Nomura: “I’m Talking Full-Blown, Game Of Thrones “Red Wedding” Style Liquidation Death”

Nomura’s Charlie McElligott was spot on in his explanation for why the market broke yesterday, yet even he is concerned about what is going on today, and writes that in addition to the potential shock of the aforementioned six Fed speakers today (“culminating in tonight’s Hawk-led Bullard / Waller double-banger, where there’s some Delta they could again try to talk-up 75bps hikes”), the week’s crash – which sees the S&P on track for the longest weekly losing streak since 2011 – is also “an Earnings and Valuation story, which is bearing-out again in more “rich” names and (former) favorites of the Growth crowd, and culminating in “absolute scenes” in Growth portfolios, as “obvious liquidations ripple-through the market, with outrageous -2.5- to -3.5-sigma 1-day selloffs yday in bunches of these names, full capitulation.“

Here are the summary highlights from McElligott’s latest note (the full note is available to ZH professional subscribers in the usual place):

The fixed-income disaster was a major input in Equities calamity yesterday, and most didn’t see the Unit Labor Cost print which screamed “wage / price spiral” at the Fed, where after the number was released, the Bond murder (particularly the long-end, one of the largest 1d selloffs in 30Y ever).

The market is telling central banks around the world that they are behind the curve—period. Inflation is shifting into services now, with the aforementioned wage / price spiral risking even more persistent and embedded inflation into a consumer that is starting to show signs of drag.

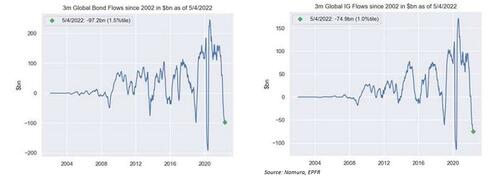

This is an increasingly huge deal from a fund flows perspective, where we are now seeing real damage from Redemptions:

- Global IG Credit -$7.7B, 1%ile weekly outflow, -$23.3B for the past 4w, also 1%ile and outflows 17 consecutive weeks; -$86B of total fund redemptions YTD

- Global Bonds -$9.1B, 2%ile weekly outflow, -$37.6B for the past 4w, 9%ile and outflows 9 consecutive weeks; -$118B of total fund redemptions YTD

And remember now, we are out of the Fed black-out, with a massive slate of Fed speakers today, culminating in tonight’s Hawk-led Bullard / Waller double-banger, where there’s some Delta they could again try to talk-up 75bps hikes.

And this Fixed-Income meltdown mattered enormously for Equities again yesterday, and longer-term, where over the past decade have been indices made of securities which are “Leveraged Long Duration” as their nose-bleed Valuations were justified by absurdly bastardized interest rates from CB easy money / QE policies which actually contributed to “Goldilocks” economies, along with the long-term “Structural Disinflationary” drivers of the “3 D’s”—Debt, Demographics and (Tech) Disruption.

But as our “Inflation Overheat” went full-flown Spinal Tap “to eleven” for a lot of wildly idiosyncratic reasons since COVID (some unfortunate, some man-made stupidity and excess), this “macro regime” shift has crushed legacy portfolio positioning being “Long High-Valuation Secular Growth” Equities vs de facto “Short Cyclical Value / Inflation.”

But yes, it’s also an Earnings and Valution story—and that is bearing-out again both yday and overnight in more “rich” names and (former) favorites of the Growth crowd.

Hence the *absolute scenes* occuring in TMT Growth portfolios, as obvious liquidations ripple-through the market, with outrageous -2.5- to -3.5 Z-score 1d selloffs yday in bunches of these names, full capitulation.

