From Record Selling To Panic Buying: A Week For The Hedge Fund History Books

If one had to describe last week’s turmoil in the hedge fund world it would be just two words: “sheer chaos”, because we have finally reached a point where smart investors have given up trying to predict what comes next and instead are merely trying to react (as fast as possible) to the newsflow.

As Goldman’s Prime Brokerage explains, “the desk has witnessed the increasingly high level of difficulty in terms of navigating this market (10 out of 10 difficulty?). Indeed, the most recent GS PB flows data suggests that “investors are now chasing trends – buying on rallies, selling on selloffs – instead of anticipating what comes next, as that has become virtually impossible.”

Witness the latest out of GS PB over recent sessions

- Prime Flow for Mar 11-14thth (SPX -2.03%) — Largest $ net selling since early January

- Prime Flow for Mar 15th (SPX +2.14%) — Largest $ net buying in 3 weeks

- Prime Flow for Mar 16th (SPX +2.24%) — Largest $ net buying since late January

- Prime Flow for Mar 17th (SPX +1.23%) — Overall book slightly net bought (1-Yr Zscore +0.2)

The numbers in terms of actual hedge fund activity are even more remarkable:

- Net selling from Friday (3/11) and Monday (3/14) combined was the 3rd largest over any 2-day period in the past decade (behind late Dec ’18 and early Jan ’22).

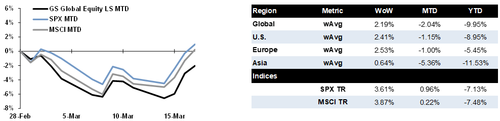

- Fundamental LS -6.0% (alpha -2.0%) vs MSCI TR -3.7%. Fundamental LS managers experienced negative alpha performance in 9 of the 11 trading days MTD.

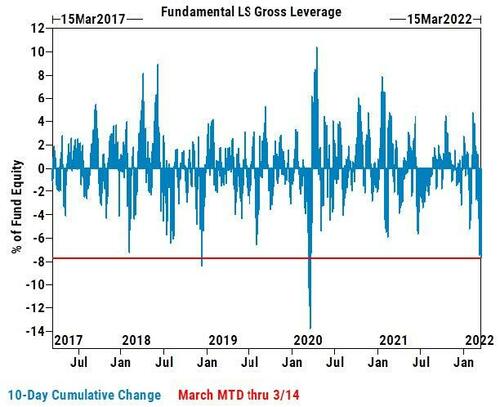

- Fundamental LS Gross leverage has fallen -7.6 pts MTD – the 3rd largest decrease over any 10-day period behind Mar ’20 and Dec ‘18.

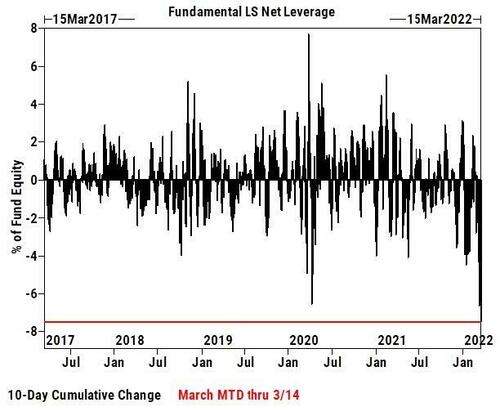

- Fundamental LS Net leverage has fallen -7.5 pts MTD – the largest decrease over any 10-day period on record (since Jan ’16).

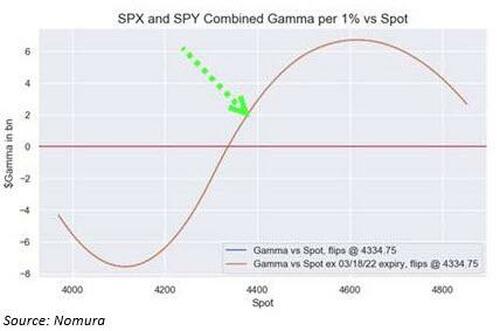

It is this phenomenon of extreme swings that has underscored a “short gamma” market (however, as we noted on Friday, dealers are now slightly long gamma so the volatility may finally quiet down)…

…. which results in one thing: buyers higher, and sellers lower.

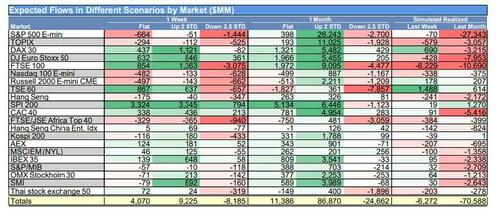

The same can now be said for the systematic crowd as well – with the moves over the past 48hrs, Goldman estimates that CTAs are decent buyers of global equities over the next week and next month…

… a shift we haven’t seen in some time.

The relentless, trendless rollercoaster in stocks, explains why yet again, hedge funds are painfully underperforming their benchmarks, with Equity L/S managers down -10% YTD on an asset-weighted basis and down around -6% on a simple average basis.

The problem is that with hedge fund positioning the lowest in two years both gross and net…

… any continued ramp higher will lead to another panicked, frenzied chase higher. Of course, if instead we see a reversal of last week’s furious stampede, brace for the selling as hedge funds – already shellshocked – resume their liquidating ways.

Tyler Durden

Sun, 03/20/2022 – 21:37

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com