Futures Flat As Traders Freak Over Jackson Hawk

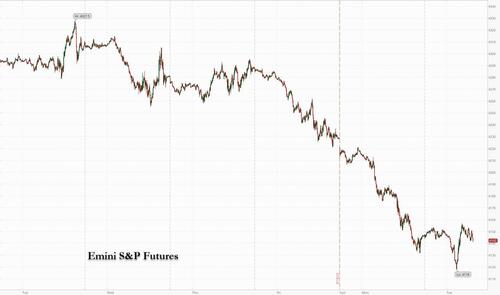

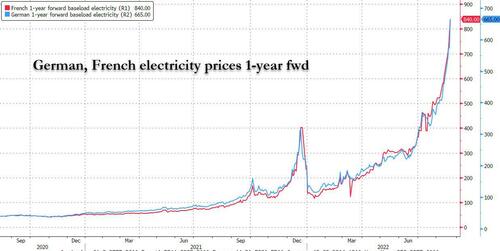

After Monday’s furious selloff which sent stocks tumbling the most in two months when the yield on 10-year Treasuries breached 3%, S&P futures have stabilized overnight, and after earlier dropping as low as 4,120 – or some 200 points below last week’s 200DMA resistance – have since rebounded to unchanged, if near the bottom of Monday’s range as nervous traders increasingly fear Powell will unleash a Hawk-ano during his Friday Jackson Hole speech. The 10-year Treasury yield held above 3% and the Bloomberg dollar index hovered at a five-week high as the EUR briefly dropped to 0.99, a fresh 20-year low, amid exponentially increasing energy costs. Oil futures climbed another 2% amid fears OPEC+ will cut output, as the market finally grasped what we were saying back in July 8 in “Inside The Oil Market’s Jekyll-And-Hyde Moment” after the Saudi Energy minister said that “The paper and physical markets have become increasingly more disconnected.”

In US premarket trading, Zoom Video Communications tumbled 9% after the communications software company cut its full-year forecast. Meanwhile, Palo Alto Networks rallied 8.7% after the security software company reported fiscal fourth- quarter results that beat expectations and gave a full-year forecast that is ahead of the analyst consensus. Here are some of the biggest US movers today:

- Bed Bath & Beyond (BBBY US) shares rise as much as 6.6% in US premarket trading, set to end three days of losses, as a rout in retail-trader favorites eases, though worries over more challenging economic conditions remain

- Dlocal (DLO US) shares fall as much as 9.5% in US premarket trading after the Uruguay payments firm reported second-quarter earnings that Morgan Stanley said were “good,” but not an “outright beat.”

- Ocugen (OCGN US) shares rise as much as 6.8% in US premarket trading as Mizuho initiates the biopharma firm with a buy rating and $5 PT

- Grocery Outlet (GO US) slips 4% after Morgan Stanley cut to underweight with the risk-reward on the grocery stores operator now looking negative

- Kohl’s (KSS US) rose 2.1% in extended trading after a filing with the SEC showed Chairman Peter Boneparth bought $750,130 of shares

As discussed countless times before, the J-Hole symposium starting Friday with a keynote speech from J-Powell will be a key catalyst for equities, which have started pulling back again amid renewed fears of a more hawkish Fed. The Nasdaq has been under the most pressure after its valuation climbed above the 10-year average as higher rates weigh on the present value of future profits, hurting pricier growth stocks, like tech.

“For the moment, global sentiment is both skittish and volatile,” said Richard Hunter, head of markets at Interactive Investor. “There is little cause for optimism on the immediate horizon, with any glimmers of economic hope yet to take hold on a sustainable basis.”

“We expect equity markets to remain volatile as investor sentiment oscillates between hopes that the Fed will succeed in steering the US economy to a ‘soft landing,’ and fears that it will not,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Against this uncertain backdrop, we have recommended that investors retain a selective approach toward equities, and we believe this remains the right strategy.”

