After Bashing It For Years, The World’s Largest Asset Manager Is Now Offering Bitcoin To Its Top Clients

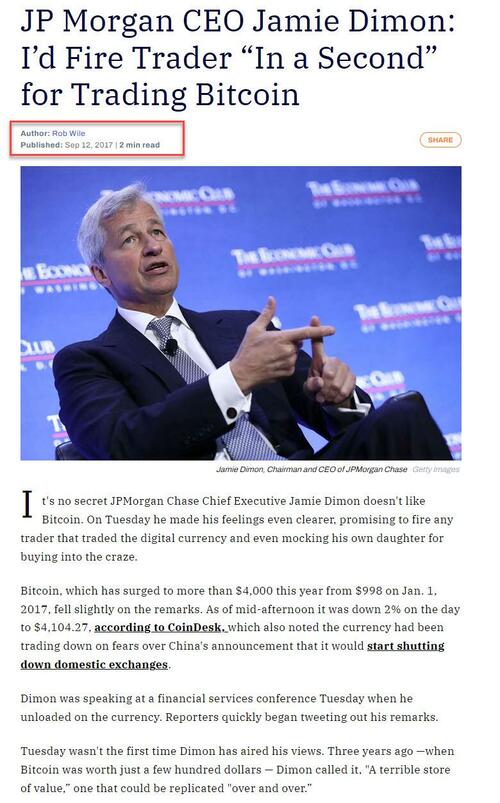

Think back some five years ago, to September 2017, when the always outspoken JPMorgan CEO Jamie Dimon decided to make a splash by pompously declaring that he would fire any JPM trader “in a second” for trading the fraud that is bitcoin.

It’s funny, because five years later, bitcoin (and crypto) has become a multi-billion revenue stream for JPMorgan, which now has a dedicated research team covering the space…

… and bank employees who trade bitcoin regularly make millions in bonuses.

But while JPM’s wholesale embrace of crypto is well-known, what is less well known is that roughly the same time Jamie Dimon was bashing bitcoin, the world’s largest asset manager was similarly pretending to be all virtuous and stuff, its morally-flexible CEO going on the record claiming that bitcoin is the “index of money laundering”

Well, guess what: five years later Bitcoin appears to not only be encouraging money laundering but profiting from it, because on Thursday, the world’s largest asset manager unveiled its first-ever investment product directly in Bitcoin, marking its second significant move into crypto markets in the past week.

The new private Bitcoin trust seeks to track the price of bitcoin in response to demand from large institutional clients seeking exposure to the asset even after its price plunged this year, the $10 trillion New York-based BlackRock said in a statement.

“Despite the steep downturn in the digital-asset market, we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities,” the company said. Would it be… money-laundering demand?

Whatever the reason, a pattern emerges: once there is retail “blood in the street” in any asset class – most certainly including crypto – the richest come out and start buying it…. which is precisely

The announcement of the new Bitcoin trust is the second major move into digital assets in the past week by BlackRock, and shows how Wall Street’s biggest players are deepening their involvement with money-laundering in an industry that only a few years ago was criticized for being susceptible to fraud and money-laundering.

BlackRock last week unveiled a high-profile partnership with crypto exchange Coinbase to allow institutional traders the ability oversee their Bitcoin investments alongside other portfolio assets such as stocks and bonds. The move sent Coinbase’s shares surging, with analysts concluding that the venture was a validation of digital assets and the crypto industry more broadly.

For BlackRock CEO Larry Fink, the Bitcoin trust is also a shift from four years ago, when he said he hadn’t heard from any client seeking exposure to crypto. In March of this year, Fink said the firm was studying the growing importance of digital assets and stablecoins and how they can be used to help clients. And the following month, the company joined a group of investors in Circle, the issuer of USD Coin, and said it would seek to serve as a primary manager of the stablecoin’s cash reserves.

In short, having effectively taken over the US capital markets with its relentless ETF encroachment which has steamrolled active managers everywhere, BlackRock has now set its sights on crypto.

Finally for those wondering, these are the kinds of “clients” who don’t actually trade with paper hands, and the more the price drops, the more they buy.

Tyler Durden

Thu, 08/11/2022 – 12:46

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com