Futures Slide On Renewed China Covid Lockdown Fears As Traders Brace For Q2 Earnings, Red Hot CPI

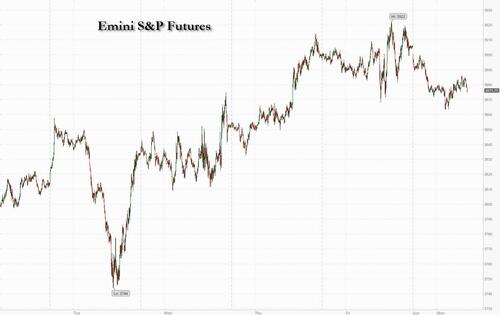

US equity futures and global markets started the second week of the 3rd quarter on the back foot, with spoos sliding on Monday morning as traders were spooked by fears that Covid may be making a return to China leading to more virus restrictions, amid growing concern about an ugly second-quarter earnings season which begins this week. A closely watched CPI print on Wednesday which is expected to rise again, will also keep markets on edge.

Contracts on the S&P 500 and Nasdaq 100 traded 0.7% lower, suggesting last week’s rally in US stocks my stall as concerns about China’s Covid resurgence weigh on risk appetite. The dollar jumped, reversing two weeks of losses and trading around the highest level since 2020 while Treasuries gained. Bitcoin dropped, oil declined and iron ore extended losses on concern about the demand outlook in China.

Adding to the risk-off mood were the latest covid news out of China, whose stocks had their worst day in about a month as a Covid resurgence combined with fresh fines for the tech giants sent investors running for the door. Both the Hang Seng and Shanghai traded negative after a rise in Shanghai’s COVID-19 cases prompted authorities to declare more high-risk areas and the city also reported its first case of the BA.5 omicron subvariant, as well as two more rounds of mass testing in at least 9 districts. Casino stocks were heavily pressured in Hong Kong after Macau announced to shut all non-essential businesses including casinos, while shares in tech giants Tencent and Alibaba weakened after reports that they were among the companies fined by China’s antitrust watchdog concerning reporting of past transactions. There was more bad news out China including a rejection by China Evergrande Group’s bondholders on a proposal to extend debt payment, as well as a warning by a prominent investor’s wife that a key lithium maker’s stock is overvalued.

The Chinese selloff is a reminder that the nation’s Covid Zero policy and lingering uncertainty toward tech crackdowns remain key risks for investors betting on a sustained rebound in Chinese shares. The Hang Seng China gauge has recorded just one positive session in the last eight after rallying nearly 30% from a March low.

Anyway, back to the US where in premarket trading, Twitter shares slumped in premarket trading after Elon Musk terminated his $44 billion takeover approach for the social media company. Some other social media stocks were lower too, while Digital World Acquisition (DWAC US), the SPAC tied to Donald Trump, jumps as much as 30%. Bank stocks are also lower in premarket trading Monday amid a broader decline in risk assets as investors await the release of key inflation data later this week. S&P 500 futures are also lower, falling as much as 1%, while the US 10-year Treasury yield holds above the 3% level. In corporate news, UBS is considering a plan to promote Iqbal Khan to sole head of the bank’s global wealth management business. Meanwhile, Klarna is shelling out loans for milk and gas with cash-strapped customers looking for ways to cover basic necessities. Here are some other notable premarket movers:

- US-listed Macau casino operators and Chinese tourism stocks fall after local authorities in the gambling hub shut almost all business premises as a Covid-19 outbreak in the area worsened. Las Vegas Sands (LVS US) down 3.5%, MGM Resorts (MGM US) -3.5%, Wynn Resorts (WYNN US) -3.1%.

- Cryptocurrency-exposed stocks were lower after the latest MLIV Pulse survey suggested that the token is more likely to tumble to $10,000, cutting its value roughly in half, than it is to rally back to $30,000. Crypto stocks that are down include: Marathon Digital (MARA US) -6%, Riot Blockchain (RIOT US) -4.5%, Coinbase (COIN US) -3.8%.

- Lululemon (LULU US) cut to underperform and Under Armour (UAA US) downgraded to hold by Jefferies in a note on athletic apparel firms, with buy-rated Nike (NKE US) “still best-in-class.” Lululemon drops 1.8% in US premarket trading, Under Armour -3.1%

- Morgan Stanley cut its recommendation on Fastly (FSLY US) to underweight from equal-weight, citing a less favorable risk/reward scenario heading into the second half of the year. Shares down 5.2% in premarket.