Meanwhile, looking at market technicals, Citi’s Chris Montagu said that the disjointed set of flows from both exchange-traded funds and futures last week paint a “muddled picture,” reflecting various assessments of whether the current rally has reached its near-term peak. The recent bullish sentiment appears weak and investors are uncertain with muted flows, they wrote in a note.

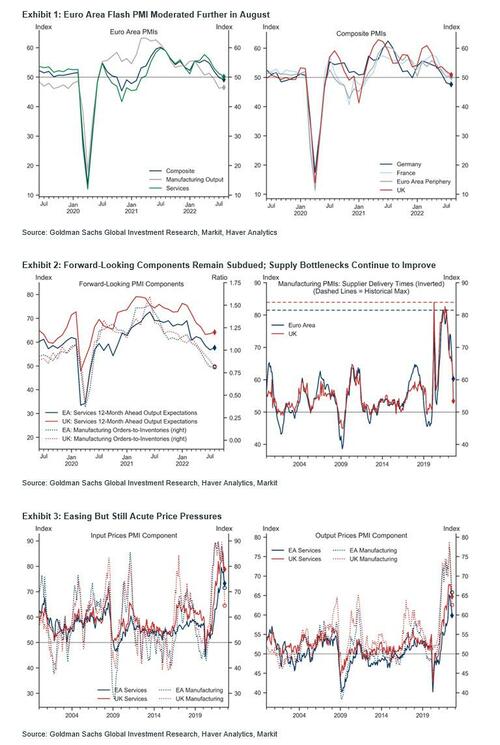

In Europe, the Stoxx 600 fluctuated near a three-week low after euro-area economic activity declined for a second month, signaling that fears of a recession may already be coming to pass as record inflation saps demand. While German PMIs came in a little stronger, a gauge of French private-sector activity dropped in August to its lowest level since the pandemic-related disruptions of early 2021, suggesting France is joining Germany in recession. It fell more than economists had expected, dipping below the threshold that separates expansion from contraction.

Energy stocks advanced thanks to a boost for crude oil from the possibility of OPEC+ output cuts. The euro hovered near a two-decade through, and only stronger than expected German PMI data prevented the EURUSD from sliding below 0.99; bond yields edged higher.

The looming European recession and the drop in the euro-area PMIs presents a dilemma for the ECB, which is raising interest rates to curb the hottest inflation in decades, even as uncertainty about the outlook is high and economic momentum fades. Meanwhile, the surge in European electricity prices continued and investors are finally waking up to the prospect that German stocks have further to fall due to the spiraling energy crisis according to Bloomberg. In the panic over Russian supplies, German power surged to above 700 euros a megawatt-hour for the first time and the Belgian prime minister said Europe could face up to 10 difficult winters.

European stocks tumbled, with the DAX a notable laggard, down over 2% Monday although it steadied on Tuesday. The DAX is now the worst-performing major Western European equity benchmark so far this month. Investors may be coming to realize that the energy crisis will put long-term strain on economies and companies, with the official start of the winter heating season just over a month away. Equities, especially in Germany, have not fully priced the energy stew. Cyclical German stocks are particularly at risk from this cocktail of soaring energy, inflation and recession risk, with chemicals, autos and industrials making up about 45% of the DAX, whose negative 30-day correlation with nat gas prices is the highest since April. That month German stocks fell 2.2%, more than the Stoxx 600. The correlation was most negative in late February/early March, when Russia invaded Ukraine. The DAX slumped 6.5% in February, also more than the Stoxx 600. European 2Q earnings were better than feared but there are signs conditions will get tougher from this cocktail of soaring energy, inflation and recession risk.

