Deutsche Sours On Auto Sector, Citing Ukraine War As Reason For “Broad Risk” Across The Sector

Deutsche Bank is officially souring on auto stocks due to concerns over the outlook for the entire industry. This morning, the bank released a note outlining its Q1 earnings and 2022 guidance preview and playbook.

The takeaway is that the bank expects Q1 results to be slightly below consensus and that it sees “broad risk” for 2022 outlook, mostly driven by the war in Ukraine and the spiking of input costs for manufacturers.

The firm noted risks to names like Ford and General Motors, stating:

Among automakers, while Q1 earnings could benefit from stronger pricing than expected, we see downside risk to 2022 outlooks from GM and F reflecting steeper commodity cost headwinds. Vehicle pricing has so far remained strong, but we believe OEMs may be reluctant to raise their full-year assumption further in light of some early signs of industry pricing normalization, and broader investor concerns around health of the consumer.

Instead, the firm notes that it “favors” Tesla:

On the OEM side, we believe traditional automakers could struggle to attract investor attention due to concerns around the consumer. We continue to favor TSLA for which 2022 should be important, with the ramp up of 2 new factories, considerable growth in volumes despite Shanghai shutdown, strong pricing power, favorable raw material contracts, FSD deployment, and initial production of its own battery cells and Cybertruck.

Here is a look at the bank’s revised estimates for names in the industry:

“…we see risk that 2022 guidance from several suppliers may need to be revised down and in some cases, come in lower than ingoing consensus estimates,” the bank’s note reads.

The firm also revised price targets lower for numerous names in the sector:

Finally, the bank noted the correlation between supplier performance and rates:

“On the supplier side, we favor those that could still see multi-year production volume recovery, eventual moderation in raw mats headwind, possibly large recoveries from OEMs in 2H, and potential stock pop on Ukraine crisis resolution. At the same time, we dust off the old supplier playbook to evaluate names that could outperform over the coming fed fund rate hike cycle. Historically, suppliers start underperforming the market as soon as rates start being raised from the bottom.”

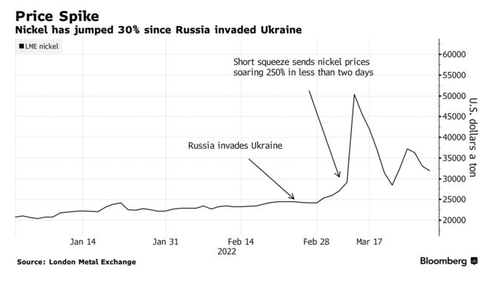

Deutsche also noted that a rise in commodity prices is “directionally negative for all autos names,” although not all companies will be impacted to the same degree. We have written about these challenges for automakers extensively.

Yesterday we noted that Tesla is facing challenges in procuring raw materials necessary for battery production. Prior to that, we noted a couple weeks ago that Tesla had secured a “secret deal” that helped it sidestep rising nickel prices.

Additionally, Bloomberg reported last month that a multiyear supply deal for nickel has been in place and covers nickel from Canada. “Unlike most of its peer automakers, Tesla has spent years focusing on how to secure its own nickel supplies,” the report says.

We also noted last week that Chinese and Japanese EV manufacturers have both been grappling with rising costs. Many EV manufacturers are doing the only thing they can to help alleviate the pressure – and that means raising prices for consumers.

Companies like Tesla, BYD, Xpeng and Li Auto all hiked prices in March. Among the manufacturers raising prices was also Contemporary Amperex Technology, the world’s biggest EV battery maker. They said they were making “dynamic adjustments to the prices of some of our battery products”. Remember, we just wrote days ago that Japanese automakers were also grappling with the skyrocketing cost of raw materials and a shortage of semiconductors still.

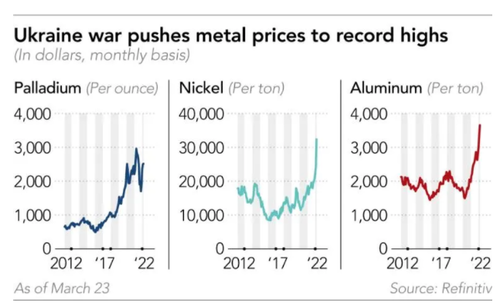

Even as some parts have become unavailable, raw materials for other parts have skyrocketed in price. For example, palladium, nickel and aluminum have all surged to record highs this month. The metals are used in automobile catalytic converters, batteries and other car parts.

The price hikes are likely due to the fact that 40% of palladium production comes from Russia. This has forced auto manufacturers to abandon buying from Russia and seek out alternative sources.

If Deutsche’s outlook is accurate, it looks like there could still be plenty more bumps in the road for autos heading into the second half of 2022.

Tyler Durden

Fri, 04/22/2022 – 07:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com