Stocks, Cryptos Tumble To Close Out Catastrophic First-Half

It was supposed to be a 7% ramp into month-end on billions in pension fund residual buying.

Instead, it ended up being more or less the opposite, with crypto-led liquidations dragging futures and global markets lower, and extending Wednesday losses after central bankers issued warnings on inflation and fueled concern that aggressive policy will end with a hard-landing recession, which increasingly more now see as being 2022 business, an outcome that now appears assured especially after yesterday’s disastrous guidance cut from RH, the second in three weeks!

Recession fears and inflation woes may be prolonged by today’s PCE deflator report. The consumer price gauge favored by the Fed may have picked up to 6.4% last month from 6.3%. Personal income growth probably edged up but Bloomberg Economics highlights an anticipated decline in real personal spending as a major worry.

Meanwhile, China’s economy showed further signs of improvement in June with a strong pickup in services and construction, even if the latest Chinese PMI print came slightly below expectations. Also overnight, Russia said it withdrew troops from Ukraine’s Snake Island in the Black Sea after Ukraine said its forces drove Russian troops from the area.

In any case, with zero demand from pensions so far (even though the continued selling in stocks and buying in bonds will only make the imabalnce bigger), overnight Nasdaq 100 contracts dropped 1.8% while S&P 500 futures declined 1.3%, and cryptos crumbled, with bitcoin dragged back below $19000 and Ether on the verge of sliding below $1000. The tech-heavy gauge managed to end Wednesday’s trading slightly higher, while the S&P 500 fell for a third straight day. In Europe, the Stoxx Europe 600 Index slid 1.9%. Treasuries gained, the dollar was steady and gold declined and crude oil futures edged lower again.

Which brings us to the last trading day of a quarter for the history books: the S&P 500 is set for its biggest 1H decline since 1970 and the Nasdaq 100 since 2002, the height of the dot.com bust. The Stoxx 600 is set for the worst 1H since 2008, the height of the GFC.

Traders have ramped up bets that the global economy will buckle under central bank tightening campaigns — and that policy makers will eventually backpedal. The bond market shifted to price in a half-point rate cut in the Federal Reserve’s benchmark rate at some point in 2023. On Wednesday, during the annual ECB annual forum, Fed Chair Jerome Powell and his counterparts in Europe and the UK warned inflation is going to be longer lasting. A view that central banks need to act fast on rates because they misjudged inflation has roiled markets this year, with global stocks about to close out their worst quarter since the three months ended March 2020.

“Markets are worried about growth as central bankers continue to emphasize that bringing down inflation is their overriding objective, and that it may take time to bring inflation down,” said Esty Dwek, chief investment officer at Flowbank SA. “We still haven’t seen total capitulation in markets, so further downside is possible.”

Meanwhile, the cost of insuring European junk bonds against default crossed 600 basis points for the first time in two years on Thursday.

And speaking of Europe, stocks are also down over 2% in early trading, with all sectors in the red. DAX and CAC underperform at the margin with autos, consumer discretionary and banking sectors the weakest within the Stoxx 600. Here are some of the biggest European movers today:

- Uniper shares slump as much as 23% after the German utility withdrew its outlook and said it was discussing a possible bailout from the German government following Russia’s move to curb natural gas deliveries.

- SAP sinks as much as 6.5% after Exane BNP Paribas downgraded stock to neutral from outperform, saying it sees risks on demand side in the near term as software spending decisions come under increased scrutiny.

- Sanofi shares decline as much as 4.5% after the French drugmaker said the FDA placed late-stage clinical trials of tolebrutinib on partial hold in US because of concerns about liver injuries.

- European semiconductor stocks fell, following peers in the US and Asia lower amid growing concerns that the industry might face a downturn soon as chip stockpiles build. ASML drops as much as 3.4%, Infineon -4.1%, STMicro -3.1%

- Norsk Hydro shares slide as much as 6% amid metals decline and as DNB cuts the stock to sell from hold, citing concerns about rising aluminum supply.