Price pressures, a wave of monetary tightening and a slowing global economy continue to shadow markets. the June CPI print reading on Wedensday is expected to get closer to 9%, a fresh four-decade high, buttressing the Federal Reserve’s case for a jumbo July interest-rate hike. Company earnings will shed light on recession fears that contributed to an $18 trillion first-half wipe-out in global equities.

“The real earnings hit will come in the second half as we’re hearing from companies, especially retailers, saying they’re already seeing weakness from consumers,” Ellen Lee, portfolio manager at Causeway Capital Management LLC, said on Bloomberg Television.

The Stoxx Europe 600 index pared a decline of more than 1% as an advance for utilities offset losses for carmakers and miners. The Euro Stoxx 50 was down 0.8% as of 10:30 a.m. London time, having dropped as much as 1.9% shortly after the cash open. DAX and CAC underperform at the margin. Autos, miners and consumer products are the worst-performing sectors. Copper stocks sank as fear of global recession continues to suppress metals prices; miners suffered: Anglo American -5.1%, Antofagasta -5.3%, Aurubis -3.7%, Salzgitter -5.1%. Copper was hit hard, with futures down 1.9% today. Here are the top European movers:

- Dufry shares rise as much as 11%, while Autogrill falls as much as 9.4% after the Swiss duty-free store operator agreed to buy the Italian company from the billionaire Benetton family, with the offer price being below Autogrill’s closing price on Friday.

- Danske Bank declines as much as 6.4% after the lender cut its outlook for the year.

- Fincantieri advances as much as 7% after the Italian shipbuilder said it secured an ultra-luxury cruise ship order that will be built by the end of 2025.

- Joules drops as much as 25% after the British retailer said it hired KPMG to advise on how to shore up its cash position.

- MJ Gleeson jumps as much as 7.4% after the homebuilder published a trading update stating that it sees full-year earnings being “significantly ahead of expectations.” Peel Hunt says it was a “strong finish to the year.”

- Uniper falls as much as 12%, adding to its declines in recent weeks, after the German utility last week asked the government for a bailout.

- Wizz Air declines as much as 5.3% after the low-cost carrier provided a 1Q update, with ticket fares down 12% versus FY20.

- Nordex rises as much as 7.8%, reversing early losses after the wind-turbine maker said it plans to raise EU212m via a fully-underwritten rights issue.

- Mining stocks sink as fear of global recession continues to suppress metals prices. Anglo American and Antofagasta are among the decliners.

Earlier in the session, Asian stocks declined as resurging Covid-19 cases in China dented investor sentiment and raised fears of lockdowns that could hurt growth and corporate earnings. The MSCI Asia Pacific Index dropped as much as 1.1%, erasing an earlier gain of as much as 0.5%. Chinese stocks had their worst day in about a month as a Covid resurgence combined with fresh fines for the tech giants sent investors running for the door. Japan was a bright spot, buoyed by the prospect of administrative stability after the ruling coalition expanded its majority in an upper house election. Alibaba and Tencent dragged the gauge the most after China’s watchdog fined the internet firms. All but two sectors declined, with materials and consumer discretionary sectors leading the retreat. Chinese stocks were the region’s notable losers, with benchmarks in Hong Kong slumping about 3% and those in mainland China down more than 1%. A bevy of bad news from the world’s second-largest economy ahead of major economic data releases later this week dampened the mood. The first BA.5 sub-variant case was reported in Shanghai in another challenge to authorities struggling to counter a Covid-19 flare-up in the financial hub. Macau shuttered almost all casinos for a week from Monday as virus cases remain unabated.

“Sentiment got weakened again as Covid-19 cases spread again in China,” said Cui Xuehua, a China equity analyst at Meritz Securities in Seoul. “There are also worries about lockdowns as companies will start reporting their earnings.” Meanwhile, benchmarks in Japan outperformed the region, gaining more than 1% following the ruling bloc’s big election victory. Traders in Asia are awaiting for a set of data from the world’s second-largest economy this week, including its growth and money supply figures. Also on the watch are corporate earnings, which would give investors more clues about the impact of lockdowns in China and rising costs of goods and services.

