Surging Oil Prices Show Business Cycle Slowdown Is Inevitable

By John Kemp, senior market analyst

Policymakers, economists and journalists often talk about the business cycle using the good-and-evil language of a fairy tale. Booms are attributed to wise and enlightened policies while recessions are blamed on policy errors or the need to cleanse previous excess.

But the economy is not a morality play. Expansions are not a reward for virtuous and wise actions, and recessions are not a punishment for bad behaviour and mistakes. Wrenching cycles in production, employment, prices and wages can be traced as far back in history as the data will allow economic performance to be reconstructed.

The “trade cycle” of booms and busts goes back at least as far as the early nineteenth century in Britain and North America.

Only the paucity of data on output and employment limits tracing it back into early modern and medieval Europe.

Cyclical volatility seems to reflect fundamental forces rather than blameworthy behaviour by central banks, finance ministries, markets, businesses and households. There is no sign policymakers can stabilise the cycle if they have enough information and insight about the workings of the economy.

Long expansions in the 1990s, the early 2000s and the 2010s resulted in premature pronouncements about the end of the business cycle, only to be followed by recessions in 2001, 2008 and 2020.

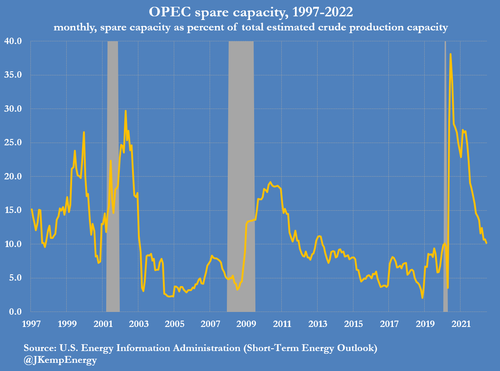

SPARE CAPACITY

In the case of the oil market, spare production capacity, inventories and prices in both crude oil and refined products are closely correlated with the business cycle.

Prolonged business cycle expansions result in the progressive erosion of spare crude production and refinery capacity, as well as stocks, and eventually put strong upward pressure on crude prices and refining margins.

Recessions restore a higher margin of capacity and inventories in both crude and refining and result in downward pressure on prices and margins.

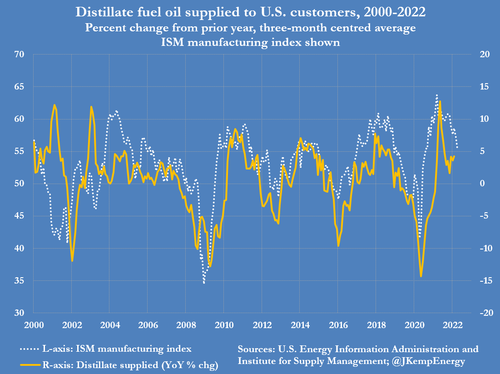

At present, the global economy is rapidly running out of spare capacity to produce more crude and turn it into refined fuels especially diesel. The rapid rebound in oil consumption in the aftermath of the pandemic has been compounded by Russia’s invasion of Ukraine and the U.S. and European sanctions that have been imposed in response.

The result is an accelerating increase in crude prices and refining margins which mirrors the end of earlier booms in 2008 and 2001. In the United States, the Biden administration has been reduced to pleading impotently for an increase in oil production and trying to magic up more refining capacity in the short term.

But based on past experience, the only resolution is a sharp slowdown in the business cycle to restore higher levels of spare capacity and reverse some of the run up in prices and margins.

The problem of consumption outstripping production capacity is not limited to oil.

The same tensions are evident in a host of other markets for commodities (including gas, electricity and coal), as well as food, manufactured items and services, creating a broad-based inflation problem.

Central banks in the United States and around the world have started to raise interest rates sharply to reduce inflation by forcing slower growth in consumption and investment.

At this point, a business cycle slowdown has become inevitable because the only alternative is worsening shortages and accelerating inflation.

The only question is whether it will be a gentle one, in which case it will be called a “soft patch” and the current cycle will be said to continue, or a more severe one, in which case it will be termed a “recession” and the cycle will start all over again.

One way or another the rate of economic growth must slow to bring the oil market back into balance.

Tyler Durden

Tue, 06/14/2022 – 15:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com