- Stainless steel stocks in Europe fall, with Morgan Stanley saying the settlement on the latest ferrochrome benchmark missed its expectations. Outokumpu shares down as much as 6.6%, Aperam -7.2%, Acerinox -4%

- Saab shares jump as much as 8.4%, after getting an order worth SEK7.3b from the Swedish Defence Materiel Administration for GlobalEye Airborne Early Warning and Control aircraft.

- Orsted shares rise as much as 2.5%, before paring some of the gains. HSBC raises to buy from hold, saying any further downside for the wind farm operator looks limited.

- Bunzl shares rise as much as 2.6% after the specialist distribution company said it now expects very good revenue growth in 2022.

- Grifols shares rise as much as 7.8% after slumping on Wednesday, as the company says that the board isn’t analyzing any capital increase “for the time being.”

Earlier in the session, Asian stocks fell for a second day as tech-heavy indexes in Taiwan and South Korea continued to get pummeled amid concerns over the potential for aggressive monetary tightening in the US to rein in inflation. The MSCI Asia Pacific Index declined as much as 1.2%, dragged down by technology shares including TSMC, Alibaba and Tencent. Taiwan slid more than 2%, while gauges in Japan, South Korea, Australia dropped more than 1%. Stocks in mainland China rose more than 1% after the economy showed further signs of improvement in June with a strong pickup in services and construction as Covid outbreaks and restrictions were gradually eased. Traders are also watching Chinese President Xi Jinping’s trip to Hong Kong, his first time outside of the mainland since 2020.

Asian stocks are struggling to recover from a May low as the threat of higher US rates outweighs China’s emergence from strict Covid lockdowns and its pledge of stimulus measures. While mainland Chinese stocks led gains globally this month, the rest of the markets in the region — especially those heavy with technology stocks and exporters — saw hefty outflows of foreign funds. “Investors continue to assess recession and also inflation risks,” Marcella Chow, JPMorgan Asset Management’s global market strategist, said in an interview with Bloomberg TV. “This tightening path has actually increased the chance of a slower economic growth going forward and probably has brought forward the recession risks.” Asian stocks are set to post a more than 12% loss this quarter, the worst since the one ended March 2020 during the pandemic-induced global market rout.

Japanese stocks declined after the release of China’s data on manufacturing and non-manufacturing PMIs that showed slower than expected improvements. The Topix Index fell 1.2% to 1,870.82 as of market close Tokyo time, while the Nikkei declined 1.5% to 26,393.04. Sony Group contributed the most to the Topix Index decline, falling 3.4%. Out of 2,170 shares in the index, 531 rose and 1,574 fell, while 65 were unchanged. “Although China is recovering from a lockdown, business sentiment in the manufacturing industry is deteriorating around the world,” said Tomo Kinoshita, global market strategist at Invesco Asset Management China’s Economy Shows Signs of Improvement as Covid Eases.

Indian stock indexes posted their biggest quarterly loss since March 2020 as the global equity market stays rattled by high inflation and a weakening outlook for economic growth. The S&P BSE Sensex ended little changed at 53,018.94 in Mumbai on Thursday, while the NSE Nifty 50 Index dropped 0.1%. The gauges shed more than 9% each in the June quarter, their biggest drop since the outbreak of pandemic shook the global markets in March 2020. The main indexes have fallen for all but one month this year as surging cost pressures forced India’s central bank to raise rates twice and tighten liquidity conditions. The selloff is also partly driven by record foreign outflows of more than $28b this year. Despite the turmoil in global markets, Indian stocks have underperformed most Asian peers, partly helped by inflows from local institutions, which made net purchases of more than $30b of local stocks. “Investors worry that the latest show of central bank determination to tame inflation will slow economies rapidly,” HDFC Securities analyst Deepak Jasani wrote in a note. Fourteen of the 19 sector sub-gauges compiled by BSE Ltd. fell Thursday, with metal stocks leading the plunge. The expiry of monthly derivative contracts also weighed on markets. For the June quarter, metal stocks were the worst performers, dropping 31% while information technology gauge fell 22%. Automakers led the three advancing sectors with 11.3% gain.