Here are some of the biggest European movers today:

- On the Beach shares rose as much as 6.6% after CEO Simon Cooper notified the company he had increased his stake in the company with a purchase of ~1.53m shares at 129.54 pence per share

- TAG Immobilien shares gained as much as 4.8% before paring gains after the German real estate company reported 2Q earnings following a capital increase in July

- Zurich Airport shares rose as much as 3.9% and was among the top performers on the Stoxx 600 Industrial Goods and Services index as analysts praised 1H results that came in ahead of consensus expectations

- BT shares rose as much as 1.7% after the telecom firm said the UK government decided to take no action on Altice UK’s stake in the company, after announcing in May that it would review it under the national security act

- Virgin Money UK shares rose as much as 1% after Liberum increased the price target on the stock, saying the company is delivering on its accelerated digital strategy

- Wood shares dropped as much as 12% before paring declines, with Jefferies saying the engineering services firm’s outlook “looks light”

- Halfords shares slid as much as 11%, dropping to the lowest since July 2020, after Panmure Gordon cut the retailer of auto parts and bicycles to hold from buy and halved its price target to a Street-low

- Grieg Seafood shares fell as much as 6%, to the lowest intraday since May 13, after the salmon and trout farmer cut its harvest guidance for the year

- Dermapharm shares declined as much as 4.4% after the company posted 1H results that Jefferies called “solid but still not exciting”

- Evotec shares fell as much as 3.8%, the worst performer in the Stoxx 600 Health Care index. RBC (outperform) cuts its PT on the German pharma firm, though says it still sees upside for the stock

- Bakkafrost shares fell as much as 2.8%, hitting the lowest since June, with DNB saying the salmon farmer’s 2Q results were weaker than anticipated

Earlier in the session, Asian shares dropped as investors reduced bets on tech and other growth stocks amid receding expectations of slower monetary tightening by the Federal Reserve. The MSCI Asia Pacific Index fell as much as 1.2% to the lowest level in five weeks. TSMC, Sony and Samsung were among the biggest contributors to the drop. Benchmarks in most countries were in the red, with key measures in Japan, South Korea, Australia and the Philippine tumbling more than 1%. Expectations are building ahead of this week’s Jackson Hole central banker meeting that Federal Reserve Chair Jerome Powell will double down on the need to tame inflation. That’s helped cool the recent equity rally that was fueled by bets on slower interest rate hikes.

“It’s hard to profit more from here — the dollar is strengthening again on views that the rate hike pace won’t slow down,” said Heo Pil-Seok, chief executive officer at Midas International Asset Management in Seoul. “Risk-off sentiment is spreading again.” In addition to currency, traders were monitoring the impact of expected tighter Fed policy on bonds, with the 10-year Treasury yield holding above 3%. Corporate earnings are also in focus, with more than 340 members of the MSCI Asian benchmark reporting this week.

Japanese stocks tumbled amid deepening investor concerns over the Federal Reserve’s monetary policy plans as the Jackson Hole meeting draws near. The Topix fell 1.1% to close at 1,971.44, while the Nikkei declined 1.2% to 28,452.75. Sony Group Corp. contributed the most to the Topix decline, decreasing 3.3%. Out of 2,170 stocks in the index, 453 rose and 1,624 fell, while 93 were unchanged. “For the time being, we will have to wait and see what Powell has to say throughout the week, as Jackson Hole is still the most important factor to watch,” said Hideyuki Suzuki, general manager at SBI securities. “However, it’s also difficult to take a position since it’s the end of the month, and there should be more moves in the beginning of September with employment statistics and the major SQ.”