Japanese equities climbed after the ruling coalition expanded its majority in an upper house election held Sunday, two days after the assassination of former Prime Minister Shinzo Abe. The Topix index rose 1.4% to 1,914.66 as of the market close in Tokyo, while the Nikkei 225 advanced 1.1% to 26,812.30. Toyota Motor Corp. contributed the most to the Topix’s gain, increasing 1.9%. Out of 2,170 shares in the index, 1,862 rose and 256 fell, while 52 were unchanged. “In the next two years or so, the government will be able to make some drastic policy changes and if they don’t go off in the wrong direction, the stability of the administration will be a major factor in attracting funds to the Japanese market,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management

Australia’s S&P/ASX 200 index fell 1.1% to close at 6,602.20, with miners and banks contributing the most to its drop. All sectors declined, except for health. EML Payments was the worst performer after its CEO resigned. Costa slumped after Credit Suisse downgraded the stock. The produce company also said it’s faced quality issues from weather. In New Zealand, the S&P/NZX 50 index fell 0.6% to 11,106.14

India’s benchmark stock index declined following the start of the first quarter earnings season, with bellwether Tata Consultancy Services Ltd. disappointing amid worsening cost pressures faced by Indian companies. The S&P BSE Sensex Index fell 0.2% to 54,395.23 in Mumbai, after posting its biggest weekly advance since April on Friday, helped by a recent correction in key commodity prices. The NSE Nifty 50 Index ended little changed on Monday. Tata Consultancy contributed the most to the Sensex’s drop, falling 4.6%, its sharpest decline in seven weeks. Bharti Airtel slipped as Adani Group’s surprise announcement of participating in a 5G airwaves auction potentially challenges its telecom business. Still, 15 of the 19 sub-sector gauges compiled by BSE Ltd. gained, led by power producers. Software exporter HCL Technologies Ltd. slumped more than 4% before its results on Tuesday.

In FX, the pound fell as the race to replace Boris Johnson as UK premier heats up. Over in Europe, the main conduit for Russian gas goes down for 10-day maintenance on Monday. Germany and its allies are bracing for President Vladimir Putin to use the opportunity to cut off flows for good in retaliation for the West’s support of Ukraine following Russia’s invasion. The Bloomberg Dollar Spot Index snapped a two-day decline as the greenback rose against all of its Group-of-10 peers. The Norwegian krone and the Australian dollar were the worst performers. The Aussie declined amid the greenback’s strength, and poor sentiment triggered by Covid news and political strife with China. Australian Prime Minister Anthony Albanese has ruled out complying with a list of demands from the Chinese government to improve relations between the two countries. Shanghai reported its first case of the BA.5 sub-variant on Sunday, warning of “very high” risks as the city’s rising Covid outbreak sparks fears of a return to its earlier lockdown. The yen dropped to a 24-year low above 137 per dollar. Japanese Prime Minister Fumio Kishida’s strong election victory presents him with a three-year time frame to pursue his own agenda of making capitalism fairer and greener, with no need to quickly change course on economic policy including central bank stimulus

In rates, Treasuries are slightly richer across the curve with gains led by the front end, following a wider rally seen across bunds and, to a lesser extent, gilts as stocks drop. Sentiment shifts to second-quarter earnings season, while focus in the US will be on Tuesday’s inflation print. Bunds lead gilts and Treasuries higher amid haven buying. Treasury yields richer by up to 3.5bp across front end of the curve, steepening 2s10s and 5s30s spreads by almost 2bp; 10-year yields around 3.06%, with bunds and gilts trading 3bp and 1bp richer in the sector. Auctions are front loaded, with 3-year note sale today, followed by 10- and 30-year Tuesday and Wednesday. Auctions resume with $43b 3-year note sale at 1pm ET, followed by $33b 10-year and $19b 30-year Tuesday and Wednesday. WI 3-year around 3.095% is above auction stops since 2007 and ~17bp cheaper than June’s stop-out.

Bitcoin caught a downdraft from the cautious start to the week in global markets, falling as much as 2.6% but holding above $20,000.

