“That Escalated Quickly”: Mike Wilson Takes Victory Lap As Markets Crash, Sees S&P Tumbling To 3,400

One week ago, Wall Street’s second biggest bear (after BofA’s Michael Hartnett who turned rather apocalyptic last Friday, and of course excluding SocGen’s Albert Edwards who is in a category of his own), said that “there is no place left to hide” in stocks as the rolling bear markets finally hit the broader index, and warned that the bear market rally (which he was correct about unlike all of his JPMorgan peers) was about to turn “grisly” (or is that grizzly).

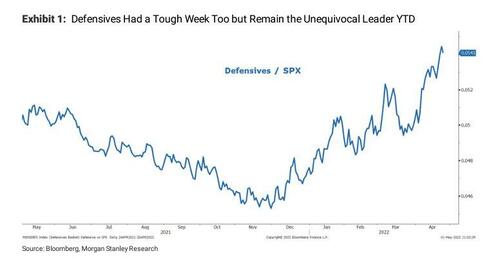

Fast forward to his latest Weekly Warm-up note (available to professional subscribers in the usual place), where he takes a prompt, well-deserved (again) victory lap on his latest dismal forecast, and writes that after suggesting last week that the bear market was entering the phase when virtually nothing would work, even defensives, “based on the price action, that seems to be exactly what’s happening” with price action turning “especially vicious” last week as we enter the next phase of the bear market. Indeed, while the S&P 500 dropped “only” 3.4%, the breadth suggested the move was even worse with the cumulative advance / decline line making new lows for this bear market. Defensives were a very modest underperformer for the week (-0.5% relative) even though they remain the unequivocal leader year to date (+15% relative).

Meanwhile, the negative fundamental news and data points are piling up fast as – according to Wilson – they “tend to follow stocks that have been signaling bad news was coming” and as such, last week’s shockingly bad, pre-recessionary Q1 GDP at -1.4% fits the bill and “suggests Ice has arrived.“

What was behind last week’s sharp market repricing and earnings reassessment?

Recall one week ago – well before the dismal earnings from AMZN and the mediocre reports from the other gigacap GAMMA stocks – we said that “Q1 Earnings From Bad To Dismal: Tech Earnings Sliding, Guidance Collapsing.” Looking back, Wilson agrees that the catalyst for the sharp and broad move lower last week “was the growing evidence that growth is slowing faster than most investors believe. In short, we believe earnings estimates remain too high over the next 12 months even though 1Q results have been better than expected, once again.”

At the same time, another issue is that the quality of earning is deteriorating, and the commentary from management teams is getting incrementally cautious about the future path of growth. This, Wilson says, “is very much in-line with our view for earnings revisions breadth to continue falling as operating leverage turns negative. We think Amazon’s earnings and commentary from CEO Andy Jassy may encapsulate this view better than anything else:

“Today, as we’re no longer chasing physical or staffing capacity, our teams are squarely focused on improving productivity and cost efficiencies throughout our fulfillment network. We know how to do this and have done it before. This may take some time, particularly as we work through ongoing inflationary and supply chain pressures, but we see encouraging progress on a number of customer experience dimensions, including delivery speed performance as we’re now approaching levels not seen since the months immediately preceding the pandemic in early 2020.”

Meanwhile, Wilson also points to the S&P 500 real earnings yield which he observes is the most negative since the 1950s. As the MS strategist reminds us, the textbook view of valuation says that higher rates should lead to lower valuations, and sure enough today this story is painfully unfolding with “the highest inflation in 40 years and rates nearly doubling over the past two months, yet index valuations remain stuck at historically high levels.” Add 8%+ YoY inflation into the mix and we are left with the most negative real earnings yield back to the 1950s!