India’s benchmark equities index ended higher after fluctuating between gains and losses for much of the session, with heavyweight Reliance Industries among the winners. The S&P BSE Sensex rose 0.4% to 59,031.30 in Mumbai, after falling as much as 1% earlier in the session. The measure had lost 2.5% in previous two days. The NSE Nifty 50 Index climbed 0.5% on Tuesday. Traders are bracing for hawkish talks at the Federal Reserve’s Jackson Hole symposium later this week amid concerns that the central bank may not slow the pace of monetary tightening to tackle price pressures. “Markets may witness bouts of volatility in coming days as global factors will continue to keep investors on tenterhooks,” said Shrikant Chouhan, head of research at Kotak Securities Ltd. Reliance Industries advanced 1.5%, the most in over a week. Among the 30 stocks in the Sensex, 21 ended higher. All but two of 19 sectoral sub-indexes compiled by BSE Ltd. gained, led by a gauge of metal companies.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed against its Group-of-10 peers. Risk- sensitive Scandinavian and Antipodean currencies advanced along with the yen. Two-year Treasury yields rose by 2bps, while 10- year yields were little changed. The euro briefly erased losses against the dollar and German benchmark 10-year bonds erased earlier gains, following stronger-than-forecast German manufacturing PMI data. The common currency was earlier on the verge of falling below the $0.99 handle. One-month implied volatility in euro-dollar is up for an eighth day, for the first time since April 2017. The pound fell against a broadly stronger dollar, slipping below $1.18 to approach its lowest since March 2020. China’s onshore and offshore yuan extend declined to their lowest level in two years as the currency continued to be weighed by the dollar’s strength. Additional policies to support the nation’s property sector did little to alleviate growth concerns.

In rates, Treasuries extended flattening with long-end yields slightly richer on the day, front-end cheaper led by 2-year sector with yields ~2bp higher on the day ahead of $44BN auction at 1pm. 10-year are yields little changed around 3.015% with bunds and gilts in the sector cheaper by ~1bp and ~3bp; long-end outperforms, flattening 2s10s, 5s30s spreads by ~2bp each. Bunds, gilts underperformed following stronger-than-forecast German manufacturing PMI. US S&P Global PMIs are due later in the session. The yield on bunds 10-year is up about 1 bp to 1.31%; gilts curve flattens, with belly underperforming. Peripheral spreads widen to Germany with 10y BTP/Bund adding 2.1bps to 233.9bps. The Treasury auction cycle begins with $44b 2-year note sale at 1pm ET, followed by $45b five-year Wednesday and $37b seven-year Thursday.

In commodities, WTI drifts 1.5% higher to trade below $92. Base metals are mixed; LME nickel falls 1.6% while LME aluminum gains 1%. Spot gold rises roughly $4 to trade near $1,740/oz

To the day ahead now, flash PMIs from around the world will be the main data highlight. Otherwise, there’s also the Euro Area’s preliminary consumer confidence reading for August, and in the US there’s new home sales for July and the Richmond Fed’s manufacturing index for August. From central banks, the ECB’s Panetta will speak, and earnings releases include Intuit and Medtronic.

Market Snapshot

- S&P 500 futures up 0.3% to 4,153.00

- MXAP down 0.9% to 158.27

- MXAPJ down 0.7% to 515.06

- Nikkei down 1.2% to 28,452.75

- Topix down 1.1% to 1,971.44

- Hang Seng Index down 0.8% to 19,503.25

- Shanghai Composite little changed at 3,276.22

- Sensex up 0.4% to 59,011.72

- Australia S&P/ASX 200 down 1.2% to 6,961.81

- Kospi down 1.1% to 2,435.34

- STOXX Europe 600 little changed at 433.29

- German 10Y yield little changed at 1.31%

- Euro little changed at $0.9939

- Gold spot up 0.3% to $1,741.69

- U.S. Dollar Index down 0.11% to 108.92

Top Overnight News from Bloomberg

- Hedge funds are unleashing record bets the Federal Reserve will stick to its hawkish script at Jackson Hole to rein in the fastest inflation in four decades. The group has collectively placed a big short across futures for a key overnight rate that moves in line with the Fed’s benchmark. The position, which has more than tripled in the past month, will benefit if Fed Chair Jerome Powell effectively rules out a dovish pivot when he speaks at this week’s symposium

- The Global Inflation-Linked Bond Index has plunged 17% in 2022 — the worst-performing of the 20 key fixed-income benchmarks offered by Bloomberg. The reason has everything to do with the kind of bonds that make up the benchmark. Linker indexes are concentrated in longer-maturity debt that have absorbed the worst losses as central banks around the world lift interest rates.

