“Miserable” German Retail Sales Crash The Most On Record As Europe Slumps Into Recession

While it is now largely consensus that Europe is sliding into a recession, if not already in one, few were prepared for today’s retail sales print from Germany which was shocking: according to Destatis, the German national statistics office, German retail sales fell at the largest annual rate since records began in 1994, highlighting the scale of the economic collapse facing the eurozone’s largest economy.

Retail sales volumes dropped 9.8% in June (unadjusted) compared with the same month last year.

That said, while German retail sales volumes fell significantly, consumers reduced their overall spending by a much smaller amount, an annual drop of only 0.8 per cent, due to inflation’s impact on purchasing power. Still, Monday’s figures disappointed investors, with the 1.6% fall in sequential volumes between May and June much worse than the 0.2% expansion forecast by economists polled by Reuters.

The fall in retail spending also reflects a shift in spending back to services – not included in retail sales – after the boom in demand for goods that occurred during the early quarters of the coronavirus pandemic, when restaurants, bars and entertainment venues were often closed.

According to Claus Vistesen, Pantheon Macroeconomics chief eurozone economist, the figures were “miserable” and mainly due to the impact of soaring prices on consumer spending. Inflation in Germany is at a multi-decade high of 8.5%.

The german retail sales deflator is going haywire. Inflation-adjusted sales slumped by nearly 4% q/q in Q2, down 0.6% in nominal terms. pic.twitter.com/3cOTKBWM9T

— Claus Vistesen (@ClausVistesen) August 1, 2022

Vistesen noted that the retail sales decline could lead to a downward revision of last week’s figure for German gross domestic product, which was a flash estimate and is often subject to change.

The plunge in retail sales follows news on Friday that German economic growth stagnated between the first and second quarters, and an update of business and consumer confidence which is now at its lowest level since the early months of the pandemic.

Translation: recession. Indeed, while the eurozone economy as a whole grew 0.7% between the first and second quarters, analysts now almost uniformly expect the region to enter a downturn in the coming months as the impact of Russia’s full-scale invasion of Ukraine on energy markets and confidence bites

Chris Williamson, chief business economist at S&P Global Market Intelligence, said manufacturing activity in Germany and elsewhere was “sinking into an increasingly steep downturn, adding to the region’s recession risks”.

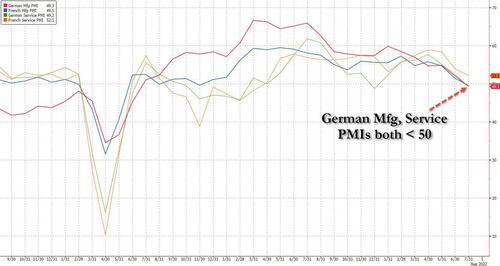

The closely watched purchasing managers’ indices for eurozone manufacturing, also out on Monday, showed factory activity was now slipping across the eurozone. And just in case the recession case wasn’t strong enough, Germany’s manufacturing PMI dropped below the crucial 50 level, confirming a contraction, for the first time in two years.

Across the region, new orders fell — a sign that conditions are likely to remain tough in the coming months. The biggest risk facing the region is that tensions with Moscow worsen, triggering Russia to reduce — or halt — gas flows to the EU. Economists believe this would trigger a major recession across the bloc.

Paradoxically, and similar to the US, even as Europe slumps into a deep recession, its labor market remains surprisingly strong. Although here too cracks are appearing: labor data also released on Monday showed that in June the number of unemployed people rose in the eurozone for the first time in 14 months, the FT reported.

While the region’s labor market remains one relatively bright spot and the joblessness rate remained unchanged at a record low of 6.6 per cent, the absolute figure of those looking for work was up by 25,000 to almost 11 million.

Needless to say as a full-blown recession grips Europe and as millions of workers lose their jobs in the next few months, the distinct choice between fighting inflation or fighting an economic collapse and mass layoffs, will make life for central banks much more difficult. It’s also why the ECB’s rate hiking cycle will end just a few months after it started in late July, in a mirror image to what happened the last time when the ECB hiked in 2011 only to reverse a few short months later…

Tyler Durden

Tue, 08/02/2022 – 02:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com