US Pending Home Sales Plunge For 4th Straight Month

After unexpectedly plunging in January, pending home sales were expected rebound very modestly in February (despite both new- and existing-home-sales tumbling as mortgage rates soar). The analysts were very wrong as pending home sales puked 4.1% MoM (after a downwardly revised drop of 5.8% MoM in January). That is the fourth straight monthly drop…

Source: Bloomberg

Pending home sales are down 5.45% YoY and the pending home sales index is at its lowest since May 2020…

Source: Bloomberg

A recent report showed a measure of homebuilders’ sales expectations for the next six months slumped in March to the lowest since June 2020 amid growing concerns over the combination of rising construction costs and higher interest rates.

“Pending transactions diminished in February mainly due to the low number of homes for sale,” Lawrence Yun, NAR’s chief economist, said in a statement.

“It is still an extremely competitive market, but fast-changing conditions regarding affordability are ahead.”

And we suspect this is far from over as mortgage applications in the last week tumbled once again, now at its lowest since pre-COVID seasonal lows…

Source: Bloomberg

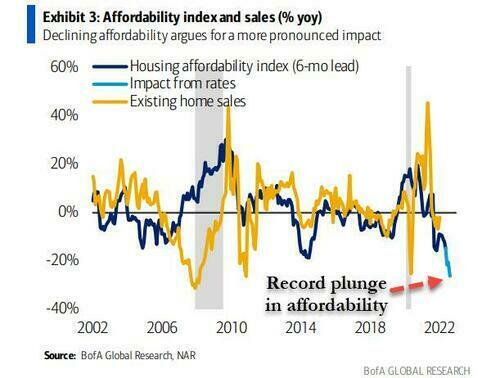

All of which has occurred before The Fed actually hiked rates even once and as housing affordability is about to crash by the most on record…

The costs and financial hurdles to buying a home are not the only thing that have been on a tear recently. Rents have been on fire over the past year, with the Zillow Observed Rent index soaring 14.9% yoy to $1,904 in January.

“The surge in home prices combined with rising mortgage rates can easily translate to another $200 to $300 in mortgage payments per month, which is a major strain for many families already on tight budgets,” Yun said.

Will the Biden admin blame Putin for US housing un-affordability too?

Tyler Durden

Fri, 03/25/2022 – 10:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com