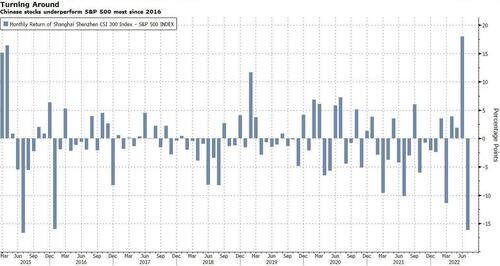

Chinese Stocks Underperform S&P 500 Most Since 2016

By George Lei, Bloomberg Markets Live commentator and analyst

Three things we learned last week:

1. Optimism toward China’s growth recovery got a reality check last week, when the Politburo meeting made two things clear: the Covid Zero policy is here to stay and large stimulus is unlikely. On Sunday, a report showed China’s factory activity unexpectedly contracted in July. The benchmark CSI 300 index retreated for a fourth week and tumbled 7% in July, its biggest monthly loss since March. It trailed the S&P 500 by 16 percentage points, giving up all of its outperformance in June when reopening euphoria swept the markets. Foreign investors sold 21 billion yuan ($3 billion) worth of stocks via the stock connect programs during the month, the most since March.

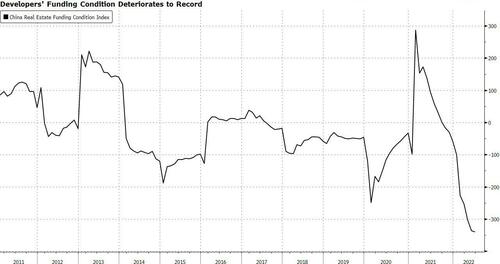

In addition to the Covid policies, the real-estate market remains a source of tension. Reports of several rescue proposals — including to seize undeveloped land from distressed real estate-companies and to provide loans to support stalled property projects — have floated around. Details may differ, but the underlying theme for all these plans is the same: saving unfinished projects to protect homeowners, instead of developers. Struggling developers such as Evergrande are left hanging.

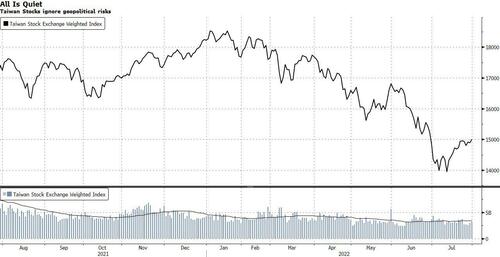

2. To be, or not to be (in Taiwan), that is the question. US House Speaker Nancy Pelosi left for her Asia trip on Friday. Whether she’ll land in Taipei remains a mystery, even as her itinerary skipped any mention of a possible stopover in Taiwan. The talk between President Xi and Biden centered on Taiwan, but neither side described the discussion as “constructive.” One thing is crystal clear: Taiwanese stocks rose on the week and month, handily beating peers in Hong Kong and China. Investors appear to have largely dismissed the simmering geopolitical tension.

3. While bad news is bad news for markets in China, it apparently is good news for US investors. The US economy contracted for a second quarter. Whether it’s truly a recession or not, growth clearly has lost momentum. The Fed signaled it could slow down the pace of tightening after it delivered another 75bp rate hike to put the benchmark rate at 2.5%. It’s hardly as pivotal as some market observers claimed, because the markets’ pricing of the Fed’s policy rates for the remaining of the year barely changed, and is in line with what’s prescribed on the Fed’s dot plot. With financial conditions easing, the risk now is that inflation doesn’t come down as quickly as markets expect.

Tyler Durden

Sun, 07/31/2022 – 18:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com