Is It Too Late To Short Bonds?

By Russell Clark of the Capital Flows and Asset Markets substack,

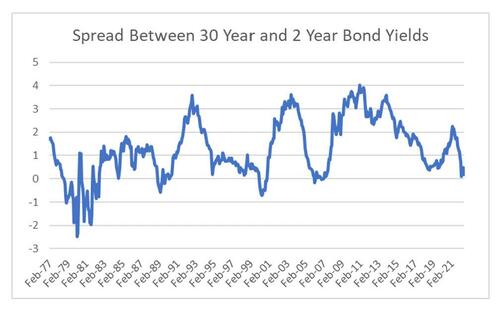

US Treasuries have been in a 40 year bull market. While short term bond yields move up and down on the basis of real or perceived Federal Reserve policy hawkishness, the 2 year yield on treasuries has rarely passed above the 30 year treasury yield.

Looking at the below chart, it would seem like the right time to be buying long dated bonds.

Or to put it another way, when the spread between the 2 year and 30 year bond get close to zero you have been rewarded with buying bonds. Looking at current spreads, that would be about now. Buy bonds, wear diamonds as people like to say.

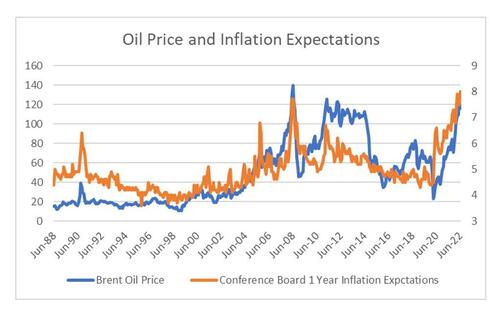

The final piece of a long bond call is for a top in commodity prices and falling inflation expectations. The Federal Reserve gets pressured to act by governments and markets when inflation expectations rise (as they are now). The US consumers inflation expectations are heavily influence by the oil price.

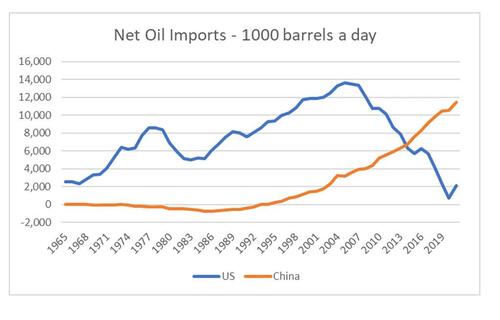

The problem is that while the US is still the biggest consumer of oil, it is not the biggest importer of oil. That title has been China’s for some years now.

The implication is we need to see Chinese demand for oil to fall, or supply to increase for oil prices to fall and allow the Federal Reserve to reverse monetary policy tightening. How likely is that? Unlikely I think. Firstly, time spreads in the oil market are still pointing to demand outstripping supply (there is a premium to delivering oil sooner rather than later).

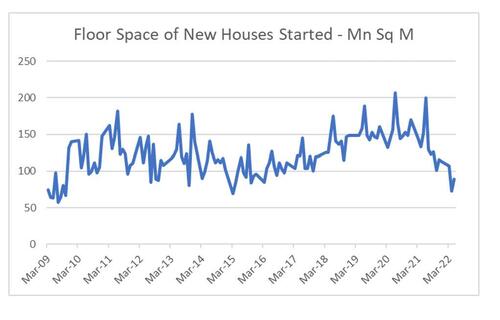

The other problem I have is that Chinese economic activity has already been weak. Housing data has been so weak, it probably has upside from here, rather than downside. Cities like Shanghai are exiting Covid restrictions, implying that demand could rise from here, not fall.

So the long bond call is based on a strong historic relationship of Federal Reserve tightening impacting the oil market. With China the biggest importer of oil, is that relationship still true? The other problem I have, is that investors pretty much have already gotten long bonds. The shares outstanding in long treasury funds are at all time highs, while the shares outstanding in short treasury funds have fallen by nearly half this year.

As I have also been highlighting in recent presentations, politically the idea of allowing rising unemployment to keep commodity prices in check, and keeping interest rates low look very unpopular. Policies have now tended to pay compensation directly to the worse off in society, which boosts commodity demand. As I pointed out in my last presentation, motivation is an important factor for me. Given positioning, and changing politics, it does not look too late to short bonds to me.

Tyler Durden

Fri, 07/01/2022 – 12:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com