Australian stocks also tumbled, with the S&P/ASX 200 index falling 2% to close at 6,568.10, weighed down by losses in mining, utilities and energy stocks. In New Zealand, the S&P/NZX 50 index fell 0.8% to 10,868.70

In rates, treasuries advanced, led by the belly of the curve. German bonds surged, led by the short-end and outperforming Treasuries. US yields richer by as much as 5.4bp across front-end and belly of the curve which outperforms, steepening 2s10s, 5s30s by 2bp and 2.8bp; wider bull-steepening move in progress for German curve with yields richer by up to 13.5bp across front-end with 2s10s wider by 3.5bp on the day. US 10-year yields around 3.055%, richer by 3.5bp. Money markets aggressively trimmed ECB tightening bets on relief that French June inflation didn’t come in above the median estimate. Bonds also benefitted from haven buying as stocks slide. Month-end extension flows may continue to support long-end of the Treasuries curve. bunds outperform by 7bp in the sector. IG issuance slate empty so far; Celanese Corp. pushed back plans to issue in euros and dollars, most likely to next week, after deals struggled earlier this week. Focal points of US session include PCE deflator and MNI Chicago PMI.

In FX, the Bloomberg Dollar Spot Index was steady as the greenback traded mixed against its Group-of-10 peers. The yen advanced and Antipodean currencies were steady against the greenback. French inflation quickened to the fastest since the euro was introduced. Steeper increases in energy and food costs drove consumer-price growth to 6.5% in June from 5.8% in May . Sweden’s krona swung to a loss. It briefly advanced earlier after the Riksbank raised its policy rate by 50bps, as expected, signaled faster rate hikes and a quicker trimming of the balance sheet. The pound rose, snapping three days of losses against the dollar. UK household incomes are on their longest downward trend on record, as the nation’s cost of living crisis saps the spending power of British households. Separate figures showed that the current-account deficit widened sharply to £51.7 billion ($63 billion) in the first quarter. The yen rose and the Japan’s bonds inched up. The BOJ kept the amount and frequencies of planned bond purchases unchanged in the July-September period. The Australian dollar reversed a loss after data showed China’s official manufacturing purchasing managers index rose above 50 for the first time since February in a sign of improvement in the world’s second largest economy.

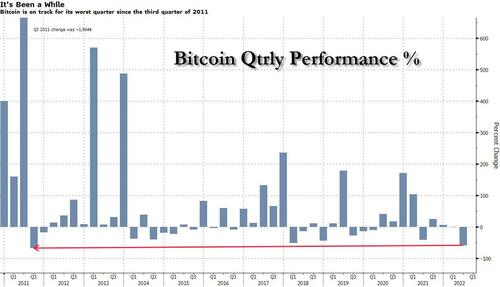

Bitcoin is on track for its worst quarter in more than a decade, as more hawkish central banks and a string of high-profile crypto blowups hammer sentiment. The 58% drawdown in the biggest cryptocurrency is the largest since the third quarter of 2011, when Bitcoin was still in its infancy, data compiled by Bloomberg show.

In commodities, WTI trades a narrow range, holding below $110. Brent trades either side of $116. Most base metals trade in the red; LME zinc falls 3.1%, underperforming peers. Spot gold falls roughly $3 to trade near $1,814/oz. Bitcoin slumps over 6% before finding support near $19,000.

Looking to the day ahead now, data releases include German retail sales for May and unemployment for June, French CPI for June, the Euro Area unemployment rate for May, Canadian GDP for April, whilst the US has personal income and personal spending for May, the weekly initial jobless claims, and the MNI Chicago PMI for June.

Market Snapshot

- S&P 500 futures down 1.2% to 3,775.75

- STOXX Europe 600 down 1.8% to 406.18

- MXAP down 1.0% to 158.01

- MXAPJ down 1.1% to 524.78

- Nikkei down 1.5% to 26,393.04

- Topix down 1.2% to 1,870.82

- Hang Seng Index down 0.6% to 21,859.79

- Shanghai Composite up 1.1% to 3,398.62

- Sensex up 0.2% to 53,136.59

- Australia S&P/ASX 200 down 2.0% to 6,568.06

- Kospi down 1.9% to 2,332.64

- Gold spot down 0.2% to $1,814.91

- US Dollar Index little changed at 105.04

- German 10Y yield little changed at 1.42%

- Euro little changed at $1.0443

- Brent Futures down 0.4% to $115.85/bbl

Top Overnight News from Bloomberg

- The surge in the dollar has set Asian currencies on course for their worst quarter since the 1997 financial crisis and created a dilemma for central bankers

