Russia Is Returning To The Gold Standard: Is China Next?

Submitted by QTR’s Fringe Finance

No sooner was it that I wrote an article talking about how Russia was going to back the ruble with gold than “one of the Russia’s most powerful security/intelligence officers and a close ally of Putin” has admitted the country’s intentions to do just that.

And I’m predicting that no sooner will the gravity of this decision finally sink in with the West that China will follow closely in Russia’s footsteps and do the same.

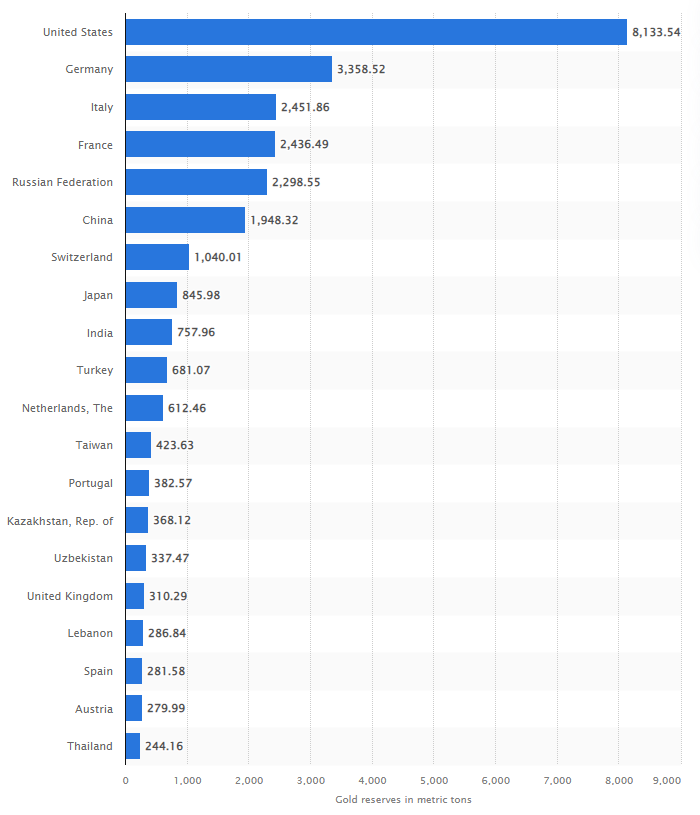

Russia backing its currency with gold represents one of the most drastic changes to the foreign currency market in decades. As of 2022, precisely zero countries still adhere to a gold standard, though many countries still hold gold in reserve.

The new global monetary system is likely going to look like Russia, China, India, Saudi Arabia and other countries with commodity-backed, sound money on one side – and the west and our allies, with our “infinite” fiat, under the tutelage of rocket surgeon Neel Kashkari, on the other.

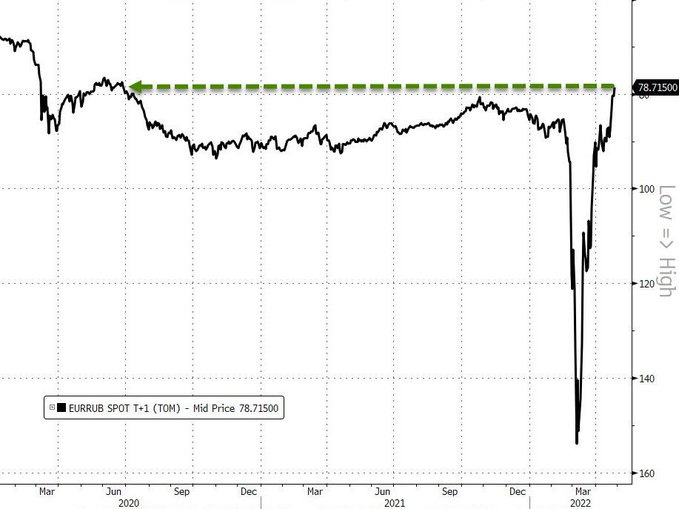

Despite the enormity of the situation, the news hasn’t really been digested by global markets yet. The FX market has been relatively calm, but for the ruble strengthening, and gold prices have crashed so far this week, with front month futures falling nearly $50/oz. on Monday, back down to about $1,860/oz.