In commodities, crude futures decline. WTI trades within Friday’s range, falling 1.3% to trade near $103.48. Base metals are mixed; LME copper falls 1.4% while LME lead gains 1.4%. Spot gold maintains the narrow range seen since Thursday, falling roughly $4 to trade near $1,739/oz.

It is a quiet start tot he week otherwise, with nothing scheduled on the US calendar today.

Market Snapshot

- S&P 500 futures down 0.6% to 3,877.75

- STOXX Europe 600 down 0.8% to 413.75

- MXAP down 0.9% to 157.30

- MXAPJ down 1.6% to 516.87

- Nikkei up 1.1% to 26,812.30

- Topix up 1.4% to 1,914.66

- Hang Seng Index down 2.8% to 21,124.20

- Shanghai Composite down 1.3% to 3,313.58

- Sensex down 0.2% to 54,349.37

- Australia S&P/ASX 200 down 1.1% to 6,602.16

- Kospi down 0.4% to 2,340.27

- German 10Y yield little changed at 1.28%

- Euro down 0.6% to $1.0122

- Brent Futures down 2.2% to $104.66/bbl

- Gold spot down 0.3% to $1,738.11

- U.S. Dollar Index up 0.47% to 107.51

Top Overnight News from Bloomberg

- Foreign Secretary Liz Truss entered the race to replace Boris Johnson as UK premier, the latest cabinet minister to make her move in an already fractious contest

- Price action in the spot market Friday for the euro was all about short-term positioning, options show

- The Riksbank needs to prevent high inflation becoming entrenched in price- and wage-setting, and to ensure that inflation returns to the target, it says in minutes from latest monetary policy meeting

- The probability of a euro-area economic contraction has increased to 45% from 30% in the previous survey of economists polled by Bloomberg, and 20% before Russia invaded Ukraine. Germany, one of the most- vulnerable members of the currency bloc to cutbacks in Russian energy flows, is more likely than not to see economic output shrink

- ECB Governing Council member Yannis Stournaras said a new tool to keep debt-market turmoil at bay as interest rates rise may not need to be used if it’s powerful enough to persuade investors not to test it

- The number of UK households facing acute financial strain has risen by almost 60% since October and is now higher than at any point during the pandemic

A more detailed look at global markets courtesy of Newqsuawk

Asia-Pac stocks traded mostly lower as the region digested last Friday’s stronger than expected NFP data in the US, with sentiment also mired by COVID-19 woes in China. ASX 200 was led lower by underperformance in tech and the mining-related sectors, while hopes were dashed regarding an immediate improvement in China-Australia ties following the meeting of their foreign ministers. Nikkei 225 bucked the trend amid a weaker currency and the ruling coalition’s strong performance at the Upper House elections, but with gains capped after Machinery Orders contracted for the first time in 3 months. Hang Seng and Shanghai Comp. traded negative amid COVID concerns after a rise in Shanghai’s COVID-19 cases prompted authorities to declare more high-risk areas and the city also reported its first case of the BA.5 omicron subvariant, as well as two more rounds of mass testing in at least 9 districts. Casino stocks were heavily pressured in Hong Kong after Macau announced to shut all non-essential businesses including casinos, while shares in tech giants Tencent and Alibaba weakened after reports that they were among the companies fined by China’s antitrust watchdog concerning reporting of past transactions.

Top Asian News

- Shanghai’s COVID-19 cases continued to increase which prompted authorities to declare more high-risk areas and is fuelling fears that China’s financial hub may tighten movement restrictions again, according to Bloomberg. In relevant news, Shanghai reported its first case of the BA.5 omicron subvariant and authorities ordered two more rounds of mass testing in at least 9 districts. An official from China’s Shanghai says authorities have classified additional areas as high risk areas.

- Macau will shut all non-essential businesses including casinos this week due to the COVID-19 outbreak, according to Reuters. It was separately reported that Hong Kong is considering a health code system similar to mainland China to fight COVID.

- China’s Foreign Minister Wang said he had a candid and comprehensive exchange with US Secretary of State Blinken, while he called for the US to cancel additional tariffs on China as soon as possible and said the US must not send any wrong signals to Taiwan independence forces, according to Reuters.

- US Secretary of State Blinken stated that the US expects US President Biden and Chinese President Xi will have the opportunity to speak in the weeks ahead, according to Reuters.

