Tomorrow The Fed Hikes 75bps: What Happens Next Has Wall Street Hopelessly Split

What the Fed says at Wednesday’s meeting is going to matter much more than what they do.

That, according to Bloomberg’s Garfield Reynolds, will be the case even if Powell shocks us all by hiking less or more than the three-quarter point shift that’s been solidly priced in for most of the time since the June meet.

But assuming policy makers meet those projections, then all of the focus is going to be on what guidance we get from the policy commitment statement and Chair Powell’s presser. Traders are betting the cash rate will be about 3.1% in a year’s time and 2.6% in two years, following rate cuts which are expected to start in Q1 2023. Making matters more complicated, the Fed’s WSJ mouthpiece, Nick Timiraos today published an article warning that the Fed could nuke the practice of forward guidance (similar to what the ECB did last week).

That doesn’t leave the Fed a lot of room — the benchmark after today will be within a percentage point of the one-year forecast and a quarter point away from the two-year. As Reynolds concludes, “how Powell and his colleagues square that picture with their commitment to get inflation back down toward 2% will be fascinating.”

Said otherwise, get the timing of the Fed pivot right and you will make a lot of money.

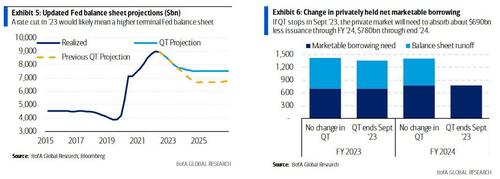

Regular readers are aware of our thoughts on this topic: one month ago we wrote “Fed Rate-Hikes To End This Year, Followed By 3% Of Rate-Cuts & QE“, a view which has since been validated by Wall Street’s most accurate strategist, BofA’s Michael Hartnett, who forecast the Fed pivot to take place in November, while iconic former NY Fed analyst Marc Cabana also reinforced our view, predicting that his former coworkers at the Fed will end QT much sooner than expected.

Still, confusion over what the Fed does next remains, and nowhere more so than among some of Wall Street’s top strategists who disagree over the impact of weaker economic data on the Federal Reserve’s policy outlook, what it’ll mean for stocks and, of course, when the Fed will pivot.

Take Morgan Stanley’s uber-bear, Michael Wilson, who on Monday said it’s too early to expect the Fed to stop tightening its policy even as fears of a recession grow, suggesting that stocks have more room to fall before finding a bottom, somewhere around 3,000.

Equity markets “may be trying to get ahead of the eventual pause by the Fed that is always a bullish signal,” Wilson said. “The problem this time is that the pause is likely to come too late” he added (his full comments can be found here).

On the other hand, the always permabullish JPMorgan strategists – such as Marko Kolanovic – who have unabashedly been telling their clients to buy stocks every single week of 2022 – have now pivoted to the last recourse Hail Mary where bad news (the same bad news they never forecast) is now good news, and predict that inflation has peaked and will lead to an early Fed pivot thus improving the risk picture for equities in the second half.

Contrary to Michael Wilson, who has been running laps around his far more insight-challenged JPMorgan peers, JPM strategist Mislav Matejka said in a note on Monday that challenging activity momentum and softer labor markets could open doors to a more balanced Fed policy, leading to a peak in the US dollar and inflation.

For once, we agree with JPMorgan, which is actually correct this time if for all the wrong reasons: after all, unlike the largest and seemingly most clueless commercial bank, we have been saying since last December that the Fed will not only hike into a recession, but will be forced to cut rates – and resume QE – early. JPMorgan, on the other hand, never even contemplated a worst case outcome. And only now, that its year-end price target has become a laugh out loud joke, does the bank magically make the jump from a growing economy to a sharp slowdown, which forces the Fed to end hiking. Even first-year analysts will call that sloppy, embarrassing goalseeking.

That said, JPMorgan is not alone: Generali senior economist Paolo Zanghieri said he expects the pace of rate hikes to slow after this week’s meeting. Still, concerns are growing that the Fed could already be too late in its attempt to tame inflation and avoid a US recession. More than 60% of the 1,343 respondents in the latest Bloomberg’s MLIV Pulse survey said there’s a low or zero probability of the central bank reining in consumer-price pressures without causing an economic contraction.

Jefferies LLC strategist Sean Darby said that while the economic slowdown is building, he expects the pressure on stocks from tighter monetary policy to ease in the second half of this year.

“Unlike the words ‘recession’ and ‘hyperinflation’ which have garnered a lot of news headlines, ‘pivot’ has yet to capture the same interest,” he wrote in a note. “Nevertheless, if the shapes of the US yield curve and Fed futures curves are correct, then the headwind from rate hikes will decelerate somewhat as tightening enters the last part of the year.”

Of course, the deeper the recession the Fed unleashes, the faster it will be forced to reverse and undo the damage… and Democrats will be riding Powell all the way there – that’s precisely what we discussed over the weekend in “Democrats Prepare To Unleash Hell On Fed Chair Powell For The Coming Recession.”

The worst case, for bulls, is not if the US slides into a recession – after all that will prompt the Fed to panic and unleash the usual liquidity tsunami – it would be if Wilson is right: the Morgan Stanley strategist who has been among the most vocal bears on US stocks and correctly predicted this year’s selloff, said that even though inflation could indeed have peaked “from a rate of change standpoint,” the “demand destructive nature of high inflation that is presenting itself today will not easily disappear even if inflation declines sharply because prices are already out of reach in areas of the economy that are critical for the cycle to extend–i.e. housing, autos, food, gasoline and other necessities.”

A rising number of analysts have also said that with inflation proving persistent at a four-decade high, it will take a recession and markedly higher joblessness, to ease price pressures significantly. It’s also why the Fed’s unspoken goal is precisely that: to tip the US into a moderate recession.

JPMorgan’s Matejka said that another factor that improves the outlook for equities in the second half of the year is the changing reaction to earnings, where weaker results can start being seen as good news.

Wilson again disagrees, saying that earnings estimates for S&P 500 firms are still too high and that the second quarter is likely to be the first of “several disappointing quarters before estimates finally trough.” As such, stocks may have further to fall before hitting a bottom, he said. “Recent positive price action to some earnings cuts is unlikely to be the low for most stocks as it’s usually unwise to buy the first cuts when we are entering a major revision cycle,” Wilson wrote on Monday.

Ultimately, Wilson sees the S&P dropping to 3,000 before the next bull market begins.

Goldman, uncharacteristically for the permabullish bank, sides with Morgan Stanley. The bank’s strategist David Kostin sees pressure on S&P 500 revenues from a stronger dollar. The bank’s top-down model shows that a 10% appreciation in the trade-weighted greenback should reduce earnings-per-share by 2% to 3%, he wrote in a note on July 22. And earlier today, the bank’s Cecilia Mariotti wrote that it is still too early to bet on an early Fed pivot: at this stage, she wrote, it “would be wary in calling for a sustained pro-cyclical shift across assets as we think markets might be underestimating the risks of continued inflationary pressures, which might keep the central bank put far out of the money for longer.”

Goldman – which has been catastrophically wrong in virtually all of its forecasts in the past two years – turning bearish? That may be just the tiebreaker we need to confirm that in just a few months the prevailing talk will be not how low the Fed can cut rates but whether it will follow the ECB into negative territory…

Tyler Durden

Tue, 07/26/2022 – 21:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com