amid recent sharp underperformance relative to their US counterparts.

The same positive risk sentiment pushed commodity prices lower. We’ve already mentioned the slump in Oil but European gas prices also fell, with front month Dutch TTF contracts losing -17.29%. Oil prices fell despite no additional supply via Iran, US, Venezuela, or OPEC appearing likely. Instead, it seems as though Russian supply may make its way to buyers such as China and India with fewer frictions than were previously feared. As a secondary consideration, reports of Covid-19 lockdowns in China may have pushed prices lower due to potential lower demand needs.

Industrial metals lost steam as well, with aluminium and copper falling -4.69% and -2.24%, respectively, while gold lost -1.89% as markets revised geopolitical risks downwards.

One developing story with unclear implications so far is Russia’s request for Chinese support of its invasion. There have been conflicting reports about the veracity of the original claims. We do know that the US National Security Advisor met with his Chinese counterpart yesterday to try and dissuade China from offering any such support. One to keep a very close eye on.

To the day ahead now. In today’s data releases, markets have PPI for February in the US. In Europe, Germany’s ZEW survey expectations, UK jobless claims change, ILO unemployment rate 3 months, Eurozone ZEW survey expectations and industrial production are all due. Elsewhere, housing starts and manufacturing sales in Canada will be released. Earnings include Volkswagen, RWE and Generali.

Tyler Durden

Tue, 03/15/2022 – 07:53

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com