- US Commerce Secretary Raimondo said cutting China tariffs will not tame inflation and that many factors are pushing prices higher, according to FT.

- China’s antitrust watchdog fined companies including Alibaba (9988 HK) and Tencent (700 HK) regarding reporting of past deals, according to Bloomberg.

- Japan’s ruling coalition is poised to win the majority of seats contested in Sunday’s upper house election and is projected to win more than half of the 125 Upper House seats contested with a combined 76 seats and the LDP alone are projected to win 63 seats, according to an NHK exit poll cited by Reuters.

- Japanese PM Kishida said that they must work toward reviving Japan’s economy and they will take steps to address the pain from rising prices, while he added they will focus on putting a new bill that can be discussed in parliament when asked about constitutional revision and noted that they are not considering new COVID-19 restrictions now, according to Reuters.

European bourses are pressured, Euro Stoxx 50 -0.5%, but will off post-open lows amid a gradual pick-up in sentiment. Pressure seeped in from APAC trade amid further China-COVID concerns amid a relatively limited docket to start the week. Stateside, futures are directionally in-fitting but with magnitudes less pronounced with earnings season underway from Tuesday; ES -0.4%. Toyota (7203 JP) announces additional adjustments to its domestic production for July; volume affected by the adjustment will be around 4000 units, global production plan to remain unchanged, via Reuters.

Top European News

- Fitch affirmed European Stability Mechanism at AAA; Outlook Stable and affirmed Greece at BB; Outlook Stable, while it cut Turkey from BB- to B+; Outlook Negative.

- UK Companies are bracing for a recession this year with multiple companies said to have begun “war gaming” for a recession, according to FT. In other news, local leaders warned that England’s bus networks could shrink by as much as a third as the government’s COVID-19 subsidies end and commercial operators withdraw from unprofitable routes, according to FT.

- Senior Tory party figures are reportedly seeking to narrow the leadership field quickly, according to FT. It was separately reported that only four Tory party leadership candidates are expected to remain by the end of the week under an accelerated timetable being drawn up by the 1922 Committee of backbenchers, according to The Times.

- UK Chancellor Zahawi, Transport Minister Shapps, Foreign Secretary Truss, junior Trade Minister Mordaunt, Tory MPs Jeremy Hunt and Sajid Javid have announced their intentions to run for party leader to replace UK PM Johnson, while Defence Secretary Wallace decided to not run for PM and several have declared the intention to cut taxes as PM, according to The Telegraph, Evening Standard and Reuters.

FX

- Buck firmly bid after strong US jobs report and pre-CPI on Wednesday that could set seal on another 75bp Fed hike this month, DXY towards top of 107.670-070 range vs last Friday’s 107.790 high.

- Aussie undermined by rising Covid case count in China’s Shanghai, AUD/USD loses grip of 0.6800 handle

- Yen drops to fresh lows against Greenback after BoJ Governor Kuroda reiterates dovish policy stance amidst signs of slowing Japanese growth, USD/JPY reaches 137.28 before waning.

- Euro weak due to heightened concerns that Russia may cut all gas and oil supplies, EUR/USD eyes bids ahead of 1.0100.

- Pound down awaiting Conservative Party leadership contest and comments from BoE Governor Bailey, Cable under 1.2000 and losing traction around 1.1950.

- Hawkish Riksbank minutes help Swedish Crown avoid risk aversion, but Norwegian Krona declines irrespective of stronger than forecast headline inflation; EUR/SEK sub-10.7000, EUR/NOK over 10.3200.

- Yuan soft as Shanghai raises more areas to high-risk level; USD/CNH and USD/CNY nearer 6.7140 peaks than troughs below 6.6900 and 6.7000 respectively.

Fixed Income

- Debt regains poise after post-NFP slide, with Bunds leading the way between 151.00-149.75 parameters

- Gilts lag within 114.94-33 range awaiting Conservative leadership contest and comments from BoE Governor Bailey

- 10 year T-note firm inside 118-00+/117-18+ bounds ahead of USD 43bln 3 year auction

Commodities

- Crude benchmarks are curtailed amid the COVID situation with broader developments limited and heavily focused on Nord Stream.

- French Economy and Finance Minister Le Maire warned there is a strong chance that Moscow will totally halt gas supplies to Europe, according to Politico.