Ruble vs. Euro chart from Zero Hedge

Today’s content is free, but if you enjoy it and have the means to support the blog, I’d be humbled by your subscription: Subscribe now

Aside from the FX market, the news also hasn’t been digested by US politicians or financial “thought leaders” yet.

However, there are underground rumblings starting to catch the ears of those who are actively listening. Ronan Manly wrote for BullionStar.com last week:

On Tuesday 26 April in an interview with newspaper Rossiyskaya Gazeta (RG), the Secretary of the Russian Federation’s Security Council, Nikolai Patrushev, said that Russian experts are working on a project to back the Russian ruble with gold and other commodities.

Manly was kind enough to translate the interview with RG, which stated Russia’s intentions to back the ruble with gold in crystal clear fashion:

RG Question: And what do we need to do to ensure the ruble’s sovereignty?

Nikolai Patrushev: “For any national financial system to be sovereignized, its means of payment must have intrinsic value and price stability, without being pegged to the dollar.

Now experts are working on a project proposed by the scientific community to create a two-circuit monetary and financial system.

In particular, it is proposed to determine the value of the ruble, which should be backed by both gold and a group of goods that are currency values, and to put the ruble exchange rate in line with the real purchasing power parity.”

Manly concludes, matter-of-factly:

So there you have it. The Russian Government is actively working on creating a gold and commodity backed Russian ruble with intrinsic value which is outside the orbit of the US dollar.

…

What we are seeing now is Nikolai Patrushev and the Kremlin confirming this simple equation of linking the Russian ruble to gold and commodities. In other words, the beginning of a multilateral gold and commodity backed monetary system, i.e. Bretton Woods III.

Just days ago I published an in-depth analysis by my friend Lawrence Lepard, about what Bretton Woods III might look like. For anyone concerned about the future of the monetary system, it is a must-read: Putin Knows The Monetary System Is A Credit Based Ponzi Scheme: Lawrence Lepard

Finally, to take Manly’s analysis one step further, I think China isn’t going to be far behind Russia in adopting a gold standard.

Going back to last summer, before the invasion of Ukraine happened and before inflation was an issue, I wrote an article arguing that it was the most common sense scenario for China to affix its new digital currency to gold.

That was before Russia decided they were ready to take a stand against the west’s monetary policies and before China became interested in buying distressed strategic oil assets from Russia while the rest of the globe tries to shut the country down economically.

Now, Russia and China are closer than they’ve ever been and arguably more unified in their interests of keeping the U.S., the west and NATO in check than they’ve ever been.

China has also kept one eye on Taiwan, as I noted in an article last month exploring whether or not President Xi is actively entertaining the idea of catalyzing World War III. For now, those concerns have taken a back seat to the country’s bizarre recent reaction to a Covid “outbreak” that it is fruitlessly trying to control.

Meanwhile, as Russia accepts payment for oil only in rubles or gold, “the digital yuan has already been piloted in various Chinese cities and was used in more than $8 billion worth of transactions in the second half of 2021,” CNN reported earlier this year. In other words, the rubber is starting to hit the road for China’s digital currency.

And, with everyone locked in their homes once again, it’s extremely convenient timing.

Is the picture becoming clear yet, or do I need to spell it out for you?

If you haven’t read them yet, numerous articles that explain my position on Russia and China creating their own monetary system include:

-

Russia And China Might Collectively Challenge The Dollar’s Reserve Status

-

The Dominance Of The U.S. Dollar Is Fading Right Before Our Eyes

-

The Dollar Dethroned: We Have Reached The End Of Monetary Policy As We All Once Knew It

Thank you for reading QTR’s Fringe Finance . This post is public so feel free to share it: Share

Disclaimer: I am long gold and silver and tons of miners. This is not a recommendation to buy or sell any stocks or securities. I own or may own all names I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Tue, 05/03/2022 – 19:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com