- The UK economy almost ground to a halt in August as falling demand and a shortage of labor and materials disrupted work of all kinds, a closely-watched survey showed. S&P Global said its index of private-sector growth fell to 50.9 this month. That’s the worst reading since the height of the UK lockdown in February 2021 and close to the level of 50 that separates expansion from contraction

- Swedish home prices continued to fall last month as the surging cost of living threatens to upend what has been one of Europe’s hottest housing markets. The downturn has raised fears that what currently looks like a correction may accelerate into a crash with more wide- ranging implications. Prices had dropped the most since the financial crisis in June

- China’s property market crisis is testing whether central bank Governor Yi Gang can stick to his stimulus-lite strategy. Over the past couple of weeks, Yi has cut key lending rates, announced special loans to struggling property developers via policy banks and urged state-owned lenders to extend more credit. Meantime, speculation of a cut to reserve requirement ratios grows

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the negative mood rolled over from global counterparts amid growth and energy-related concerns. ASX 200 was subdued as losses in financials and the consumer sectors overshadowed the gains in the mining and energy industries, while sentiment was also dampened after Flash PMI data weakened from the previous month in which Services and Composite PMIs slipped into contraction territory. Nikkei 225 declined as Japan suffered a similar fate on the data front which showed factory activity cooled to its slowest pace in 19 months. Hang Seng and Shanghai Comp weakened at the open amid a slew of earnings although the mainland gradually recovered as developers benefitted from China’s plans to offer CNY 200bln in special loans to troubled developers, while the PBoC also recently called on the major financial institutions to maintain stable growth of loans and pledged support for the platform industry and infrastructure construction.

Top Asian News

- PBoC could reduce RRR this year to compensate for MLF maturities and further RRR cuts could lower lending prime rates, according to Security Times.

- Japan’s government is preparing to increase the daily cap of arrivals to Japan to 50k from 20k, according to FNN. In relevant news, Japanese Chief Cabinet Secretary Matsuno said border controls will be lightened in a way to prevent COVID spread and aid economic activity, while he added that they cannot comment on the timing of new measures but will respond appropriately based on conditions at home and abroad.

- Shimao Group (0813 HK) is proposing offshore creditors to repay USD 11.8bln over three-eight years as part of a restructuring plan, according to Reuters sources; proposes payment based on a two-tier structure.

European bourses have reversed initial pressure following EZ Flash PMIs, Euro Stoxx 50 +0.2%, which were mostly mixed though noted of less intense price pressures. FTSE 100 -0.3% lags following its respective measures which posted a surprise manufacturing drop into contractionary territory. Stateside, futures are firmer, ES +0.2%, and have been in-fitting with European peers throughout the morning awaiting their own Flash PMI metrics. “Twitter has major security problems that pose a threat to its own users’ personal information, to company shareholders, to national security, and to democracy”, according to CNN citing a whistle-blower.

Top European News

- French S&P Global Composite Flash PMI (Aug) 49.8 vs. Exp. 50.8 (Prev. 51.7); Manufacturing Flash PMI (Aug) 49.0 vs. Exp. 49.0 (Prev. 49.5); Services Flash PMI (Aug) 51.0 vs. Exp. 53.0 (Prev. 53.2)

- German S&P Global Composite Flash PMI (Aug) 47.6 vs. Exp. 47.4 (Prev. 48.1); Manufacturing Flash PMI (Aug) 49.8 vs. Exp. 48.2 (Prev. 49.3); Services Flash PMI (Aug) 48.2 vs. Exp. 49.0 (Prev. 49.7)