This has translated into real S&P 500 returns at -7% YoY, and means that “the S&P 500 has come full circle on the year, starting in May 2021 at 4200 and now nearly a year later, we’re at 4135.” Worse, if one factors in the latest March CPI at 8.5%, trailing 12 month real returns were -10%, -8% including dividends. The real return is even worse for the Nasdaq 100 (-15%), and the Russell 2000 (-25%), or as Wilson puts it, “Anyone who tells you we are in a bull market has got a lot of explaining to do.” We are confident Marko Kolanovic will get right on that…

Sarcasm aside, Wilson next makes a critical observation, noting that “perhaps stocks are no longer the inflation hedge investors expect” a point he made first several weeks ago in “Inflation Is No Longer A Positive For Earnings Growth… Or Stocks“. As he adds, “rising inflation should theoretically pass through to top-line growth, making stocks a historically safe bet against inflation. Why is this time different” he asks rhetorically and answers that “valuations are still near their highest levels ever as shown by the earnings yield and subtracting inflation gives you a real negative earnings yield. This theoretically means you’re buying -4% earnings contraction at today’s levels.“

Unfortunately, the plunging real earnings yield suggests even more downside from here according to Wall Street’s second most bearish analyst. Looking back at history, Wilson notes that the real earnings yield leads the real returns by ~6 months. While the relationship is not perfect, it has held true during the 2001 and 2008 cycle with the real earnings yield leading real returns lower. And while Morgan Stanley thinks real earnings yields will likely bottom soon as inflation peaks, the market will continue to move lower from here. In short, the “ice” phase that Wilson has been predicting for a year, is now front and center and hard to deny. Stocks have been warning of this for months and now the evidence is becoming more obvious to all.

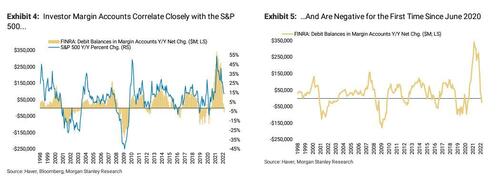

Meanwhile, even retail is realizing that pain is coming and margin accounts finally turned negative in April. Curiously, April is historically a strong seasonal month and 1Q22 earnings have been strong, yet the S&P 500 is down 8% and the NDX is down 12% in April. One possible factor in this according to Wilson, has been the first deleveraging in investor accounts since June 2020, as retail begins to sell (to hedge funds).

Hedge funds were selling all of Q1 and retail was a buying, i.e., distribution.

Now retail is selling, and HFs are buying.

— zerohedge (@zerohedge) April 28, 2022

Why? Because rising rates are increasing the cost of margin while markets are 15-20% lower from 2021 highs, hurting the ‘buy the dip’ mentality. Here Wilson thinks that lower liquidity will continue to point to a broad de-rating and lower prices at the index level.

What does all this mean for stocks in the coming months? Nothing good: as Wilson concludes, from a technical standpoint “the S&P 500 has minimum downside to 3800 (-8%) in the near term. This represents 16x forward 12 month bottoms up consensus EPS which is looking more at risk now.” In other words, 16x is fair value… but if forward EPS starts to fall, there could be “much” more downside.

Which means that as Wilson highlighted back in January, the true technical support lies at the 200 week moving average if there is going to be a true growth scare with recession probabilities rising materially. Unfortunately for bulls, that currently comes in at 3460, or 16% lower. It also lines up with the pre pandemic highs of 3400 which seems to be where a lot of stocks have already ventured.

In many ways, Wilson concludes, “this makes perfect sense from the point of view that the pandemic did not create real value for the economy or most companies, but rather destroyed it.” On the positive side, even Wall Street’s 2nd biggest bear concedes that the market is currently so oversold, any good news could lead to a vicious bear market rally, something which Goldman discussed in its bullish note. Which is why Wilson writes that while he can’t rule anything out in the short term he wants to make it clear “this bear market is far from completed, in our view.”

There is more in the full Wilson note available to professional subscribers in the usual place.

Tyler Durden

Mon, 05/02/2022 – 13:10

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com