- Canada will grant a sanctions waiver to return the repaired Russian turbine to Germany needed for maintenance on the Nord Stream 1 gas pipeline but will expand sanctions against Russia’s energy sector to include industrial manufacturing.

- The US does not expect any specific announcements on oil production at this week’s US-Saudi summit, according to FT sources.

- JPMorgan (JPM) sees crude prices in the low USD 100s in H2 2022, falling to high USD 90s in 2023.

- Spot gold remains relatively resilient, torn between the downbeat risk tone and the USD’s modest advances; attention on the metal’s reaction if DXY surpasses Friday’s best.

- Copper pulls back as Los Bambas returns to full output and on the China readacross.

US Event Calendar

- Nothing major scheduled

Central Banks

- 14:00: Fed’s Williams Takes Part in Discussion on Libor Transition

DB’s Jim Reid concludes the overnight wrap

If you’re in Europe over the next week good luck coping with the heatwave. In the UK I read last night that there’s a 30% chance that we will see the hottest day ever over that period. The warning signs are always there when at 5am you’re sweating and not just because of the immense effort put in on the EMR.

Talking of red hot, it’s that time of the month again where all roads point to US CPI which will be released exactly half way through the European week. This will be followed by the US PPI release (Thursday) and the University of Michigan survey for July on Friday where inflation expectations will be absolutely key. With US Q2 GDP currently tracking negative Friday’s retail sales and industrial production could still help swing it both ways. Staying with the US it’s time for Q2 earnings with a few high profile financials reporting. This is a very important season (aren’t they all) as the collapse in equities so far in 2022 is largely due to margin compression and not really earnings weakness.

Elsewhere China’s Q2 GDP on Friday alongside their main monthly big data dump is a highlight as we see how data is rebounding after the spike in Covid. In Europe, it will be a data-packed week for the UK.

Going through some of this in more detail now and US CPI is the only place to start. Our economists note that while gas prices fell in the second half of June, the first half strength will still be enough to help the headline CPI print (+1.33% forecast vs. +0.97% previously) be strong on the month but with core (+0.64% vs. +0.63%) also strong. They have the headline YoY rate at 9.0% (from 8.6%) while core should tick down from 6.0% to 5.8%.

Aside from an array of Fed speakers, investors will be paying attention to speeches from the BoE Governor Bailey (today and tomorrow). Markets will be also anticipating the Bank of Canada’s decision on Wednesday, and another +50bps hike is expected based on Bloomberg’s median estimate. Finally, G20 central bankers and finance ministers will gather in Bali on July 15-16.

In Europe, it will be a busy week for the UK, with monthly May GDP, industrial production and trade data due on Wednesday, among other indicators. Germany’s ZEW Survey for July (tomorrow) will also be in focus as European gas prices continue to be on a tear amid risks of Russian supply cut-offs. Speaking of which, Nord Stream 1 will be closed from today to July 21st for maintenance with much anticipation as to what happens at the end of this period. Elsewhere, Eurozone’s May industrial production (Wednesday) and trade balance (Friday) will also be due.

Finally, as Q2 earnings releases near for key US and European companies, key US banks will provide an early insights on the economic backdrop and consumer spending patterns. Results will be due from JPMorgan, Morgan Stanley (Thursday), Citi and BlackRock (Friday). In tech, TSMC’s report on Thursday may provide more insight into the state of supply-demand imbalance in semiconductors. In consumer-driven companies, PepsiCo (tomorrow) and Delta (Wednesday) will also release their results. The rest of the day by day week ahead is it the end as usual.

Asian equity markets are starting the week mostly lower on rising concerns around a fresh Covid flare-up in China as Shanghai reported its first case of the highly infectious BA.5 omicron sub-variant on Sunday. Across the region, the Hang Seng (-2.89%) is the largest underperformer amid a broad sell-off in Chinese tech shares after China imposed fines on several companies including Tencent and Alibaba for not adhering to anti-monopoly rules on disclosures of transactions. In mainland China, the Shanghai Composite (-1.50%) and CSI (-2.05%) both are trading sharply lower whilst the Kospi (-0.30%) is also weaker after see-sawing in early trade. Bucking the trend is the Nikkei (+1.02%) after Japan’s ruling party, the Liberal Democratic Party (LDP) and its coalition partner, Komeito, expanded its majority in the upper house in the country’s parliamentary vote held on Sunday and following the assassination of former Prime Minister Shinzo Abe last week. Outside of Asia, US stock futures are pointing to a weaker start with contracts on the S&P 500 (-0.60%) and NASDAQ 100 (-0.85%) moving lower.