- EU S&P Global Composite Flash PMI (Aug) 49.2 vs. Exp. 49.0 (Prev. 49.9); Manufacturing Flash PMI (Aug) 49.7 vs. Exp. 49.0 (Prev. 49.8); Services Flash PMI (Aug) 50.2 vs. Exp. 50.5 (Prev. 51.2)

- UK Flash Composite PMI (Aug) 50.9 vs. Exp. 51.1 (Prev. 52.1); Services PMI (Aug) 52.5 vs. Exp. 52.0 (Prev. 52.6); Manufacturing PMI (Aug) 46.0 vs. Exp. 51.1 (Prev. 52.1)

FX

- DXY reversed earlier gains after coming close to the YTD peak at 109.29 before pulling back.

- EUR has been in focus; EUR/USD tested 0.9900 to the downside before rebound post-PMI.

- The JPY has remained in the green vs the USD throughout the European session thus far as the earlier soured sentiment improved and the Dollar pulled back from near-YTD highs.

- CAD and NZD lead the G10 gains whilst the EUR and CHF lag vs the USD.

Fixed Income

- Pronounced two-way action on the French and German Flash PMI metrics, resulting in a ~200 tick range for Bunds thus far.

- Initial upside was driven on the French release though this reversed in short-order and session lows then printed following the German figures.

- Gilts were comparably contained on a surprise Manufacturing contraction, currently near the lower-end of 112.86-111.89 parameters.

- USTs have been dictated by EGB action thus far but, now that the morning’s risk events have passed, have detached themselves somewhat and regained a positive foothold.

- UK DMO says Gilt dealers suggested 2039 or 2073 I/L Gilts for November syndication, investors had mixed views on the November syndication some believe the current risk appetite for ultra-long I/L Gilt could be muted.

Commodities

- WTI and Brent October contracts have been edging higher since the resumption of futures trading overnight.

- Spot gold is choppy under USD 1,750/oz and moving in tandem with the Dollar.

- Base metals are mixed but 3M LME copper maintains its head above USD 8,000/t.

- Caspian Pipeline Consortium (CPC) says it will take a month to repair each mooring point in suitable weather, according to Interfax.

- China’s Agricultural Ministry cautions that drought and high temperatures poses a “serious threat” to autumn crops; necessary to do everything possible to expand water source and relieve drought.

US Event Calendar

- 09:45: Aug. S&P Global US Manufacturing PM, est. 51.8, prior 52.2

- 09:45: Aug. S&P Global US Services PMI, est. 49.8, prior 47.3

- 09:45: Aug. S&P Global US Composite PMI, prior 47.7

- 10:00: Aug. Richmond Fed Index, est. -4, prior 0

- 10:00: July New Home Sales MoM, est. -2.5%, prior -8.1%

- 10:00: July New Home Sales, est. 575,000, prior 590,000

DB’s Jim Reid concludes the overnight wrap

Yesterday was a sea of red for risk assets and sovereign bonds, as the energy crisis intensified in Europe, contributing to the specter of global central bank tightening already weighing on asset markets. Diving right in …

Starting in Europe, the energy crisis intensified yet further, after news over the weekend that Nord Stream would be shut for maintenance at the end of the month introduced fresh fears it would not re-open. European natural gas prices ratcheted +14.59% higher to €280/MWH, a record high. German power prices surged +18.60% to another record as well, closing at €663 and breaching €700/MWH intraday for the first time ever. The threat of climbing prices drove 10yr bund yields +7.6bps higher, led by a +5.9bp widening in 10yr breakevens to 2.54%, their widest levels since early May. 10yr OATs were +9.0bps higher, while BTPs increased +13.3bps, widening their spread to bunds to 230bps, the widest in nearly a month. In turn, the front end also climbed as additional ECB tightening was factored into market pricing, with the amount of tightening expected by March 2023 increasing +10.5bps.

