Euro Area Flash PMI Paints A Grim Picture

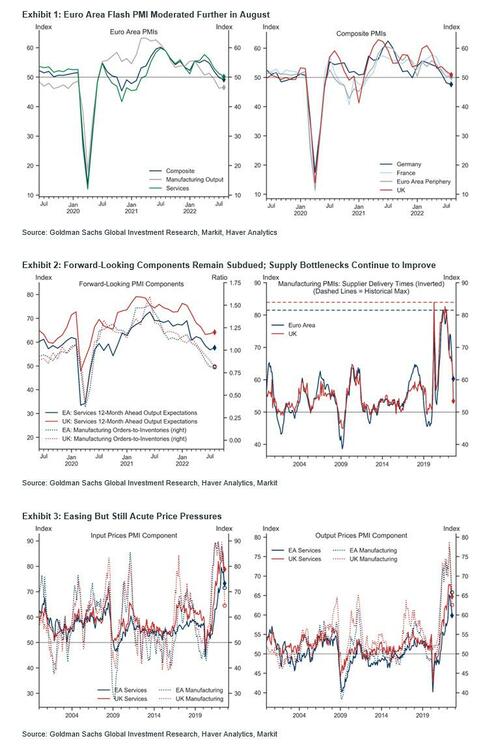

The Euro area composite flash PMI decreased by 0.7pt to 49.2 in August, slightly above consensus expectations but with material weakness among the components. Across sectors, the decline was driven by services, while across countries the weakening was led by France and, to a lesser extent, Germany, while the periphery composite index improved marginally. Expectations of future output edged up after having declined for three consecutive months but remain well below their historical average.

Commenting on the report, Bloomberg markets live reporter and commentator Nour al Ali writes that the flash PMIs point to uncertainty and struggling businesses across the euro area as services slow and manufacturing remains in downturn. European bond yields could rise further as a tough winter approaches while policymakers work to tame inflation regardless of the economic situation.

Key points to highlight from the reports for August include:

-

In the euro area, the overall reduction in business activity was mainly centred on the largest national economies such as Germany and France. Declining demand undermined business activity due to strong inflationary pressures. Economic weakness has become more broad based, with declining output seen in a range of sectors, from basic resources and autos to tourism and real estate.

-

In Germany, weaker export sales were once again a key driver of the downturn as a slowdown in services sector is compounding continued weakness in manufacturing, the report showed. Average prices charged for goods and services continued to rise sharply but the rate of inflation eased for the fourth month running in August. A further easing of supply bottlenecks was seen.

-

In France, flash data suggest the economy has now entered into contraction for the first time in a year and a half as a sharp manufacturing downturn more than offset only a marginal increase in service sector activity, according to the report.

The data adds to a growing chorus that says a recession is more likely than not in the euro area. The possibility of the ECB raising rates into a recession comes as the continent braces for a cold winter and an energy crisis that leaves much uncertainty up in the air.

Summarizing today’s PMI data, Goldman writes that “we continue to forecast below-consensus growth in H2 and look for a technical recession in coming quarters in the Euro area.”

Tyler Durden

Tue, 08/23/2022 – 08:53

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com