US Nat Gas Prices Have Exploded Thanks To Soaring LNG Exports To Europe

Regular readers will be aware of our view regarding the soaring US nat gas price, which we have repeatedly said is to a large extent a function of US nat gas exports to Europe, meant to ease Europe’s historic natgas shortage which is the direct result of the Ukraine war (as Putin turns the screws on European nat gas exports) and Europe’s disastrous “green” policies which virtually assured that the continent would have a historic energy crisis. Indeed, as we noted a few days ago in “US NatGas Prices Top $9, Hit 2008 Highs As EU ‘Convergence’ Accelerates“, when addressing a recent Pew Poll which found that “61% of Americans would favor exporting large amounts of natural gas to Europe”, we doubt 61% would be supportive of such policies if they knew they are behind the historic spike in domestic nat gas prices.

Now ask them again after explaining this would mean a convergence in prices, meaning a surge in the US nat gas price, like right now https://t.co/hy9sZ9JOKP

— zerohedge (@zerohedge) May 13, 2022

Today, none other than Reuters’ senior energy analyst John Kemp confirms that behind the surge in US nat gas prices are LNG exports to Europe, writing that “US natural gas production will have to accelerate significantly if the country is to keep growing record export volumes without creating shortages for consumers at home.” And while we may avoid shortages, we certainly will have much, much higher prices to look forward to before the European nat gas crisis “converges” with the US.

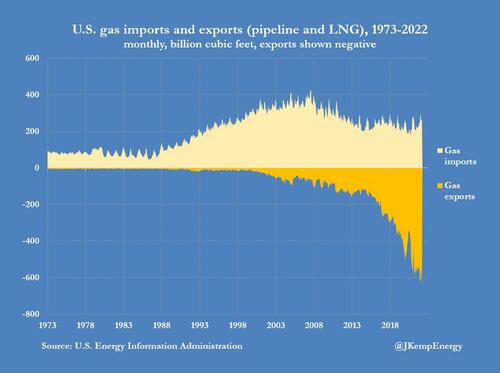

According to Kemp, gas exports in the form of LNG were up by 674 billion cubic feet or 87% in the first three months of 2022 compared with the same period in 2019.

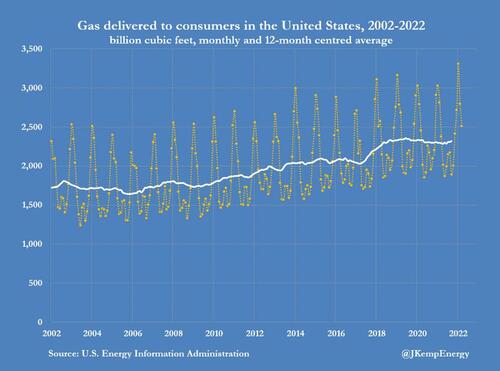

Domestic consumption was flat over the same period, selected to span the pandemic, according to the latest monthly data compiled by the U.S. Energy Information Administration.

But domestic production increased by only 433 billion cubic feet (5%), mostly as a result of low prices and consolidation within the industry.

In consequence, LNG exports have grown to around 12% of domestic gas production, up from 4% in 2019, and the proportion is set to increase further.

Net exports in all forms, by pipeline as well as LNG, hit a record 377 billion cubic feet in March 2022, up from just 121 billion in March 2019.

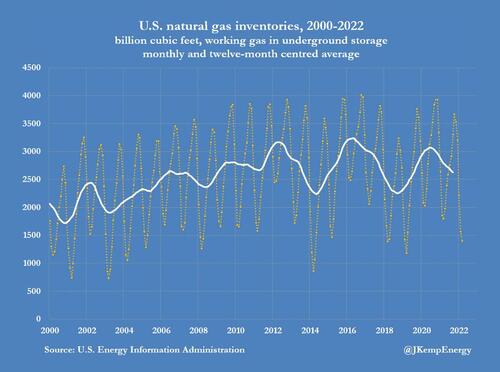

Rapid growth in LNG exports, in excess of domestic production, has put increasing downward pressure on gas inventories and upward pressure on prices.

