Nomura “Seeing Clear Signs Of A Pre-Emptive ‘Defensive’ Trade Brewing”

Besides yesterday being an obvious downtrade in Equities after a torrid rally, Nomura’s Charlie McElligott warns in today’s note that it continues to jump off the page that we are seeing clear signs of a pre-emptive “Defensive” trade brewing.

The bid in bonds overnight (and the curves flattening) is being attributed to a bunch of bullish fixed-income dynamics listed below…

-

The final push from the month- / quarter- end pension rebal- AND duration- extension “bid”;

-

A signif drop in Crude Oil overnight, after reports that the Biden Admin is looking at yet another US SPR release, targeting perhaps as much as 180mm barrels over six months (~1mm b/d), in an effort to alleviate energy price inflation–which of course does absolutely ZERO as it pertains to structural supply deficits;

-

NATO’s Stoltenberg saying that Russia’s pullback is merely a regroup ahead of an offensive into Donbas

-

Chinese official PMIs dropping into full-tilt CONTRACTION, crunched by ZCS and the ongoing contraction of the property sector;

-

BoJ announcing an upgraded notional amounts of 10Y bond purchases in their April / June JGB ops schedule in order to “achieve yield target”;

-

Relief in Europe after French and Italian March HICP came in relatively “in-line” against expectations (vs the shock upside surprises seen in Ger and Spa CPI data yday);

-

The reality of pnl management in consensus “short” positioning, seeing ongoing dribs-and-drabs of monetization

But, as McElligott notes, in the scheme of things, the overnight rally seem shockingly puny and reiterates just how much “Bond Hate” there is out there…

Source: Bloomberg

Nonetheless, the real Delta of the eventual Fed pivot DOVISH soon thereafter (now pricing in 3 rate-cuts) evidences a market where there continues to be real buy-in to the idea of a “hard landing” slow-down / recession, due to the Fed’s planned “restrictive” rate policy and upgraded Street view of the eventual terminal rate…

Source: Bloomberg

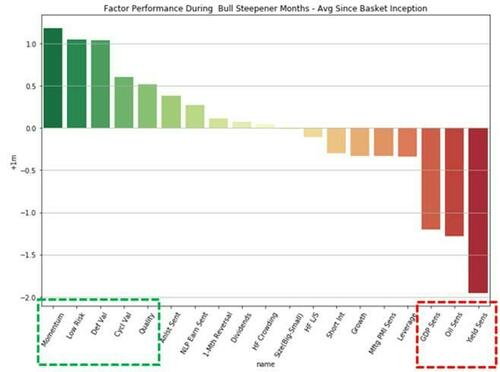

But, it is on the US Equities thematic-factor / risk-premia level, that the pre-emptive ‘Defensive’ trade is most obvious (and confirms the Eurodollar market’s thoughts above on a “hard-landing” as the Fed’s plans to run restrictive policy will push the economy into recession

McElligott points to the old-school “Duration Barbell” approach of “Low Risk,” “Size” and “Quality” relative leadership being paired with “Growth” and “LT Momentum”… all despite a session where “WTI Crude Sensitive” factor was +2.6% and where “Energy” was the S&P’s best performing sector, +1.2% on the day…

This “Energy” and “Crude” running higher while “Low Vol” and “Quality” outperform is a tell-tale sign of a market which believes we are late-cycle, and where the Fed’s perceived tightening path is going to crunch the economy into contraction.

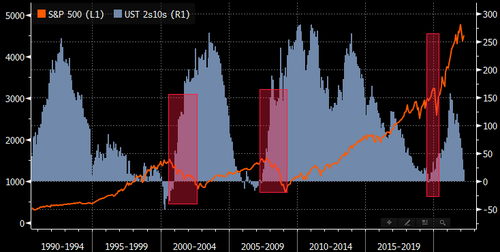

And what is the “real” contraction signal? Not the curve inversions (although they are a critical part of the overall sequencing, of course)….

…but instead, the signal is when we get the STEEPENING (a likely “bull steepening” in this case, potentially as soon as late 2H22) which tells you that the market is “smelling the recession”.

Tyler Durden

Thu, 03/31/2022 – 10:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com