“We’re Approaching A Slowdown”: Bridgewater Braces For Stagflationary Shock And Fed Rate Cut Capitulation; Buys Billions In Credit Index Swaps

Bridgewater’s Ray Dalio has a remarkable knack of saying something boringly obvious, expected, or price in and making it appears like it is some fascinating insight into markets or the future. Case in point, his latest interview to Australian Financial Review in which he said what we have been saying since late 2021 and the market, since a few months ago, namely that central banks across the world will be forced to reverse their current paths of monetary tightening and cut rates in 2024 after their economies get hit by stagflation.

The billionaire founder of Bridgewater said that stagflation would follow the current bout of central bank rate hikes. In other words, precisely what we said in Oct 2021: “Is Stagflation Here“, an article which the “best and brightest” finally read.

“It is a structural inflation situation that is going to produce stagflation,” Dalio told the outlet, adding that “we are in a tightening mode that can cause corrections or downward moves to many financial assets.”

“The pain of that will become great and that will force the central banks to ease again probably somewhere close to the next presidential elections in 2024,” he said, referring to the upcoming presidential elections in the United States.

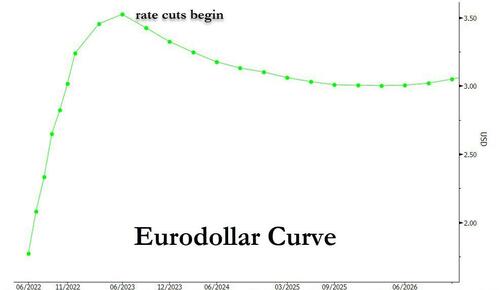

Which, again, is news only to anyone who doesn’t actually care about markets, especially since the market had long ago priced in that the Fed will start cutting rates not in 2024 but in June 2023.

In reality, what will most likely happen is that the Fed will concede the US is headed for a recession some time around the Jackson Hole symposium after the BLS admits the US jobs market is cracking, and the market will start pricing in rate cuts in late 2022/early 2023, and eventually QE (see “Global Recession Next, And Then QE5“).

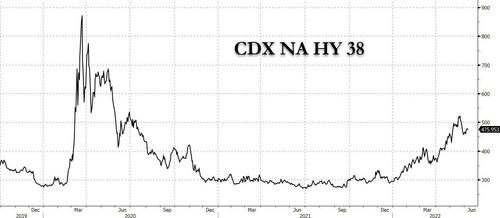

Separately, in something that might actually pass as news, the FT reported overnight that Bridgewater – which we now know expects stagflation – is betting on a sell-off in corporate bonds (which would be a surprise only to central bankers, career economists and other clueless hacks who are unaware that one sells everything in stagflation), and is doing so by buying CDS:

Bridgewater in April used baskets of credit derivatives in Europe and the US to make the bet against corporate bond markets, according to people familiar with the trade. The spread on the main high-yield CDX index, which tracks insurance like products that protect against defaults on riskier corporate bonds, has surged from around 375 basis points at the beginning of April to 475 basis points this month, indicating an increased cost to protect against issuers reneging on their debts… Jensen declined to say how Bridgewater had structured the short bet on credit or how large the position was.

In other words, Dalio is doing now what Ackman did years ago ahead of the covid crash, when he loaded up on billions of credit default swaps and then made billions in profits when spreads blew out.

“We’re in a radically different world,” Greg Jensen, one of Bridgewater’s chief investment officers, told the Financial Times. “We’re approaching a slowdown.”

He added that if Fed policymakers were committed to bringing inflation down to its target of 2 per cent, “they may tighten in a very strong way, which would then crack the economy and probably crack the weaker [companies] in the economy”.

Echoing frequent warnings from this website that only (lack of) liquidity matters in the end, Jensen said the Fed’s decision, coupled with tighter policy from a panoply of central banks across the globe, would drain liquidity from the financial system. In doing so, he said the prices of many assets that rallied last year would come under pressure.

“You want to be on the other side of that liquidity hole, out of assets that require the liquidity and in assets that don’t,” he said.

Repeating another forecast we have made, Jensen also said he thinks that the Fed would blink and accept inflation above its 2 per cent target, an outcome which would send growth stocks and cryptos exploding higher. Policymakers, in his view, will be unable to tolerate a stock market sell-off and the high unemployment that would probably result from raising rates high enough to bring inflation down to that threshold.

Otherwise, Jensen estimated stocks could “crash” a further 25% from current levels if the Fed was unrelenting in its push to tackle inflation.

As the FT adds, the year’s earlier investments have paid off handsomely for Bridgewater, which is best known for its global macro approach in which it attempts to profit by making bets based on economic trends. The fund managed $151bn in assets at the start of the year and its flagship Pure Alpha investment fund is up 26.2% this year through the end of May, according to a person familiar with the matter, compared with a 13.3% decline for the benchmark S&P 500 over that period. Of course, the only way the hedge fund could be up so much is if it was balls deep in energy exposure, which it is because as Jensen told the FT, he favors commodities and inflation-indexed bonds. Both asset classes would, he said, benefit in a stagflationary environment — a toxic combination of low growth and rising prices.

Tyler Durden

Wed, 06/08/2022 – 14:06

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com