Early morning data showed that Japan’s core machine orders dropped -5.6% m/m in May (v/s -5.5% expected) and against an increase of +10.8% in the previous month. Over the weekend, China’s factory gate inflation (+6.1% y/y) cooled to a 15-month low in June (v/s +6.0% expected) compared to a +6.4% rise in May. Additionally, consumer prices rose +2.5% y/y in June (v/s +2.4% expected), widening from a +2.1% gain in May and to the highest in 23 months.

Elsewhere, oil prices are lower with Brent futures down -0.36% at $106.63/bbl and WTI futures (-0.77%) at $103.98/bbl as I type. Treasury yields are less than a basis point higher at the moment.

Recapping last week now and a return to slightly more optimistic data boosted yields and equities, as central bank pricing got a bit more hawkish after a dovish run. More pessimistically, natural gas and electricity prices in Europe skyrocketed, as another bout of supply fears gripped the market. Elsewhere, the resignation of Prime Minister Johnson left a lot of questions about the medium-term policy path for the UK.

After global growth fears intensified at the beginning of the month, a combination of stronger production and labour market data allayed short-term aggressive slow down fears. This sent 10yr Treasury and bund yields +20.6bps (+9.1bps Friday) and +11.3bps (+2.7bps Friday) higher last week. In the US, the better data coincided with expectations that the Fed would be able to tighten policy even more, which drove 2yr yields +27.2bps higher (+9.1bps Friday), and drove the 2s10s yield curve into inversion territory, closing the week at -2.5bps. The market is still anticipating that the FOMC will reach its terminal rate this cycle around the end of the first quarter next year, but that rate was +24.4bps (+12.2bps Friday) higher over the week. A large part of the jump in yields came on Friday following the much stronger than expected nonfarm payrolls figures, which climbed +372k in June, versus expectations of +265k. It’s hard to have a recession with that much job growth, so hiking will continue. Elsewhere in the print, average hourly earnings were in line at 0.3%, with the prior month revised higher to 0.4%, while the unemployment rate stayed at an historically tight 3.6% as consensus expected.

Contrary to the US, yield curves were steeper in Europe, with 2yr bund yields managing just a +1.1bp climb (-3.1bps Friday). The continent had more immediate concerns in the form of a potential energy crisis. Fears that Russia would use the planned Nord Stream maintenance period beginning this week as a chance to squeeze supplies, alongside a now averted strike in Norway, sent European natural gas prices +14.44% higher (-4.24% Friday), ending the week at €175 per megawatt-hour, levels last rivaled during the initial invasion of Ukraine. German electricity prices also took off, increasing +20.26% (-7.54% Friday), setting off fears of a genuine energy crisis on the continent. That, combined with more expected Fed tightening priced in versus the ECB over the week, drove the euro -2.23% (+0.21% Friday) lower versus the US dollar, to $1.018, the closest to parity the single currency has come in over two decades. The fears were somewhat tempered by the end of the week, when it was reported that Canada would send a necessary turbine to Russia via Germany, enabling Russia to in theory remit gas supply back to Germany post the shutdown.

Through all the macro noise the S&P 500 posted its 12th weekly gain of the year, climbing +1.94% (-0.08% Friday), driven by a particularly strong performance among tech and mega-cap stocks, with the NASDAQ (+4.56%, +0.12% Friday) and FANG+ (+5.82%, -0.22% Friday) both outperforming. European equities also managed to climb despite the energy fears, with the STOXX 600 gaining +2.35% (+0.51% Friday), the DAX gaining +1.58% (+1.34% Friday), and the CAC +1.72% higher (+0.44% Friday). UK equities underperformed, with the FTSE 100 gaining just +0.38% (+0.10% Friday). The pound was in the middle of the pack in terms of G10 currency performance versus the US dollar, however losing -0.53% (+0.05% Friday).

Tyler Durden

Mon, 07/11/2022 – 08:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com