Treasuries Start New Norm Between Inflation And Recession Fears

By Garfield Reynolds, Bloomberg Markets Live analyst and reporter

There’s an alarming lack of conviction in the way markets are flip-flopping all over the place, and that’s a tribute to the epoch-making transformations occurring across the global economy.

In case you think that’s an exaggeration, consider what’s been going on in Treasuries, often cited as the world’s deepest market and a potential haven for investors panicked into prizing return of capital over returns on capital.

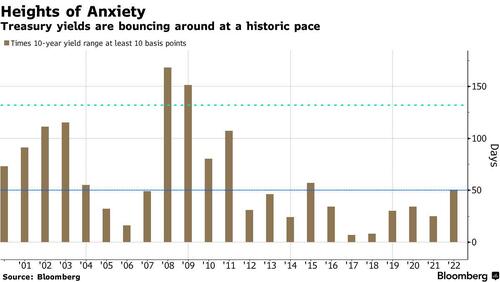

The past two days saw the benchmark 10-year yield jump 10 basis points and then drop by the same amount, as traders gyrated between inflation and recession fears.

This sort of action is now the norm, with Wednesday marking the 50th trading day this year when the range for 10-year yield was at least 10 basis points.

That’s already more than for any full year since 2015, and puts us on pace for more than 130 such days.

The only years to exceed that mark this century are 2008 and 2009.

Tyler Durden

Thu, 05/19/2022 – 07:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com