- French Finance Minister Bruno Le Maire said the EU can deliver the global minimum corporate tax with or without the support of Hungary, circumventing Budapest’s veto earlier this month just as the bloc was on the brink of a agreement

- German unemployment unexpectedly rose, snapping 15 straight months of decline as refugees from the war in Ukraine were included in those searching for work

- The SNB bought foreign exchange worth 5.7 billion francs ($5.96 billion) in the first quarter of 2022 as the franc sharply appreciated against the euro and briefly touched parity in March

- The ECB plans to ask the region’s lenders to factor in the economic hit of a potential cut off of Russian gas when considering payouts to shareholders

- European stocks were poised for their biggest drop in any half-year period since 2008, as investors focused on the prospects for economic slowdown and stubbornly high inflation in the region

- New Zealand will enter a recession next year that could be deeper than expected, Bank of New Zealand economists said after a survey showed business sentiment continues to slump

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were varied at month-end amid a slew of data releases including mixed Chinese PMIs. ASX 200 was dragged lower by weakness in energy, miners and the top-weighted financials sector. Nikkei 225 declined after disappointing Industrial Production data and with Tokyo raising its virus infection level. Hang Seng and Shanghai Comp. were somewhat mixed with Hong Kong indecisive and the mainland underpinned after the latest Chinese PMI data in which Manufacturing PMI printed below estimates but Non-Manufacturing PMI firmly surpassed forecasts and along with Composite PMI, all returned to expansion territory.

Top Asian News

- NATO Secretary General Stoltenberg said China’s growing assertiveness has consequences for the security of allies, while he added China is not our adversary, but we must be clear-eyed about the serious challenges it presents.

- US blacklisted 5 Chinese firms for allegedly helping Russia in which Connec Electronic, King Pai Technology, Sinno Electronics, Winnine Electronic and World Jetta Logistics were added to the entity list which restricts access to US technology, according to WSJ.

- Japan’s government cut its assessment of industrial production and noted that production is weakening, while it stated that Japan’s motor vehicle production declined 8% M/M and that industrial production likely saw the largest impact of Shanghai’s COVID-19 lockdown in May, according to Reuters.

- Tokyo metropolitan government will reportedly increase COVID infections level to the second-highest, according to FNN.

It’s been a downbeat session for global equities thus far as sentiment deteriorates further. European bourses are lower across the board, with losses extending during early European hours. European sectors are all in the red but portray a clear defensive bias. Stateside, US equity futures have succumbed to the glum mood, with the NQ narrowly underperforming.

Top European News

- Riksbank hiked its Rate by 50bps to 0.75% as expected, and said the rate will be raised further and it will be close to 2% at the start of 2023. Bank said the balance sheet its to shrink faster than previously flagged, and suggested that policy rate will increase faster if needed. Click here for details.

- Riksbank’s Ingves said inflation over forecast probably not enough for Riksbank to hold extra policy meeting in summer. Ingves added that if the situation requires a 75bps hike, then Riksbank will carry out a 75bps hike.

- Orsted Gains as HSBC Upgrades With Shares Seen ‘Good Value’

- Aston Martin Extends Losses as Carmaker Reportedly Seeking Funds

- Climate Litigants Look Beyond Big Oil for Their Day in Court

- Ukraine Latest: Putin Warns NATO on Moving Military to Nordics

FX

- DXY extends on gains above 105.00, but could see more upside on safe haven demand and residual rebalancing flows over fixes – EUR/USD inches towards 1.0400 to the downside.

- Yen regroups as yields drop and risk sentiment deteriorates to compound corrective price action.

- Franc unwinds some of its recent outperformance and Loonie lose traction from oil ahead of Canadian GDP.

- Swedish Crown unable to take advantage of hawkish Riksbank hike in face of risk aversion – Eur/Sek stuck in a rut close to 10.7000.

- Pound finds some underlying bids into 1.2100 and Kiwi at 0.6200, while Aussie holds above 0.6850 with encouragement from China’s services PMI that also propped the Yuan.