Tighter policy and growing energy fears naturally weighed on risk sentiment, with the STOXX 600 falling -0.96%, while the DAX fared even worse, falling -2.32%. It was the worst daily performance in more than a month for both indices. The poor sentiment weighed on the euro as well, which, despite short-dated nominal (if not real) yield differentials keeping pace with Treasury markets (more below), broke parity again with the dollar, closing at $0.9943, the first close below parity in 20 years.

The story was much the same in the United States. 2yr Treasury yields increased +7.6bps while fed fund futures moved to price a terminal rate above 3.75% in the second quarter next year. 10yr yields were +4.3bps higher. Another day, another day flatter. More of the 10yr move came in real yields (+3.0bps), as sentiment is building toward a potentially hawkish rebuke of recent financial conditions easing from Chair Powell at Jackson Hole this week. Futures positioning is matching sentiment, where short positions in Eurodollar and SOFR futures (that is, positioning for higher short-term rates), has been building. That sentiment is already impacting rates markets, but it caught up with risk yesterday, as well, as the S&P 500 fell -2.14%, with the more rate sensitive NASDAQ underperforming, down -2.55%. It was the worst daily return for both indices since mid-June. . Yields on the 10yr USTs (-0.19 bps) are fairly stable as we go to print, trading at 3.01%.

Brent crude futures were as much as -4.52% lower intraday following cautious optimism around continued progress on the Iran negotiations and weaker broader risk sentiment. However, futures recovered to touch green before finishing -0.25% lower after the Saudi Arabian Energy Minister said the disconnect between volatile and illiquid markets and underlying fundamentals may force OPEC+ to cut production. The rally in oil helped drive medium-term breakevens wider; 5yr breakevens were around 2bps narrower before the remarks, and ended the day +2.4bps wider at 2.77%, their widest in almost a month. The next OPEC meeting is scheduled for September 5. Elsewhere, oil prices continue to gain momentum in early Asian session trading with Brent futures +0.81% higher at $97.26/bbl.

It was very light on the data front, but the Chicago National Activity Index for July printed at 0.27 versus expectations of a -0.25 print. The positive print of the comprehensive index indicated economic activity was still in expansionary territory despite recent growth jitters.

Asian equity markets are tracking sharp losses on Wall Street amid mounting rate hike concerns. The Nikkei (-1.24%) is leading losses across the region with the Kospi (-0.89%), the Hang Seng (-0.84%), the CSI (-0.61%) and the Shanghai Composite (-0.35%) all trading in the red. Elsewhere, the S&P/ASX 200 (-0.55%) is also sliding as Australia’s private sector activity contracted. Moving ahead, US equity futures are indicating a slight rebound with the contracts on the S&P 500 (+0.16%) and NASDAQ 100 (+0.20%) inching upwards.

Early morning data showed that the S&P Global Inc’s Flash Australia composite PMI fell to 49.8 in August from 51.1 in July while at the same time the services PMI Index dropped to a contractionary 49.6 from 50.9 indicating that the nation’s services sector is struggling. There was some encouraging data on the manufacturing activity with the headline index remaining in expansionary territory but eased slightly from 55.7 to 54.5.

Moving to Japan, factory activity decelerated to a 19-month low as the Jibun Bank manufacturing PMI dropped to 51.0 in August from 52.1 in July as output and new order declines deepened amid weakening global demand. Also, the nation’s services sector activity contracted for the first time in five months with the services PMI slipping to 49.2 in August from July’s final of 50.3 because of a lackluster demand at home.

To the day ahead now, and the flash PMIs from around the world will be the main data highlight. Otherwise, there’s also the Euro Area’s preliminary consumer confidence reading for August, and in the US there’s new home sales for July and the Richmond Fed’s manufacturing index for August. From central banks, the ECB’s Panetta will speak, and earnings releases include Intuit and Medtronic.

Tyler Durden

Tue, 08/23/2022 – 08:04

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com