Bitcoin Crashes To 10-Month Lows, Correlation With Tech Hits Record High

Another day, another ugly plunge in cryptos with Bitcoin breaking bad, back below $32,000 for the first time since July 2021…

This follows Bitcoin’s first six-week losing-streak since 2014.

Ethereum has been holding up relative to Bitcoin…

A headline this morning from Bloomberg brings home some of the FUD surrounding crypto:

*YELLEN TO SAY FSOC WORKING TO IDENTIFY RISKS ON DIGITAL ASSETS

And as @KimDotCom noted in a tweet, many are discussing the following crypto regulations:

-

Ban of all USD pegged stablecoin.

-

Restrictions on crypto use.

-

KYC requirements for all.

-

Big push for US Gov coin.

Or – since most of those fears have been openly discussed for months – is it simply joint-leverage with big-tech assets?

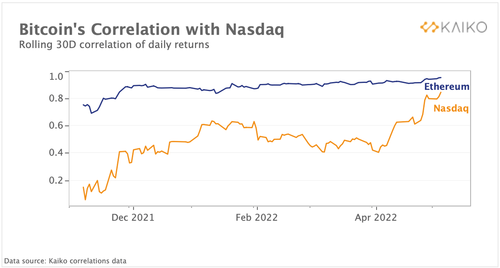

Overall, Risk assets continued to move in tandem since last week’s FOMC statement, and as Kaiko.com details in their latest note, bitcoin’s rolling correlation with the tech-focused Nasdaq 100 just hit a historically high level of 0.8. It is now nearing its traditionally strong correlation to Ethereum which is also on the rise and currently hovers around 0.9.

However, despite being strongly correlated with the Nasdaq 100, Bitcoin has been performing slightly better since the start of the year. We noticed that when inflation expectations are increasing, Bitcoin tends to outperform tech stocks…

Arguably, this could add credence to the narrative around BTC’s role as an inflation hedge.

In the meantime, according to the Crypto Fear & Greed Index, ‘fear’ is extreme…

“With Bitcoin now having retraced all the way down [below $32k], trader sentiment has fallen to six week lows,” research firm Santiment commented on the situation:

“We typically prefer to see capitulation signs like this, as weak hands leaving the space is generally what is needed for a truly notable bounce.”

So are we close any level of capitulation?

Currently, as @OnChainCollege details in a recent tweet, over 40% of the Bitcoin supply is being held at a loss, and this is the highest proportion since April 2020, just after the COVID-19 crash.

Source: @OnChainCollege

At that time, a genuine capitulation event did take place, as evidenced first and foremost by price.

Tyler Durden

Mon, 05/09/2022 – 13:27

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com