Fixed Income

- Bonds on bull run into month, quarter and half year end – Bunds top 148.00 at best, Gilts approach 113.50 and 10 year T-note just a tick away from 118-00.

- Debt in demand on safe haven grounds rather than duration as curves steepen on less hawkish/more dovish market pricing.

- Italian supply comfortably covered to keep BTP futures propped ahead of US PCE data and yet another speech from ECB President Lagarde.

Commodities

- WTI and Brent front-month futures are resilient to the broader risk downturn, and firmer Dollar as OPEC+ member members gear up for what is expected to be a smooth meeting.

- Spot gold is uneventful but dipped under yesterday’s low, with potential support at the 15th June low at USD 1,806.59/oz.

- Base metals are softer across the board amid the broader risk profile. Dalian and Singapore iron ore futures were on track for quarterly losses.

- Ship with 7,000 tonnes of grain leaves Ukraine port, according to pro-Russia officials cited by AFP.

US Event Calendar

- 08:30: June Initial Jobless Claims, est. 229,000, prior 229,000

- 08:30: June Continuing Claims, est. 1.32m, prior 1.32m

- 08:30: May Personal Income, est. 0.5%, prior 0.4%

- 08:30: May Personal Spending, est. 0.4%, prior 0.9%

- 08:30: May Real Personal Spending, est. -0.3%, prior 0.7%

- 08:30: May PCE Deflator MoM, est. 0.7%, prior 0.2%

- 08:30: May PCE Deflator YoY, est. 6.4%, prior 6.3%

- 08:30: May PCE Core Deflator YoY, est. 4.8%, prior 4.9%

- 08:30: May PCE Core Deflator MoM, est. 0.4%, prior 0.3%

- 09:45: June MNI Chicago PMI, est. 58.0, prior 60.3

DB’s Jim Reid concludes the overnight wrap

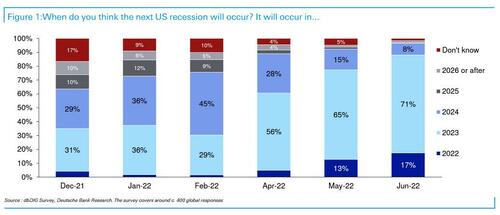

We’ve just released the results of our monthly EMR survey that we conducted at the start of the week. It makes for some interesting reading, and we’re now at the point where 90% of respondents are expecting a US recession by end-2023, which is up from just 35% in our December survey. That echoes our own economists’ view that we’re going to get a recession in H2 2023, and just shows how sentiment has shifted since the start of the year as central banks have begun hiking rates. When it comes to people’s views on where markets are headed next, most are expecting many of the themes from H1 to continue, with a 72% majority thinking that the S&P 500 is more likely to fall to 3,300 rather than rally to 4,500 from current levels, whilst 60% think that Treasury yields will hit 5% first rather than 1%. Click here to see the full results.

When it comes to negative sentiment we’ll have to see what today brings us as we round out the first half of the year, but if everything remains unchanged today we’re currently set to end H1 with the S&P 500 off to its worst H1 since 1970 in total return terms. And there’s been little respite from bonds either, with US Treasuries now down by -9.79% since the start of the year, so it’s been bad news for traditional 60/40 type portfolios. Ultimately, a large reason for that has been investors’ fears that ongoing rate hikes to deal with inflation will end up leading to a recession, and yesterday saw a continuation of that theme, with Fed Chair Powell, ECB President Lagarde and BoE Governor Bailey all reiterating their intentions in a panel at the ECB’s Forum to return inflation back to target.

