Not Enough Signs Of A Major Market Bottom

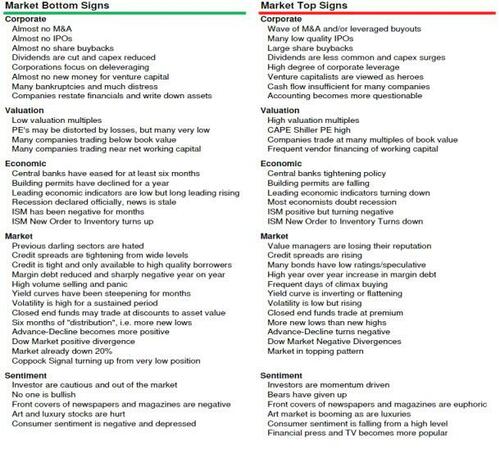

Unfortunately nobody rings a bell at the top or bottom of the market. Instead we can look through our market tops and bottoms checklist to objectively assess how many conditions have been met to call a major market bottom or top. The below is an excerpt from our May 17th report.

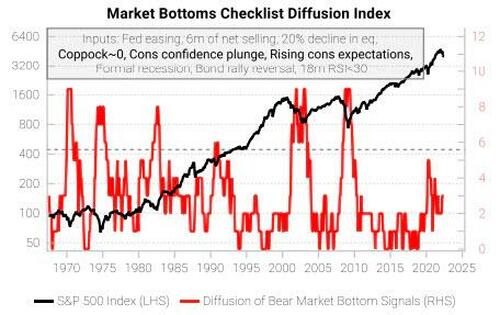

Not all the market bottom signs have a long history, but for those that do, we have built a market-bottoms checklist indicator, which has ticked up recently (see chart below).

We are still far from levels consistent with a major market bottom. The components that are active today are: consistent net selling pressure, bond reversal (i.e. yields picking up from lows), and a plunge in consumer confidence.

Market and sentiment conditions are consistent with market bottoms but corporate, valuation and especially economic indicators resemble market tops.

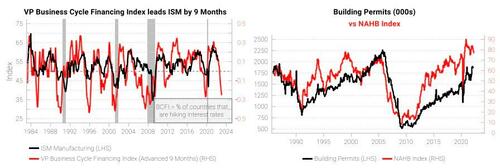

Growth LEIs continue to roll over from high levels. Most worryingly, liquidity conditions have shown no signs of relief. Excess liquidity is negative and BCFI should keep collapsing as more G20 central banks tighten.

This should amplify the growth slowdown with a lag, but pandemic one-offs such as the bullwhip effect and excess consumer savings continue to support an extended peak for industrially exposed sectors. Classic growth leading indicators like building permits have yet to weaken from their highs.

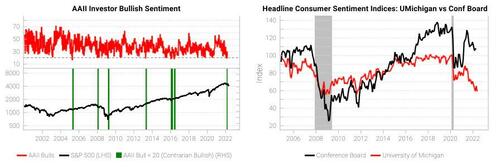

Investor sentiment surveys have collapsed (e.g. AAII), and are at contrarian bullish levels. Consumer sentiment data is a little more mixed with the Michigan survey tanking but the Conference Board index holding up at a high level.

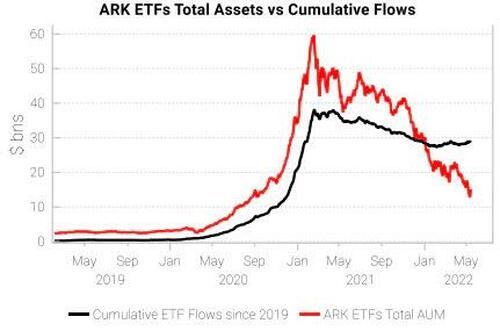

ARK has been the poster child for the post-pandemic liquidity boom. Its AUM across ETFs has collapsed 75% from 2021 highs, yet fund inflows have remarkably held up.

Overall, our market tops/bottoms checklist is not seeing enough signs of a market bottom that would warrant buying dips aggressively. Tactical buy signals point to the potential for short-squeeze rallies, but we cannot ignore the weak cyclical backdrop.

Tyler Durden

Mon, 06/13/2022 – 06:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com