Russian Fossil Fuel Revenues Double Despite Western Sanctions

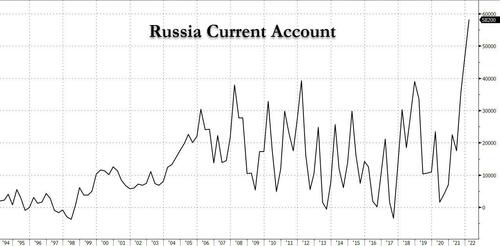

The longer Western sanctions isolate Russia and reduce energy supplies to European refiners. The higher energy prices will go. Even though Russian energy exports are declining, higher prices have enabled the country’s state-owned oil and gas companies to double revenue, thus stabilizing the ruble and allowing financing for President Putin’s military machine.

According to The Guardian, citing a new report of shipping movements by the Centre for Research on Energy and Clean Air (CREA), Russia has reaped a whopping €62 billion from oil, gas, and coal exports since the invasion of Ukraine began.

Russian exports to energy-stricken Europe totaled €44 billion in the last two months, compared with €140 billion for FY’21. The revenue surge comes as “Russia has continued to benefit from its stranglehold over Europe’s energy supply, even while governments have frantically sought to prevent Vladimir Putin from using oil and gas as an economic weapon,” CREA said.

CREA data showed Russian crude oil exports tumbled 30% in the first three weeks of April, compared with rates in January and February, before the invasion. However, soaring prices because of tight global supplies have helped cushion the blow of Western sanctions and ultimately allowed Putin to continue his funding war efforts.

“Russia has effectively caught the EU in a trap where further restrictions will raise prices further, cushioning its revenues despite the best efforts of EU governments,” CREA explained.

“Fossil fuel exports are a key enabler of Putin’s regime and many other rogue states,” Lauri Myllyvirta, lead analyst for CREA, said.

“Continued energy imports are the major gaps in the sanctions imposed on Russia. Everyone who buys these fossil fuels is complicit in the horrendous violations of international law carried out by the Russian military,” Myllyvirta said,

The EU receives around 40% of its gas, 46% of its coal, and 30% of its oil from Russia — and there are no quick and easy substitutes if supplies are disrupted. Germany has been the biggest importer of Russian energy products in the last two months. German businesses and unions have warned a ban on energy products from Russia could severely impact industry and jobs.

In recent days, Moscow has doubled down on its demands that its European “partners” pay for its oil and gas in rubles instead of euros. Russia’s Gazprom said it is halting natural gas supplies to Poland and Bulgaria over their refusal to pay in Russian rubles.

So far, Western sanctions have backfired as Russia doubled fossil fuel revenues. What’s important to understand next is that Russian oil production is likely to drop further in the coming months and will tighten global supplies and boost energy prices which could mean higher revenues for Putin.

Tyler Durden

Thu, 04/28/2022 – 11:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com