Bank of Japan Spends A Record $81 Billion To Avert Collapse, But $10 Trillion JGB Market Is Now Completely Broken

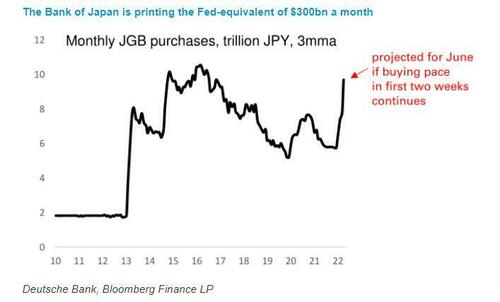

Exactly one week ago, when quantifying the dizzying cost of the BOJ’s defense of its Yield Curve Control policy (at the expense of the collapsing yen), Deutsche Bank’s George Saravelos calculated that the “the BOJ printer is on overdrive”, and if the current pace of buying persists, the bank will have bought approximately 10 trillion yen in June. To put that number in context, it is roughly equivalent to the Fed doing more than $300bn of QE per month when adjusting for GDP.

Somewhat redundantly, the DB strategist said that this is a “truly extreme” level of money printing given that every other central bank in the world is tightening policy and is one of the reasons why he has been bearish on the yen. And as so many have argued, “currency intervention in this environment is simply not credible given it is the BoJ itself that is the cause of yen weakness.”

More broadly, Saravelos echoes what we said in our preview of the end of MMT, writing that he worries that “the currency and Japanese financial markets are in the process of losing any sort of fundamental-based valuation anchor” and, as a result, “we will soon enter a phase where dramatic and unpredictable non-linearities in Japanese financial markets would kick in.”

He was proven right the very next day, when not an insigificant part of Japan’s bond market imploded as the central bank battles to keep control of its policy goals as some of the largest hedge funds in the world pile on billions in bets that the BOJ is about to lose control, in a repeat of Soros’ dramatic crusade against the BOE (which the billionaire democrat ended up winning, and affording him the wealth to be the US government’s shadow puppetmaster to this day).

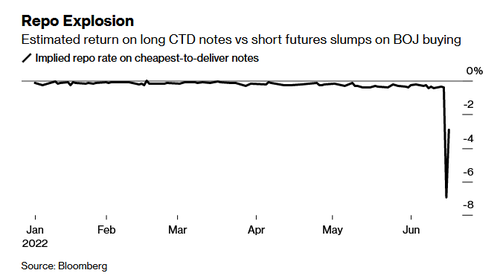

As Bloomberg explained, a small tweak to the Bank of Japan’s bond purchase plan this week blew up an arbitrage strategy popular with overseas investors known as the basis trade (the same basis trade which blew up in 2019 in the US cash/futures market sparking the historic repo crash and the Fed’s return to QE). It also exacerbated a supply shortage of government bonds that has ramped up pressure on domestic financial institutions, leading them to turn to the BOJ for help to relieve the strain.

One week ago we described how after four straight days of declines in Japanese bond futures, the central bank announced unlimited purchases of so-called cheapest-to-deliver 10-year notes for Thursday and Friday – securities closest linked to the contracts. That sent the spread between the futures and the bonds underlying them soaring to the widest since 2014 – a massive shock for traders with positions between the two.

As a result, 10Y JGB futs crashed by the most since 2013 as traders bet that the BOJ will be forced to abandon its pledge to cap yields at 0.25%…

… while the gap between JGB futs and underlying cash bonds soared the most on record.

The chart below is another way of visualizing this historic divergence between futs and cash JGBs, clearly signaling the market’s belief that the BoJ will fold on its unlimited bond buying curve control program.

Needless to say, arbs who were short the cheapest-to-deliver bonds and long the futures contracts suddenly faced steep losses and found it impossible to close their positions (remarkably all this was happening in the world’s 2nd largest bond markets, amounting to some 1.24 quadrillion yen or about $10 trillion, yet all everyone can talk about is crypto). As Bloomberg notes, the BOJ had effectively cornered the market in the cheapest-to-deliver bonds making it almost impossible for others to purchase them, while the futures price slumped to the brink of a trading halt as those caught out rushed to close.

By late day Wednesday, a Bloomberg estimate of the cost to close this so-called short basis trade widened to about minus 7% from minus 0.4% the day before. It remained at distressed levels Friday — around minus 2% — suggesting some investors were still stuck on the wrong side of the trade.

“The selloff in futures has killed arbitrage opportunities,” said Mari Iwashita, chief market economist at Daiwa Securities. “This situation will eventually end up in a total stalemate in markets.”

By stalemate, he means “crash.”

Speculative attacks on Japanese bonds have mounted as a growing number of funds – most notably the giant, $127 billion BlueBay – bet the BOJ will cave in to pressure and change its increasingly isolated super-easy monetary policy. The central bank confounded its critics Friday, holding firm with its rock-bottom interest rates and continuing with its fixed-rate bond purchase plan.

Benchmark bond yields fell further below the 0.25% ceiling, after the central bank announced a fixed-rate purchase operation for the afternoon.

