A Titanic Struggle Will End In Costlier Crude

By Jake Lloyd-Smith, Bloomberg Markets Live commentator and reporter

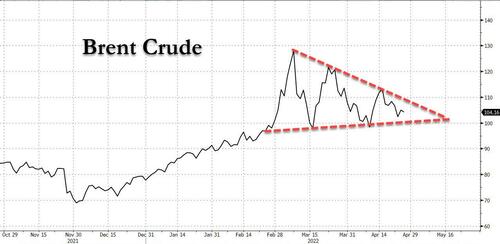

The oil market is the arena of a fantastic struggle right now that over time will be resolved in favor of higher prices, albeit with elevated volatility along the way. After largely holding the line above $100/bbl in recent weeks, Brent looks set to extend gains.

Ranged on one side are the drag from the U.S.-led SPR releases, lower demand from China’s lockdowns, and the slow-motion chill as central banks including the Fed stamp ever harder on the brakes.

Ranged on the other are the hit to supplies as Russian crude gets harder to place (apart from in Asia), risks to complementary sources of energy especially gas, a foot-dragging OPEC+, and support for consumption in ex-China economies as they move beyond the pandemic. There are also wild-card risks such as hurricanes.

In this push and pull, the bullish forces look set to prevail. The latest news from Europe is supportive of prices, especially the choking off of Russian gas flows to Poland and Bulgaria. That’ll boost energy costs, and may be the precursor to interruptions elsewhere.

In addition, there are steady moves by EU members to wean themselves off Moscow’s oil, as well as a shift away from Russian business by major trading houses. Crude looks set to push higher.

Tyler Durden

Wed, 04/27/2022 – 14:41

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com