Best Day For Discretionary Stocks Since COVID-Crash As Consumer Recession Bets Get Steamrolled

A week ago, following dismal guidance by Walmart, Target indicated that it is seeing a shift in the consumer wallet away from the pandemic purchases and into reopening purchases – including apparel – and the pace of this shift caught some retailers off guard on inventory. WMT, COST, and TGT all saw their stocks fall sharply last week as investor concerns around a US consumer slowdown mounted and investors reconsidered just where, if anywhere, you can play “defense” in the current market.

But as Goldman’s Chris Hussey writes today, this week, results from companies like DKS, Macy’s, JWN, WSM, DLTR, and DG painted a decidedly different picture.

Deep discount retailers Dollar Tree – or rather Dollar 25 Tree – and Dollar General both posted strong results and DLTR raised top-line guidance.

Which isn’t surprising: as we discussed in “Middle Class Is Shutting Down As Spending By The Rich Remains Robust” when consumers are trading down – as they are doing now due to Biden’s runaway inflation – dollar stores see more business.

As a result, Dollar Tree surged as much as 20% on Thursday, the biggest intraday move since October 2020. Evercore ISI said Dollar Tree’s move to a “$1.25 price point” last November from $1 “came in the nick of time” adding that “given the broad-based inflationary cost pressures, the 25% price increase drove material sales and margin upside for both the namesake division and the total company,” wrote analyst Michael Montani who also said that while freight, transport, and labor headwinds are real, some of the pressure cited by Target last week was likely company specific.

The analyst concluded that the read-across from DG and DLTR is “favorable,” and it seems that the low-end consumer is “hanging in better than initially thought.” Or rather, the middle-class is getting crushed and it has no choice but to trade down to the cheapest retail outlets.

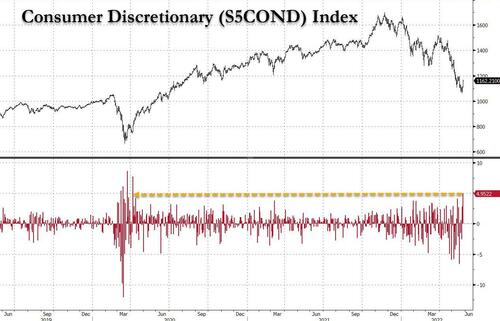

And with countless shorts having piled up and getting massively squeezed, the S&P 500 Consumer Discretionary Index today has risen as much as 5.6%, its best day since April 2020, as optimism on the health of the consumer returns following a string of better-than-expected earnings reports from retailers.

Top performers in the S5COND index include Dollar Tree, Dollar General, Norwegian Cruise, Caesars Entertainment and Carnival; the Discretionary Index is on pace for its best week since March 18, when the group climbed 9.3%; the index sank 7.4% as Walmart and Target reports spooked investors. The index is still down almost 30% YTD.

“Retail earnings are bullish…. with four blow-outs,” said Vital Knowledge’s Adam Crisafulli, referring to quarterly reports from Williams-Sonoma, Macy’s, Dollar General, and Dollar Tree. “The overall retail industry is experiencing stark changes and the market is incorrectly conflating these shifts with underlying demand weakness when the actual health of the consumer is much better than it seems,” Crisafulli says, although there are many – this website included – who wholeheartedly disagree with his optimistic view of the US consumer.

Remarkably, thanks to today’s rally, even Burlington Stores, which sank as much as 12% in premarket on disappointing results, is trading up as much as 11% and some say, the rally helped reverse the earlier tumble in NVDA shares.

The discretionary group is also getting a boost from airline operators Southwest and JetBlue, helping travel-related names, while on the economic front, better-than-expected personal consumption (for the revised Q1 GDP print). and jobless claims may be adding to the bullishness according to Bloomberg.

Tyler Durden

Thu, 05/26/2022 – 15:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com