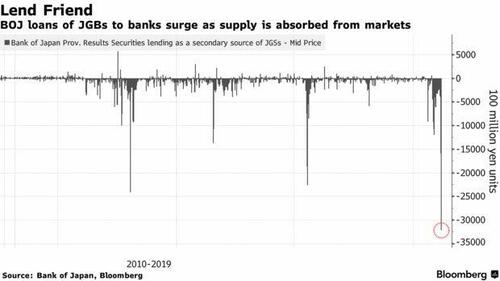

But the bigger problem for the BOJ is that those purchases, which preserving the BOJ’s YCC “credibility” (for now) are also sucking up what little liquidity is available in the JGB market, piling pressure on local institutions, something which can be seen in the usage of the BOJ’s lending program — another gauge of stress in the market.

Yes: on one hand the BOJ continues to buy billions in JGBs via QE, but on the other it is forced to lend what it has bought back into the market to avoid a terminal paralysis of what was once the second deepest bond market.

The amount of bonds the central bank has lent “temporarily” to financial institutions to relieve supply tightness has hit a record, Bloomberg data show. The BOJ lent 3.2 trillion yen ($23.9 billion) of JGBs through its Securities Lending Facility on Thursday, well above the 2.3 trillion yen lent at the peak of coronavirus fears in March 2020.

BOJ Governor Kuroda told reporters on Friday that the BOJ will take appropriate measures to address any decline in bond market liquidity. But he also said he isn’t thinking about raising the 10-year yield ceiling from 0.25%, which means that the liquidity situation will only get worse in the coming days.

“Market functioning and liquidity have deteriorated sharply with the BOJ’s massive JGB purchases,” Barclays strategist Shinji Ebihara wrote in a note.

Meanwhile, and going back to the original point brought up by DB’s Saravelos above that the BOJ is spending monstrous amounts of yen just to keep the JGB market from crashing, as traders countdown to the complete Ice-9ing of the Japanese bond market (which in recent months has seen its share of days without a single trade crossing) Bloomberg has calculated how much it cost the BOJ to preserve calm after last week’s catastrophic slide in futures, and the answer is some 10.9 trillion yen ($81 billion) of government bond purchases last week, the most on record. By way of comparison, European Central Bank asset purchases under its so-called APP program averaged about $27 billion – per month – this year through May. But fear not, once Europe’s dominoes start falling and peripheral yields explode to all time highs, Lagarde’s hedge fund will make BOJ’s purchases seems like a walk in the park by comparison.

And while every day could be the BOJ’s last, market watchers see the temporary calm as an eye in the proverbial hurricane, as the BOJ continues to defy an intensifying global wave of central bank tightening and concentrated market pressure on the yen and government bonds. Treasuries remain a key driver as does the direction of the dollar-yen, hovering around a 24-year low.

“If the yen weakens further as a sell-off in foreign bonds resumes, it would not be surprising were the yen rates market to start testing the BOJ again,” wrote Citigroup Inc. strategist Tomohisa Fujiki in a note.

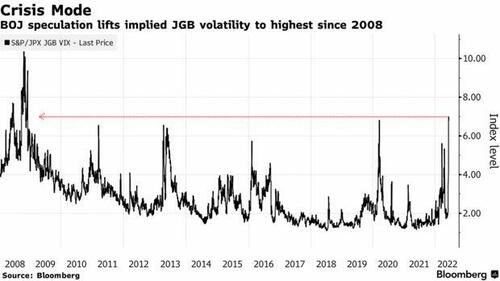

One place where the pressure is building up, is in implied volatility for 10-year JGBs, which however eased modestly after rising to the highest since the global financial crisis in 2008 on Friday. The BOJ said Friday its bond buying will continue for an extended period of time.

“Since the JGB market volatility has been initiated by the global reaction to US CPI and the Federal Reserve’s tightening, the structure keeping it unstable remains quite intact,” said Mari Iwashita, chief market economist at Daiwa Securities. “Even as the BOJ steps up efforts to defend its turf, the structure behind the challenges remain the same.”

Speculative attacks on Japan’s bond market have mounted amid bets the BOJ will cave in to pressure and tweak its increasingly isolated easy monetary policy — something it reconfirmed at its policy decision Friday. But the impact of the central bank’s bond purchases have squeezed some corners of the futures markets, putting at least some arbitrage traders under pressure.

And yet, the most ominous sign yet for the BOJ is the recent quiet appointment of a Japanese government bond expert with experience of the market turmoil of the late 1990s to a key role in the Finance Ministry, which caught the attention of market watchers in Tokyo. Michio Saito — dubbed “Mr. JGB” — will head up a division that covers the bond market and may strengthen lines of communication with the central bank, according to some strategists.

For the BOJ to seek a smooth exit from massive bond purchases, close cooperation with the finance ministry is essential, so the appointment of an experienced person in charge is very significant, Iwashita said. This “is positive news for the market,” she said.

Most disagree, however, although they know better than to take the BOJ head on: after all, shorting JGBs has been a widowmaker trade for decades. Still, there is a sense of ominous capitulation vis-a-vis the Japanese bond market in recent days, almost as if we are now well past the point of no return and the final collapse of not just the JGB market, but the entire fraudulent MMT paradig, is just days if not hours away. Indeed, as Rabobank’s Michael Every put it, with every attempt to preserve the status quo, the BOJ is pulling even further on a monetary elastic band that will hurt far more when it does inevitably come snapping back the other way, and concludes that when the BOJ’s YCC peg eventually breaks, markets are going to get hit hard: “Japan is currently a source of ultra-cheap financing in a world of rising rates, and with a currency that is only going one way – down. If both reverse at once,… ouch!”

Tyler Durden

Mon, 06/20/2022 – 22:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com