Market Braces For Scorching CPI As White House Warns Of “Extraordinarily Elevated” Inflation Numbers

If last month’s hotter than expected inflation report sparked fears of a 50bps rate hike, tomorrow’s March CPI print may spark calls for 75bps.

Tuesday’s CPI report, which will the last one the Fed will get ahead of its meeting in May, comes amidst heightened speculation that the Fed could move by 50bps at the next meeting, and futures are pricing in an 88% chance of a 50bps move.

While consensus expects an 8.4% print tomorrow – the highest since January 1982 when the Fed Funds rate was 12% (compared to just 0.50% now)…

… Deutsche Bank economists expect that the CPI increase will be even higher than that – with a monthly gain in headline CPI of +1.3% (vs consensus 1.2%) pushing the year-on-year rate up to +8.6% (vs consensus of 8.4%) – which hasn’t been seen since 1981. Some more details from the bank’s preview:

While we did see some preliminary impacts in the February data from the Russian invasion of Ukraine, the bulk of the direct inflationary impact should be felt in the March data, with gas prices rising almost 20% from February. Should our forecasts hit the mark, this would push year-over-year rates for March headline and core CPI to 8.6% and 6.6%, respectively.

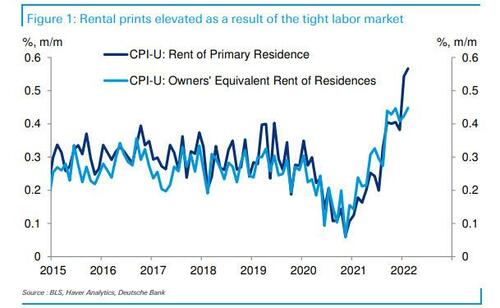

At the component level, our focus, per usual of late, will be on rents and vehicle prices. As to rents, we expect continued elevated prints, +0.6% for primary rents and +0.5% for OER, similar to their showing last month. Given that rents are one of the components of the CPI for which the Phillips curve seems to work, these outsized monthly prints are a function of the tight labor market. Indeed, income growth is a leading indicator of the series. While our expectation is that rental prints stay near their current values for the rest of the year, there is some risk that the prints accelerate further should the labor market continue to tighten. To this point, both primary rents and OER picked up slightly in February as the unemployment rate fell by two-tenths.

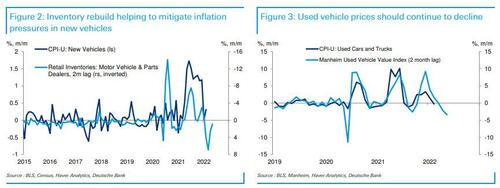

As to vehicle prices, we expect new car prices to have notched relatively moderate gains, +0.4%, in March given the potential for some supply chain disruptions. However, used car prices should show a meaningful decline, -0.8%. For the former, to the extent that vehicle retailers have begun to rebuild their inventories, the additional supply has helped to put downward pressure on price gains for new vehicles. With the Russian invasion of Ukraine and the recent resurgence of covid in China, inventory rebuilds may take a bit longer, however. As to used cars, wholesale used car prices have fallen 5.4% over February and March, so we fully expect further price declines over the next couple months given the typical 2-3 month lag structure.

That said, DB’s economists add that barring further severe disruptions, the March data is likely to be the peak in terms of year-over-year rates for both headline and core since the base effects from last year’s surge in used car prices will begin rolling off in the April data.

Not everyone agrees, and JPM economist Michael Feroli writes that “real consumer spending is set to rise in the coming year despite near-term inflationary headwinds to demand and medium-term headwinds from tighter monetary policy. Despite some indication in the Chase card spending data of a drag in spending in March, the headline composite for the ISM services survey strengthened last month, with broad-based gains in key details. The headline composite for the ISM services survey rose from 56.5 to 58.3 in March, partially reversing three months of decline during the Omicron surge. The details of the report were upbeat, with gains in business activity, new orders, and employment. The supplier delivery time index edged down in March, more than reversing the increases in the previous two months that had coincided with the Omicron surge and signaling some easing in supply chain pressures.”

And just to may sure that the March CPI print is as bad as it gets, there is a distinct possibility that the White House do a “kitchen sinking” tomorrow – as Joe Biden press secretary and MSNBC employee Jen Psaki said today, the White House is bracing for “extraordinarily elevated” inflation numbers to be reflected in Tuesday’s data from the Labor Department, which of course will be blamed on PutInflation, and sharply higher energy costs stemming from the Russian invasion of Ukraine (never mind Biden’s release of more than 1 million barrels/day from the strategic midterm reserve).

“We expect March CPI headline inflation to be extraordinarily elevated due to Putin’s Price Hikes” Psaki said, clearly ignoring that inflation hit 7.8% in February when the only Price Hikes were Biden’s.

“Because of the actions we’ve taken to address the Putin price hike, we are in a better place than we were last month,” Psaki said, referring to BIden’s release of millions of barrels of oil from the Strategic Petroleum Reserve, a move which will prove cataclysmic should there be a true emergency in the next few months as opposed to just Democrats losing the midterms.

PSAKI: “We expect March CPI headline inflation to be extraordinarily elevated due to Putin’s Price Hike.” pic.twitter.com/xImSTGKCnV

— Breaking911 (@Breaking911) April 11, 2022

“I will say that anytime there’s heightened monthly data or inflation reporting or numbers, it is a reminder to us, our allies on the Hill and hopefully to many of the American people that we need to do more to reduce costs for the American people,” Psaki said.

One of those things, of course, is to crash the market, which according to former NY Fed president Bill Dudley is what is needed to push inflation lower (spoiler alert: adding a market crash to his list of achievements will have no impact on supply-chain driven inflation, but it will certainly guarantee that Biden will have the lowest approval rating of any president in history).

Finally, will a truly “shocking” CPI print tomorrow open the door to a 75bps hike? According to JPM, “Tuesday’s CPI print should give us clarity on the Fed’s behavior where investors worry about (i) an emergency meeting to hike rates and (ii) a greater than 50bps hike.” That said, the bank believes that both of those outcomes remain unlikely since “Powell believes in transparency and thus is unlikely to surprise the market and risk unintended outcomes given his stated preference to use a data-based approach that tests how much the market can bear.”

Still, JPM concedes that a CPI print materially above consensus – which looks all but assured – would renew these fears while an in-line print should hold anchor expectations to no emergency meeting, 50bps hike in May, and the Fed sticking to the QT plan detailed in last week’s Minutes.

Tyler Durden

Mon, 04/11/2022 – 21:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com