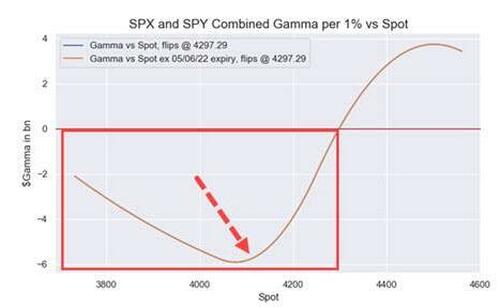

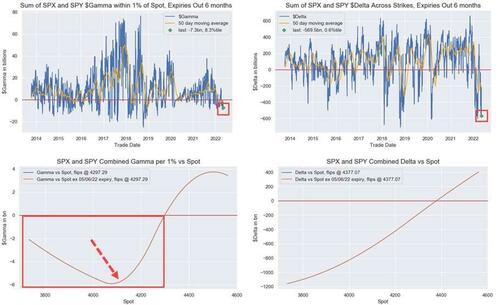

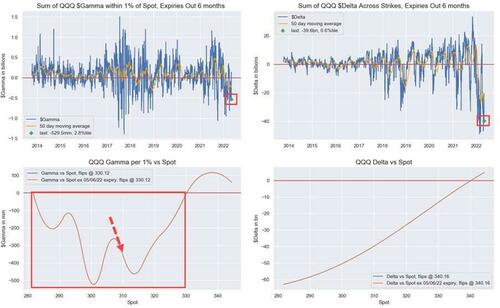

FWIW, Equities Index Options indicate that we will remain “lungy” near peak “Max Short Gamma / Extreme Negative Delta”…although notably, Skew is fading into the drawdown, and there is no grab for Tails (VVIX < 120), so this is just looking to keep “leaking” with UX1 implying more of the same “2% daily change” in SPX.

Yikes, how times have changed…

And finally, with Technicals “mattering” when markets break into new ranges, a not-great bit of feedback from our Tech Analyst Walter Burke: “ESM – the 4304 resistance held well (understatement) and was followed by a sharp turn lower. The fact that the 4056 to 4304 recovery was 3-waves strongly suggests new lows below 4056 will be seen. Weekly support is 4040/3940 area.”

And some more markety bullets:

Looking at the USD Rates / USTs specfically yesterday, the magnitude of the sell-off and bear-steepening—led by the stunning move in the long-end, with 30Y UST yields touching 3.20% and making highs since 4Q18 in what was one of the largest 30Y 1d selloffs in history—was likely part of this “hawkish reacceleration” on the “higher persistence of inflation than the central banks are yet acknowledging” macro catalyst story…

But the move too was also a story of legacy crowded “flatteners” being unwound, possibly in relation to the “supply” story driver being that the final Wednesday release of the specific Quarterly Refunding Accouncement of Coupon cuts did not end up doing much to alter or offset the distribution of supply across the curve as it relates to the impact of the QT balance-sheet runoff—which should be a natural “steepener”

Also, the move in USD Rates yesterday reveals some totally rational “truths” of new lows in Bond futs and STIRs being made, which speaks to a dynamic that I mentioned last week: this is the simple idea that as new lows are made in STIRs and UST futures, that hedgers need to build positions at new lower strikes…which means there is new open interest being created at said new lower strikes, and Dealers then need to hedge out their associated “short Gamma” into an unstable market, adding further selling pressure into these downdrafts

Mind you…this is “new lows” thing is becoming a real problem from a fund-flows perspective in Bond and Credit funds—look at the REDEMPTIONS from the last weekly period, which were released last per EPFR:

* * *

Once Bonds dragged the “Long Duration” US Equities indices into their selloff, a whole lot of stuff kicked-off…

Dealer “Short Gamma” cuts both ways as I always say, so when I’m thinking about only ~15% of the current total SPX / SPY $Gamma expiring today after this enormously “overhedged” Fed event-risk week (hence the persistently “high” levels of Vol which is leading to Vol actually UNDERPERFORMING on the massive Equities selloff yday)—meaning that 85% of the total $Gamma remains open, but on top of the day before expiration in the very sensitive short-dated stuff, there is just a ton of Dealer hedging to do with Spot melting lower as all those remaining downside strike Puts began to pick up again, and fast…which meant enormous futures selling in the hole

And as always, there was a then massive mechanical selling on a Spot gap-down tail like this, especially with Vols squeezing (albeit underperforming as noted):

CTA Trend saw -$12.2B of selling across Global Equities futs with the Net Exposure now just 4%ile rank since ‘11

Vol Control sold -$7.3B in US Equities futs as both 1m and 3m rVol are currently 100%ile 1Y lookback, with the Equities allocation now down to just 6.8%ile since ‘11

Leveraged ETF end-of-day Equities rebalancing was around -$12.5B of selling pressure, where nearly 2/3 of that was in Nasdaq- and Tech- products

