Despite Plunging Economic Sentiment, Hedge Funds Are Not Positioning For A Recession… In Fact, Just The Opposite

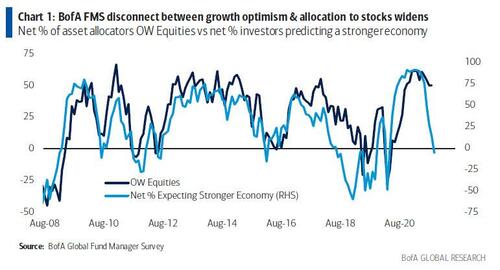

In late 2021 we noted a gaping divergence in one of Wall Street’s most closely watched surveys, the BofA Fund Manager Survey: while the number of respondents seeing a stronger economy had collapsed with the majority now expecting a contraction, the allocation to stocks remained near record high levels, resulting in what we called a “historic divergence“.

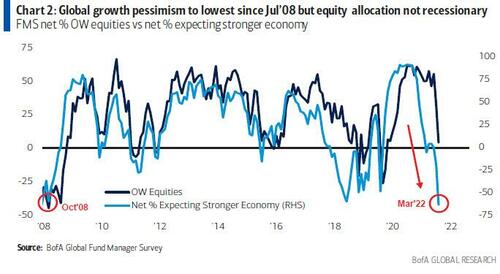

Well, earlier this week we learned that this bizarre divergence had largely collapsed: after several months of tentative declines, Wall Street sentiment in March finally hit rock bottom and according to the latest BofA Fund Manager Survey published on Tuesday (which polled some 341 panelists with $1 trillion in AUM were polled, the full survey is available to ZH pro subs in the usual place) global growth optimism has crashed to the lowest since July 08, two months before Lehman crashed.

As shown in the chart above, with the collapse in sentiment there finally has come a plunge in the number of stock overweights, or as Hartnett puts it, “the recent disconnect between global growth and equity allocation is now being corrected by a significant decline in equity allocation.”

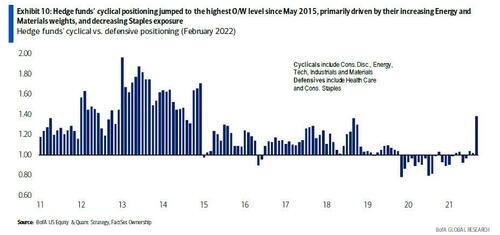

Yet despite the near record economic pessimism and sharp drop in overall net equity allocations, funds have not turned more defensive. As BofA’s Savita Subramanian writes in her latest Active Managers Holdings Update note, “clients are not positioning more defensively and in fact, just the opposite.” Indeed, as shown below, despite weakening optimism on global growth, BofA’s clients “do not appear to be positioning for a recession.” As shown in the chart below, Hedge Funds’ relative weight in cyclical vs. defensive sectors increased sharply to the levels not seen since May 2015, primarily driven by their increasing Energy and Materials weights, and decreasing Staples exposure

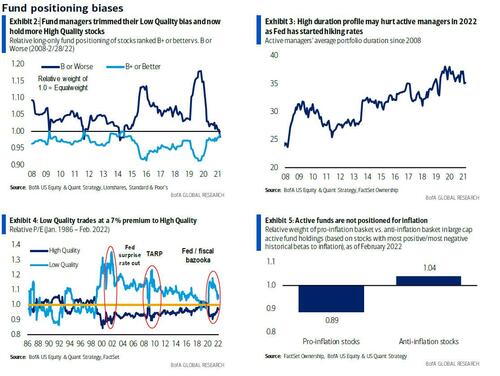

It’s not just the risk of a recession that is being ignored by funds: as Subramanian also notes, while inflation has remained higher-for-longer (and is expected to hi double digits in a few months), active managers remain unprepared for it, as well. To wit, “Long Onlies” are 11% underweight BofA’s Pro-Inflation basket (stocks historically benefitting most from inflation), while remaining 4% o/w anti-inflation stocks.

And while BofA warns that “this stance might hurt active in 2022” we disagree: now that even the market has finally grasped that a recession is coming, the reason why stocks aren’t selling off is because traders are willing to ignore the next 6-9 months and fast forward to the moment when the Fed admits that it has to start easing to offset the recession. As such, what we are now seeing is a frontrunning of the next QE!

Digging deeper, among cyclicals, in a reversal of last week week, Hedge Funds trimmed their underweight (u/w) in Energy (from 65% u/w to 11% u/w) and increased their overweight (o/w) to Materials (from 59% o/w to100% o/w). Among defensives, HFs primarily increased their u/w in Staples (from 19% u/w to 46% u/w). LO’s also increased their relative weight in cyclicals for the second consecutive month.

Separately, among cyclical sectors, Consumer Discretionary saw the biggest increase (from 7% o/w two month ago to 14% o/w now), as Health Care exposure declined most among defensive sectors (from 5% o/w to 1% o/w).

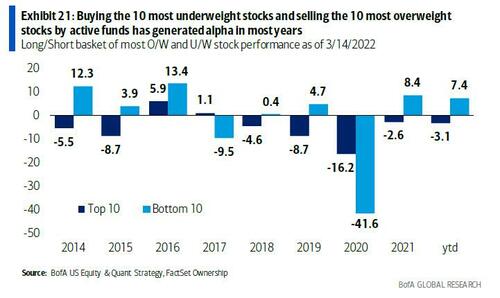

And while there is much more in the full report (available to pro subs), we will point out that our favorite trade continues to crush all else in the market: as the last chart shows, over the last decade, during which active flows were generally negative and passive flows were generally positive, a strategy which we first pitched back in 2013 of buying the most shorted or underweight stocks and selling the most widely held or overweight stocks by active core managers, would have generated strong alpha on seven of the past nine years, with the exception of 2017 and 2020.

Tyler Durden

Fri, 03/18/2022 – 14:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com