In terms of that panel, there weren’t any major headlines on policy we weren’t already aware of, although there was a collective acknowledgement of the risk that inflation could become entrenched over time and the need to deal with that. Fed Chair Powell described the US economy as in “strong shape”, but one that ultimately requires much tighter financial conditions to bring inflation back to target. Year-end fed funds expectations remained steady in response, down just -0.7bps to 3.45%. However, further out the curve the simmering slower growth narrative continued to grip markets and sent 10yr Treasury yields -8.2bps lower to 3.09%, and the 2s10s another -1.1bps flatter to 4.7bps. In line with a tighter Fed policy path and slower growth, 10yr breakevens drove the move in nominal yields, falling -8.2bps to 2.39%, their lowest levels since January, having entirely erased the gains seen after Russia’s invasion of Ukraine, when it peaked above 3% at one point in April. Along with 2s10s flattening, the Fed’s preferred measure of the near-term risk of recession, the forward spread (the 18m3m – 3m), similarly flattened by -5.7bps, hitting its lowest level in nearly four months at 154bps. And thismorning there’s only been a partial reversal of these trends, with 10yr Treasury yields (+1.3bps) edging back up to 3.10% as we go to press. Over in equities, the S&P 500 bounced around but finished off of its intraday lows with just a -0.07% decline, again with the macro view likely skewed by quarter-end rebalancing of portfolios. The NASDAQ was similarly little changed on the day, falling a mere -0.03%.

In terms of the ECB, President Lagarde said on that same panel that she didn’t think “we are going back to that environment of low inflation” that was present before the pandemic. But when it came to the actual data yesterday there was a pretty divergent picture. On the one hand, Spain’s CPI for June surprised significantly on the upside, with the annual inflation rising to +10.0% (vs. +8.7% expected) on the EU’s harmonised measure. But on the other, the report from Germany then surprised some way beneath expectations, coming in at +8.2% on the EU-harmonised measure (vs. +8.8% expected). So mixed messages ahead of the flash CPI print for the entire Euro Area tomorrow.

As in the US, there was a significant rally in European sovereign bonds, with yields on 10yr bunds (-10.7bps), OATs (-10.7bps) and BTPs (-16.0bps) all moving lower on the day. Equities also lost significant ground amidst the risk-off tone, and the STOXX 600 shed -0.67% as it caught up with the US losses from the previous session. That risk-off tone was witnessed in credit as well, where iTraxx Crossover widened +21.5bps to a post-pandemic high. At the same time, there were further concerns in Europe on the energy side, with natural gas futures up by +8.06% to a three-month high of €139 per megawatt-hour, which follows a reduction in capacity yesterday at Norway’s Martin Linge field because of a compressor failure.

Whilst monetary policy has been the main focus for markets lately, we did get some headlines on the fiscal side yesterday too, with a report from Bloomberg that Senate Democrats were working on an economic package that had smaller tax increases in order to reach a deal with moderate Democratic senator Joe Manchin. For reference, the Democrats only have a majority in the split 50-50 senate thanks to Vice President Harris’ tie-breaking vote, so they need every Democrat Senator on board in order to pass legislation. According to the report, the plan would be worth around $1 trillion, with half allocated to new spending, and the other half cutting the deficit by $500bn over the next decade.

Overnight in Asia we’ve seen a mixed market performance overnight. Most indices are trading lower, including the Nikkei (-1.45%) and the Kospi (-0.81%), but Chinese equities have put in a stronger performance after an improvement in China’s PMIs in June, and the CSI 300 (+1.62%) and the Shanghai Comp (+1.31%) have both risen. That came as manufacturing activity expanded for the first time in four months, with the PMI up to 50.2 in June (vs. 50.5 expected) from 49.6 in May. At the same time, the non-manufacturing climbed to 54.7 points in June, up from 47.8 in May, which also marked the first time it’d been above the 50 mark since February.

Nevertheless, that positivity among Chinese equities are proving the exception, with equity futures in the US and Europe pointing lower, with those on the S&P 500 (-0.28%) looking forward to a 4th consecutive daily decline as concerns about a recession persist.

When it came to other data yesterday, the third estimate of US GDP for Q1 saw growth revised down to an annualised contraction of -1.6% (vs. -1.5% second estimate). Separately, the Euro Area’s M3 money supply grew by +5.6% year-on-year in May (vs. +5.8% expected), which is the slowest pace since February 2020.

To the day ahead now, data releases include German retail sales for May and unemployment for June, French CPI for June, the Euro Area unemployment rate for May, Canadian GDP for April, whilst the US has personal income and personal spending for May, the weekly initial jobless claims, and the MNI Chicago PMI for June.

Tyler Durden

Thu, 06/30/2022 – 07:58

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com