The Fed Put “Expired” – Nomura Warns Dip-Buyers That Strength Begets Weakness

“Be careful what you wish for…”

That’s the message from Nomura’s Charlie McElligott this morning as he reflects on the equity market bounce – and potential extension of gains into Friday’s OpEx – and the conundrum that re-rising asset prices forces on The Fed.

In the short-term, options positioning is the tail that’s wagging the dog…

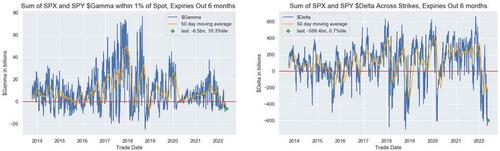

That biblical “Negative $Delta” (and “Short Gamma”) from the “over-hedging” of the past few months is seeing loaded-into downside Puts get absolutely roasted, as we collapse under the large “implied expectations” of extremely high absolute levels of Vol—which sees the “bleeding” Puts get closed, then leading to Dealer shorts in Equities futures being covered in bulk on a big relief rally out of China earlier that is lending hope to their eventual reopening as a “white knight” after the recent global growth scare.

Enormous front-week (short) $Delta serves as “fuel for a melt-up” into VIXpery tomorrow and Op-Ex Friday, as collapsing iVol (UX1 -7.2 Vols from the Thursday high to last) not only creates the Dealer “short hedge” cover, but also too gets Dealers back some of their “Short Gamma” which can eventually act to help stablize the “overshoot” market we have been operating within for months.

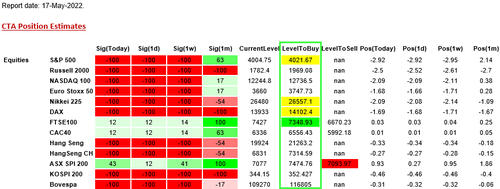

And now, the “second-order” impacts of higher Spot / lower Vol: we see big potential mechanical buying from Systematic strats in coming days and weeks

But, all of that short-term bounce bullishness leads to McElligott’s clarifying thesis of bulls being careful what they wish for…

…what “bullish” Equities and tightening in Credit Spreads then conjure is an easing of financial conditions, while higher Commods further builds inflationary pressures which Central Banks are attempting to rein-in

This goes back to my observation since the Fed’s Dec ‘21 regime pivot to “inflation hawks” and FCI vigilantes, as rallies in risk-assets then perversely dictate Central Bankers to escalate their Hawkish signaling in order to “push back” on easing FCI, which is counter-productive to their “demand-killing” Price objectives.

So yet-again, another reminder that as opposed to the prior decade’s +++ “Fed Put” regime (now “expired”), the Fed for now remains in the business of “Selling Calls” until we “at least” get to neutral and likely, ultimately forced to run outright “restrictive” policy.

The bottom line is that this is particularly tricky because the Nomura strategist believes US has gotten a bit complacent on the potentials to get up to 200bps+++ of additional hiking in short-order here…as per recent events and client feedback:

-

…on the Equities side, they continue to doubt the willingness of the Fed to see this tightening through the Summer, anticipating a downshift to 25bps in Sep as a relative “easing”.

-

This, he noted, juxtaposes sharply from the Macro / Fixed-Income side, where by-and-large they see a further “FCI wrecking ball” of persistent Fed tolerance for market Vol and Labor / Economic slowing, as their core mandate focus remains squarely on the “Price stability” mess they are finding themselves in.

That’s what makes a market.

Tyler Durden

Tue, 05/17/2022 – 10:38

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com