But without a doubt, there too was an Fundamental / Earnings / Valuation component at play, particularly seen early yday in E-Commerce “high multiple” stuff, where ETSY, EBAY, W, SHOP and AMZN have disappointed and added further “liquidation” pressure the the TMT / Growth Equities universe

And more gong-show overnight: BILL, NET, CFLT all down big as software and payment co’s, plus PTON down more as they sell another stake on the lows…and Zillow piling-on with negative housing commentary

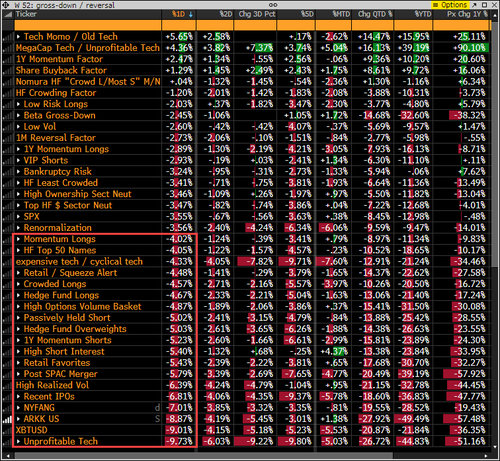

I’m talking full-blown, Game of Thrones “Red Wedding” style liquidation death in Growth / High-Multiple / MegaCap Tech / High Spec Equities yday on massive netting down of exposure (selling longs, pressing shorts)—look at the bloodshed in that stuff, i.e. 2.5-3.5 1d Z-score moves (versus huge outperf in obvious “Low Risk” and “Value” M/N factor, which by-definition is “Short Expensive”):

And with VVIX sub 120 (no grab for tails) and Skew underperforming despite Spot absolutely getting SMASHED with increasing frequency / regularity, it certainly does not indicate any sort of capitulatory panic even at this point (despite UX1 implying “just another” 2% daily change for SPX!)

Options Greeks for SPX and QQQ—VERY “Short Gamma, Negative Delta” means more lunging:

Fundamentally- and Macro- wise as it pertains to the aforementioned “High Valuation Growth” stuff, PMs have been hiding in “Leveraged Long Duration” Equities proxies for a decade, and “Survivorship Bias” meant that in order to thrive, to outperform benchmark and gather more assets, you simply built a “Doomsday Momentum Machine” that kept piling-into these “Secular Growth” names at “un-possible” nose-bleed Valuation, which were being justified by absurdly bastardized LOW RATES through ZIRP / NIRP and LSAP / QE policies around the globe…while also then being de-facto “Short” of Cyclicality and Inflation.

But as I’ve said my entire career, “Inflation is the Volatility Catalyst” in a world that has been conditioned for lazy “Duration Longs” fueled by the “Goldilocks” economic backdrop (‘meh’ 2%ish US GDP growth, ‘even-less-than-meh’ Core CPI)…which then created and perpetuated a wholesale investor cynicism towards even the concept of “Inflation”—in a world that was long-term “structurally disinflationary” due to the “3 D’s” of Debt, Demographics and (Tech) Disruption

And as we’ve all seen over the past 2.5 years, the perverse idiosyncratic catalysts of the COVID impacts (supply chain in particular, but the massive “pent-up demand” release too post Vaccine normalization) and, of course, the policy response, where unprecedented Mon Pol was then paired with unprecedented Fiscal Stimulus; add-in the disaster scenario for Commodities post Ukraine / Russia and in particular, the under-investment in Oil and Gas alongside horrible Energy policies…and we have had the a situation so FUBAR that you cannot even make it up at this point, with an absurdly steroidal “overheat” now in both Inflation and Employment

And here we are, with Central Banks being told by markets that they have to absolutely SLAM THE BREAKS to even attempt to get the (just) “Demand-side” component in-check, and try to put some of the toothepaste back in the tube

Finally turning to levels, it made sense to consult our Technical Guru Walter Burke, who has been “seeing the ball” beautifully of late…and with Technicals mattering so much as we break into “new ranges,” I thought his latest outlook for S&P futures was relevant:

- ESM – the 4304 resistance held well (understatement) and was followed by a sharp turn lower. The fact that the 4056 to 4304 recovery was 3-waves strongly suggests new lows below 4056 will be seen. Weekly support is 4040/3940 area

Tyler Durden

Fri, 05/06/2022 – 10:28

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com