At the end of March, working stocks in underground storage were 318 billion cubic feet below the pre-pandemic five-year average.

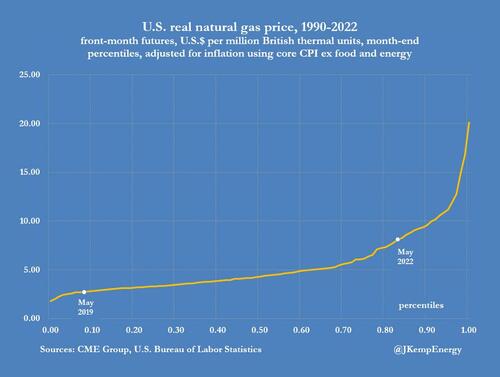

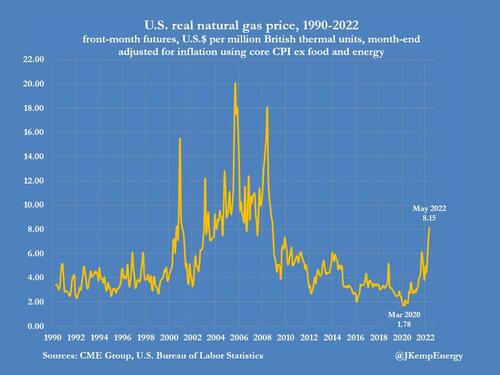

After adjusting for inflation, front-month futures prices climbed in May to their highest since November 2008, on the eve of the financial crisis and great recession.

In order to keep Europeans warm or cool, and avoid having them pay too high prices for Russian gas, real US prices are in the 83rd percentile for all months since 1990, up from the 8th percentile three years ago, signalling the need for more production and discouraging consumption.

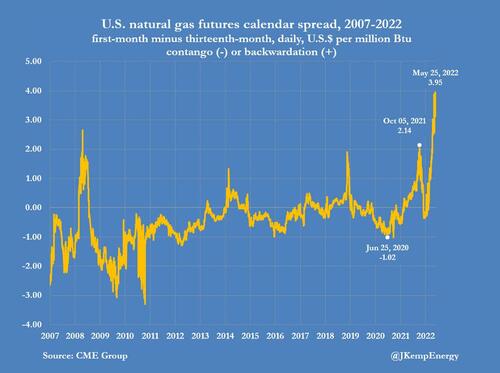

Reflecting the anticipated shortage of gas, futures prices for the current year compared with one-year forward have moved into a record backwardation.

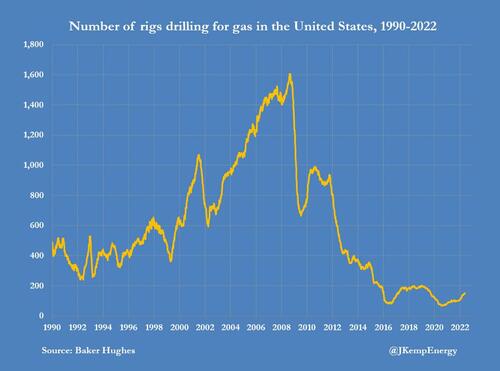

There are, however, signs that domestic producers are starting to respond to the strong price incentive to raise output. The number of rigs drilling specifically for gas has increased by 50% over the last six months, albeit from a low base, which should ensure output grows faster over the next year than in the last one.

The increase in the number of rigs drilling for oil should also help by increasing the amount of associated gas production.

The U.S. gas industry has been very successful in marketing its production to consumers in Europe and Asia who are anxious to diversify their sourcing and lock in reliable supplies.

Now the industry must show it can produce enough gas to feed the export machine, or else it will be US consumers who are left footing the bill.

Tyler Durden

Wed, 06/01/2022 – 18:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com